British Pound Could Soon be Allowed to Climb by the Bank of England

ING have suggested the Bank of England is going to have to relinquish concerns over the strength of sterling and let it run higher.

The British pound has been in decline against the euro, US dollar and other G10 majors since late summer with weakness being driven by the shift in tone at the Bank of England concerning the timing of UK interest rate rises.

In short, when markets sense the date of the first rise is drawing in the pound sterling rallies, when that date is being pushed back the GBP responds by headling lower.

It would seem that markets have now finally bought the message that no rate rise will come until inflation is seen heading back towards the long-term target of 2% from the current 0% area it finds itself in.

But the economy is growing on trend while jobs and pay are also growing at a healthy clip.

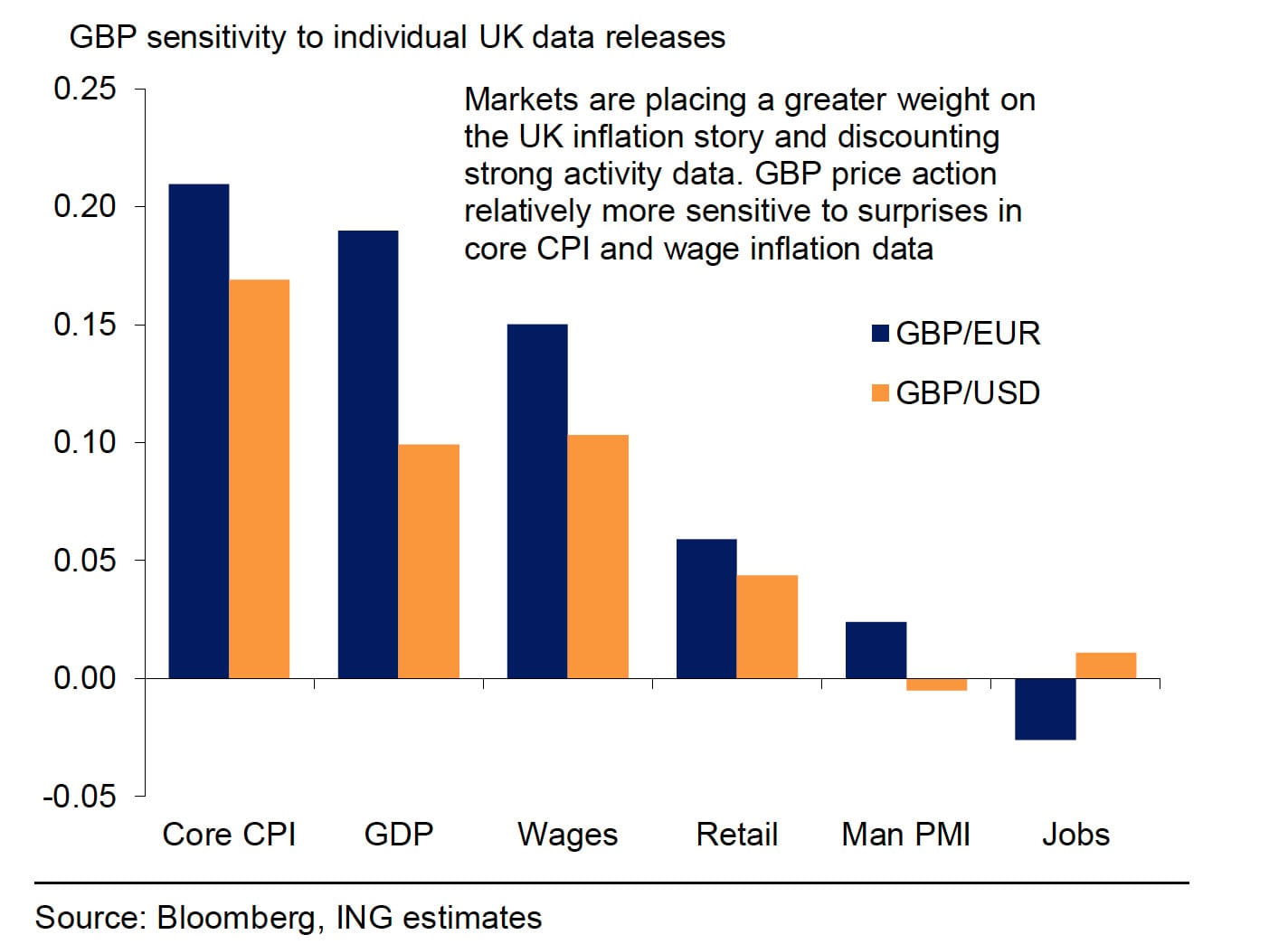

"Markets are well aware that the greatest stumbling block for the MPC is found in the weak inflation data; while much has been made about the transitory effects of low energy costs continuing to weigh on the headline CPI figure, the lagged pass-through effects of prior GBP strength is another factor that the BoE are struggling to contend with," says Viraj Patel at ING.

The MPC said in November that "more likely than not inflation would remain below 1% into the second half of 2016”, while the effects of GBP strength and weakness in energy prices would “diminish only gradually."

The minutes from the November meeting stated, “the outlook for inflation reflects the balance between persistent drags from factors such as sterling and world export prices, and prospective further increases in domestic cost growth.”

A strong sterling means the UK can purchase energy on the international market at lower prices further pushing down domestic prices. The problem, therefore, is that by raising interest rates and boosting the value of sterling the Bank risks pushing down inflation further.

Bank of England Will Allow Sterling to Rise

ING believe the BoE is gradually edging towards a rate rise, but is doing all it can to prevent a rapid rise in GBP.

That said, ING’s Patel believes the Bank of England will soon change tone regarding sterling. Indeed, the pound has hardly been putting in a strong performance over recent months.

The pound to euro exchange rate has fallen down from highs just above 1.44 seen back in July to consolidate above 1.33.

Helping to keep sterling’s value under control was the less aggressive than anticipated response from the ECB last Thursday has helped contribute to a 2% decline in the GBP nominal trade-weighted index, of which the EUR accounts for nearly half (47.3%).

