Why UniCredit are Buying Sterling and Selling the Swiss Franc

- Written by: Gary Howes

A new strategy note from UniCredit Bank has summed up the reason why more and more currency traders are betting on a stronger pound sterling.

Analysts at Italy’s UniCredit have told clients that their research advocates for a buy on the GBP-CHF pair.

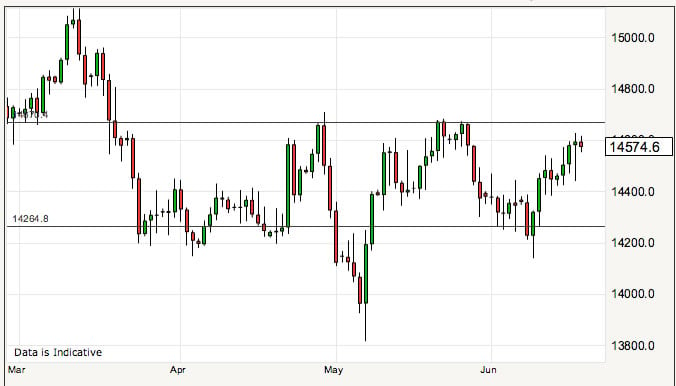

The pound to Swiss Franc exchange rate is quoted at 1.4584 at the time of writing on the spot markets and the thinking is that over the near-term horizon the rate will rise.

UniCredit have recommend going long GBP vs. CHF by buying a 3M GBP-CHF call spread with strike prices at 1.48 and 1.53 expiring on 18 September.

Those looking to base GBP / CHF payments around this research should be aware that these are spot market quotes. Your bank will affix a discretionary spread to the rate. An independent FX provider will however get you closer to the market, this can result into up to 5% more FX being delivered than your bank would have. Learn more.

The basis for the trade rests with the following observations of the British pound and Swiss Franc.

1. The June UK employment report showed pay growth rising more than expected. “Given the importance attributed to the prospective paths for wages and unit labor costs by the MPC, this should put pressure on the BoE to hike earlier than financial markets currently expect (first 25bp rate hike currently not fully priced in before 2H16),” says UniCredit’s Global Head of FX Strategy Dr. Vasileios Gkionakis in London.

2. In addition, the Italian bank thinks inflation will rise relatively quickly towards the end of 2015, to 1.3% yoy. The rise in wage growth will add to positive base effects from last year’s decline in commodity prices.

3. Given global developments, “we think a correction in the Swiss franc is overdue. Over the course of this year, we expect the global recovery to continue, with the US starting to hike rates and Europe continuing on track with accelerating growth. This will likely lead to an ongoing normalisation in global yields, calling for a weakening of the Swiss franc,” says Gkionakis.

3. Given global developments, “we think a correction in the Swiss franc is overdue. Over the course of this year, we expect the global recovery to continue, with the US starting to hike rates and Europe continuing on track with accelerating growth. This will likely lead to an ongoing normalisation in global yields, calling for a weakening of the Swiss franc,” says Gkionakis.

Turning to the Swiss side of the equation weakness in CHF could well be driven by concerns surrounding the level of the currency at the Swiss National Bank.

4. “The SNB re-emphasized today that it continues to see the Swiss franc as overvalued and expects negative interest rates to make the holding of investments in CHF less attractive, thereby depreciating the currency over time. The SNB stated it will intervene in the FX market if necessary in order to influence monetary conditions. This should limit any further pressure on the FX market,” says the note.

Meanwhile, the possibility of a Greek exit from the eurozone remains a source of uncertainty that has so far been supporting the Swiss franc as a safe haven currency.

We reflected in a piece published earlier today how currency markets could be under-estimating the impact of a Greek default on exchange rates.

“In our view, even if Greece exits, contagion will be very limited and short-lived. That said, should investor worries intensify for a period of time, pushing flows into safe haven assets, optionality limits the potential loss on this trade,” says Gkionakis.

Overall, and in light of the considerable misalignment with 2Y swap rate differentials, UniCredit expect GBP-CHF to reduce the deviation from its fundamental fair value over the next few months.