GBP/USD: Fed Hike with Dovish Statement, Blackrock’s Li

Wei Li, of global Asset Manager's Blackrock, see the most likely FOMC scenario as a rate hike wrapped in a dovish statement.

Blackrock’s head of Investment Strategy for EMEA ishares, Wei Li, believes that the most likely FOMC scenario is that the Fed announces a rate hike but that it will be accompanied by dovish commentary, and this may put downwards pressure on the greenback:

“It is possible they will hike and accompany that with very dovish language and also very dovish management of the trajectory of the rate hike path, which is our base case.”

Their alternative scenario is that the Fed may not hike at all:

“They could do what they did last September which is to keep rates unchanged and at the same time flagging out concerns about global growth, which is possible, especially given the recent correction in commodities, but if that were to happen, in our opinion, it would be bad for markets.”

A delay would be the surprise outcome, given that the markets have priced in a hike, and almost certainly lead to a swift depreciation of the dollar.

One of earliest hikes in history

Wei Li acknowledges that a December hike would be one of the earliest in history due to the comparatively anaemic growth still observed in the economy which is showing Manufacturing PMI below 50, and therefore in contraction territory.

Many economists have also argued a rate hike now could scupper the fragile recovery:

“The rate hike would happen in amongst the slowest economies compared to previous rate hike cycles.”

However, Li argues that it’s better to be early than late:

“If they don’t hike soon i.e this December they run the risk of running behind the curve, which is arguably is a bigger risk than in comparison with hiking into a weaker economy.”

Reaction of the Dollar

Historically the dollar tends to strengthen going into the meeting and then go sideways during the announcement and possibly lower afterwards.

“We are not expecting a situation where the dollar significantly spikes up after the rate hike announcement, if it happens.” Maintains the Blackrock analyst.

The possibility of downside immediately following on from the announcement echoes views held by other strategists, notably Bofa’s David Woo, who put out a call recently suggesting investors buy EUR/USD 1.1000 call options prior to the event, in anticipation that the dollar would fall following the announcement.

His argument hinges on the belief that a weaker Renminbi and China growth fears will limit the Fed’s tightening in 2016:

“Further monetary easing by Beijing resulting in a shallower Fed easing cycle, could go a long way to convincing investors that the Fed will keep real interest rates lower than in previous cycles.”

The outlook for pound to dollar exchange rate

Cable traders will have their hands full as much data is expected out of the U.K.

U.K inflation data on Tuesday, for example, will be absolutely key to the outlook for the pound, as well as the BOE’s monetary policy agenda.

Higher inflation will mean a stronger pound, because it will bring forward the time the BOE could hike interest rates.

The market has largely ignored recent improved employment and wage data, amidst concerns about continued suppressed headline inflation.

Some market-watchers are expecting a lower-than-expected inflation figure due to the negative impact of the recent Oil price hitting a 7-year low.

The consensus expectation is that CPI will rise by 0.1% yoy compared to the -0.1% previously, an increasing number of inflation Doves, however, are expecting it to come out flat.

On a month-on-month basis, CPI is expected to fall by -0.1% from 0.1% in October; whilst core CPI is forecast to rise to 1.2% from 1.1% in 2014.

Other data out during the week, includes unemployment, which is expected to rise to 5.5%, from 5.3%, and average earnings, which are forecast to come out at 2.3% from 2.5% previously.

There is a possibility, given recent positive employment reports, however, that the data will be better-than-expected, placing upward pressure on sterling.

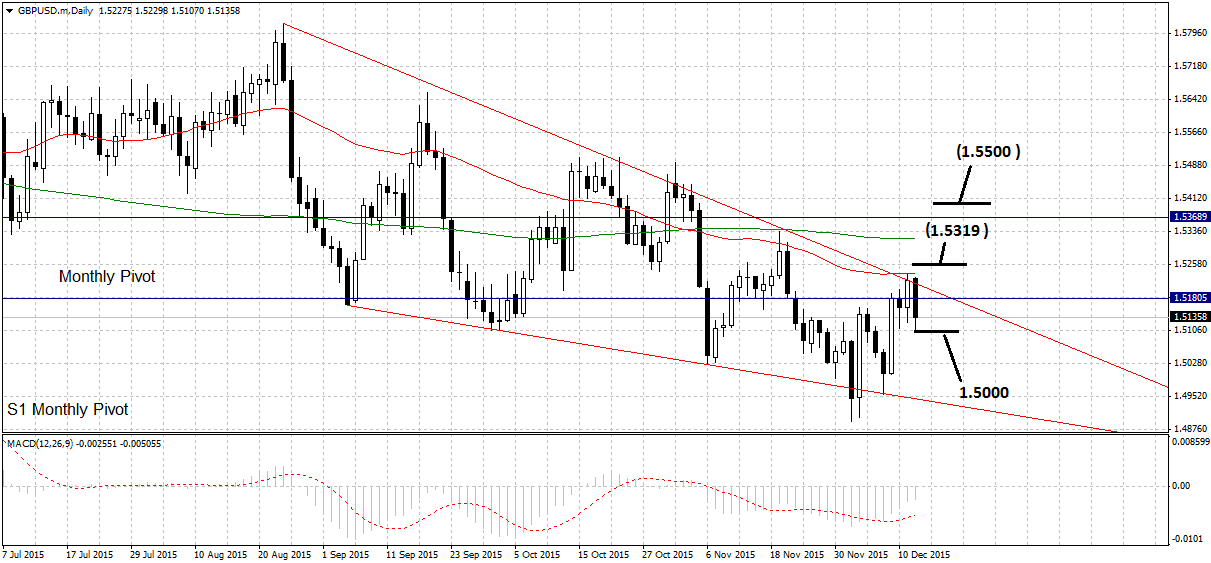

The technical outlook for GBP/USD

From a technical perspective cable has been pushed down today after meeting tough resistance from the 50-day MA and the Monthly Pivot.

Resistance from the top border of a descending wedge pattern, which has led to further downwards pressure back into the pattern.

The baseline scenario is for a break below 1.5085 probably leading to a move down to the base of the wedge at 1.5000

When the pattern completes, however, it will probably lead to a sharp spike higher as it breaks out to the upside, since this is normally what happens following the formation of falling wedges.

If this happened on Wednesday – as is possible - then it would fall in line with analyst Li and Woo’s FOMC scenarios – of dollar strength, and of a rate hike being delivered with a dovish proviso, or even of an outright delay, since such an outcome would be a surprise for the market and lead to a spike lower for the greenback.

In GBP/USD, a clear break above the 50-day, confirmed buy a break above 1.5260 would probably lead to a move up to the 200-day MA at 1.5319.

Following on from that, a break above 1.5400 would probably safely confirm further upside, to a possible target at the 1.5500.