Bailey Could be Responding to the Pound: Lloyds Bank

- Written by: Gary Howes

Above: File image of Bank of England Governor Andrew Bailey. Image: IMF Photo/Cory Hancock, reproduced under CC licensing.

Why did Andrew Bailey decide now was the time to flip the Bank of England's message on interest rates? It could have to do with the value of the Pound.

This is an assessment made by analysts at Lloyds Bank following Bailey's comment that the Bank could be "more activist" in bringing down UK interest rates.

The slight turn in phraseology belies a momentous shift in messaging: the Bank had been careful to curate a message that it would bring interest rates down slowly as UK inflation remained too high.

"Governor Bailey’s interview in The Guardian yesterday said that under the right conditions, the BoE could be both 'a bit more aggressive' and 'a bit more activist' on rate cuts. The conditionality is important but the signal is clear," says Nick Kennedy, FX Strategist at Lloyds Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The market latched onto the comment, sending the Pound lower by 1% against the Euro and Dollar, making for the biggest daily losses since 2022 and 2023, respectively.

"What prompted Bailey to shift in the dovish direction away from the 'gradualism' mantra? The exchange rate probably played a role. Versus USD, GBP topped 1.34 at quarter-end, up 9% from the 2024 low. That performance reflects perceptions of expected interest rate differentials," says Kennedy.

He notes the Federal Reserve and European Central Bank have started acting a little more dovishly recently, which had bolstered the Pound in light of the UK's apparently cautious approach to interest rate policy.

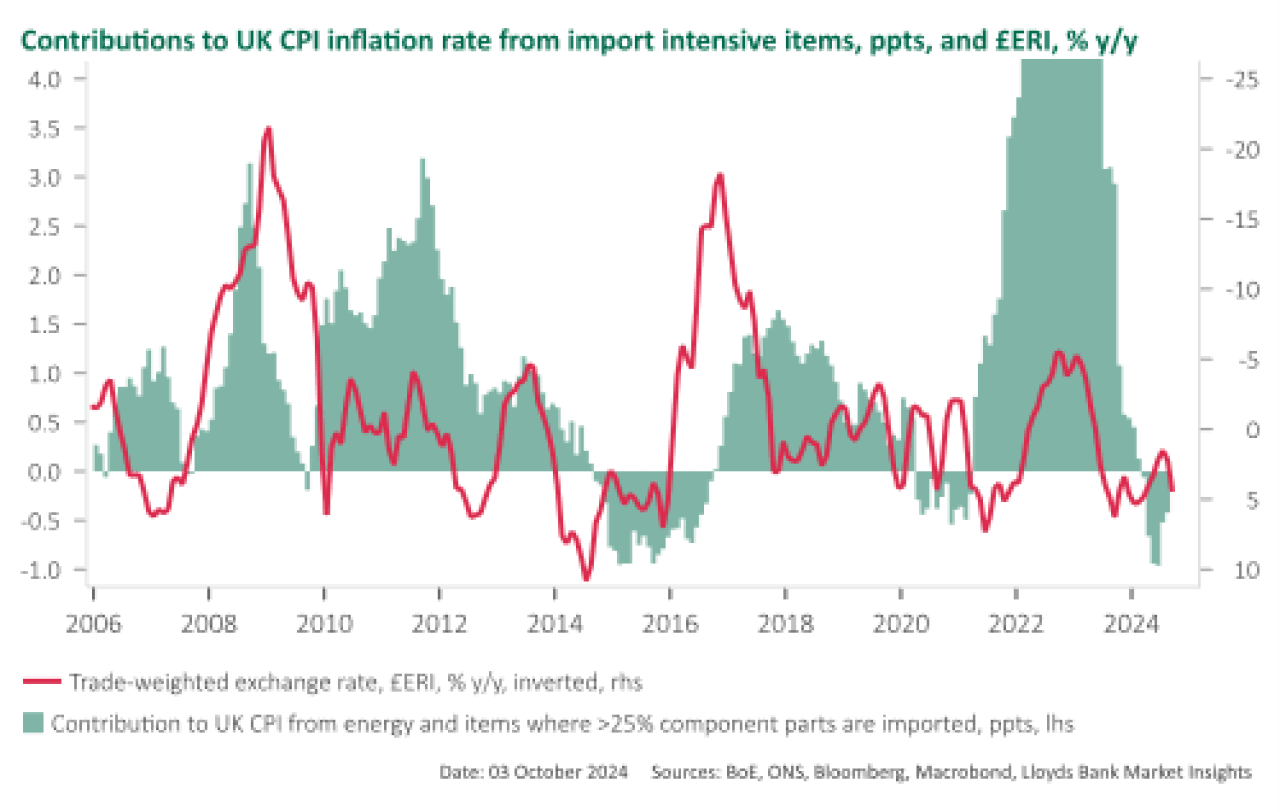

"Exchange rate strength is probably starting to play into the BoE’s inflation forecast. A stronger GBP makes the cost of imports cheaper and bears down on external inflation," explains Kennedy.

He says evidence suggests, over time, there is some link between changes in the effective Sterling exchange rate and the contribution of import intensive items in the basket to the overall CPI inflation rate.

"There are still good domestic reasons not to completely ditch the gradualist approach, but this episode is a reminder that there are likely to be limits in the extent to which the BoE ends up lagging the Fed in the cutting cycle," says Kennedy.