Pound Sterling's Safe-haven Status Returns

- Written by: Gary Howes

EU-UK negotiations injected significant uncertainty into the UK economic outlook and weighed on the Pound. Image © Adobe Images

The British Pound rises as it rebuilds its long-lost status as a safe-haven currency.

Although the General Election did not result in fireworks for the Pound, analysts have widely considered the result as supportive from a longer-term perspective.

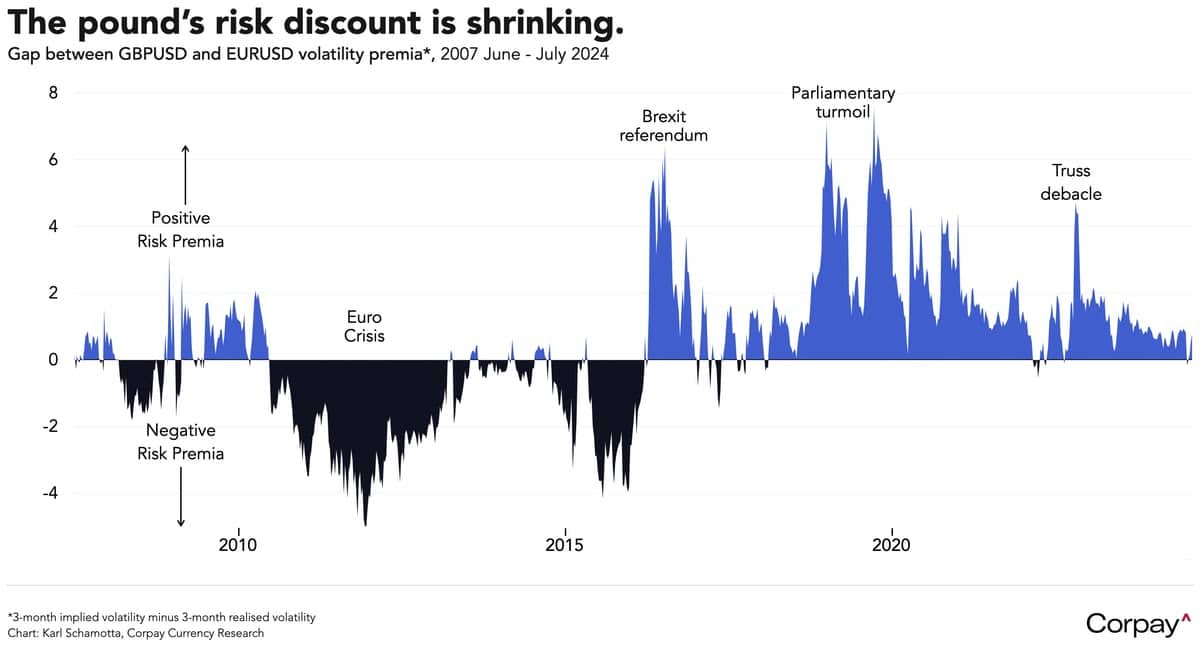

"The political risk discount embedded in the pound continues to dissipate," says Karl Schamotta, Chief Market Strategist at Corpay.

A measure of how risky investors perceive the Pound to be, the "volatility premium", has been shrinking for more than a year, notes Schamotta. It even turned negative ahead of the recent French elections.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole, says the Pound could now be acting as a "safe haven (of sorts)".

"Returning political stability in the UK could contrast with the political gridlock that could result from the inconclusive French election. In particular, the latter could add a layer of uncertainty to the outlook for French public finances and thus the country’s sovereign credit risk," says Marinov.

Crédit Agricole says a boost to the safe-haven appeal of Pound Sterling relative to the Euro can weigh on the EUR/GBP exchange rate in the coming months.

'Safe haven' demand for the Pound was last apparent during the Eurozone financial crisis of the early 2010s when money was diverted into Sterling assets. Investors questioned the future of the Eurozone as countries such as Greece suffered a severe debt crisis.

However, Prime Minister David Cameron's call for a Scottish independence referendum and the EU membership referendum opened cracks in the Pound's status as a reliable asset class. The Pound to Euro exchange rate began to fall in earnest in the months leading up to the June 2016 referendum.

The result of the vote saw the decline accelerate, and subsequent political turmoil under various Conservative Prime Ministers - most notably Liz Truss - kept the currency volatile and under pressure.

"Investors see an improving outlook for relations with the European Union, an end to fiscal experimentation, and a return to more stable political leadership translating into a burnishing of the UK’s long-dormant safe-haven credentials," says Schamotta.

Analysts at Barclays say the government's desire to improve the UK's Brexit deal with the EU can help shrink the Pound's 'Brexit premium'. In his first week in office, Prime Minister Keir Starmer said work had already begun to improve ties with the EU.

Lefteris Farmakis, an analyst at Barclays, says there is scope for a closer relationship with the EU and a further modest – but non-negligible – Brexit premium unwind in the Pound.

The Pound is 2024's best-performing G10 currency thanks to a combination of improving domestic economic growth, a cautious approach to cutting interest rates at the Bank of England and returning confidence in the UK's political landscape.

"The GBP has emerged as one of the best-performing G10 currencies since the UK general election on 4 July. We believe that the landslide Labour victory could usher in a period of political stability that, coupled with the party's supply-side reforms, could boost domestic investment," says Crédit Agricole's Marinov.

Analysts at Barclays have meanwhile raised projections for the Pound; "with growth momentum improving and carry support likely to remain in place throughout the cutting cycle, we now envisage larger (and more front-loaded) pound outperformance," says Farmakis.

Barclays holds a GBP/EUR forecast of 1.25 for the first quarter of 2025.