A speech by the MPC’s Kristin Forbes in September stated that we should be focusing on the “underlying reasons why the exchange rate moves” as this can explain why the FX pass-through to inflation varies over time.

Using the findings from Forbes (2015), ING were able to construct an inflation basket consisting of the ten most GBP-sensitive goods or services in the UK.

“While prior GBP strength had been a drag on headline CPI in 1H15, this factor has somewhat receded in 2H15 and we are yet to see any material signs of the negative effects resurfacing,” says Patel.

One gets the sense from the charts that the GBP to EUR conversion’s uptrend story is not yet over.

It is easy to get caught up in the noise of near-term directional moves (those looking to buy euros have been hanging on to the hope that 1.44 will be hit once more).

The bigger picture is important though - a look at the monthly chart confirms the longer-term uptrend is still alive.

But, the cap to the gains remains the Bank of England.

Pound to Advance Against the Euro

“Given the uncertainty, we think the BoE will in the end be more tolerable of GBP strength stemming from a 2016 rate hike should we observe a positive inflation shock,” says Patel.

This positive inflation is an uptick in wage growth and/or a sharp oil price rebound.

Who would argue that rising wages and falling inflation is anything but a positive for the economy?

“We predict the former will serve as a catalyst for both a hawkish re-pricing of the BoE story and a near-term window of opportunity for GBP strength,” says Patel

From a strategy point of view ING say they prefer fading any GBP weakness over the coming days and instead look to sell EUR/GBP ahead of next week’s more constructive UK inflation data (15 Dec).

Bank of England Decision and Minutes: Inflation Still a Concern

Standing in the way of a higher pound is subdued UK inflation.

The MPC voted 8-1 in favour of maintaining the Bank Rate at 0.5% in what was a widely expected repeat of the November vote, with Ian McCafferty again voting for a 25bp hike.

The minutes continued their “dovish” stance from November, saying that the material news on the month was that the price of oil had fallen further and nominal wage growth had “levelled off”.

The Committee was clear that the former increased “the likelihood that headline inflation rates would remain subdued”, while there was uncertainty on what the latter (softer wage growth) may mean for the inflation outlook.

Overall the MPC did not say anything to change the market’s expectation that the first rate hike will come in the second half of next year, although we continue to expect the first hike in May as spare capacity in the UK economy is close to zero.