Pound Sterling Supported by Strong Wage Growth

- Written by: Gary Howes

Image © Adobe Images

The British Pound fell against the Euro and Dollar after the UK reported job losses and rising unemployment in its latest employment figures. However, losses will be limited by still-high wage increases and the primacy of next week's inflation report.

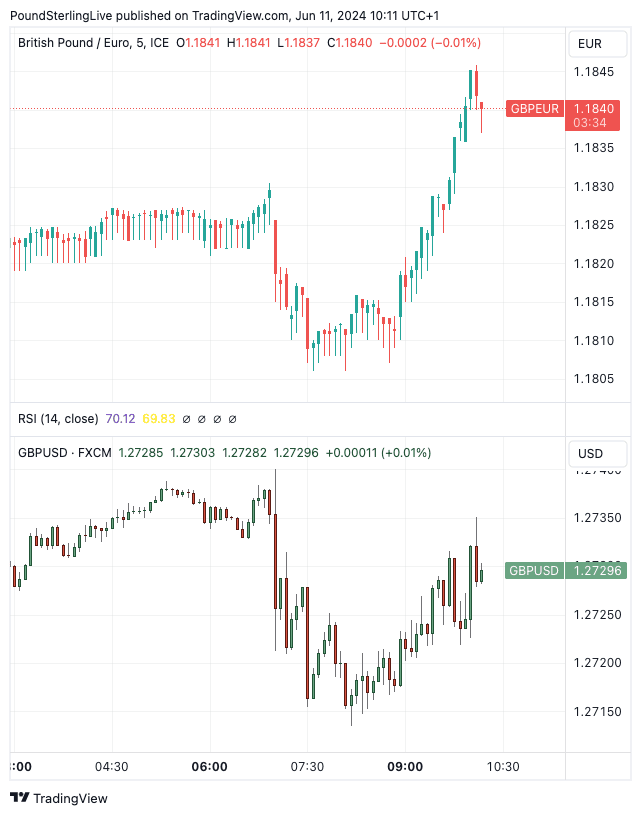

The Pound to Euro exchange rate dropped to 1.1807 in the minutes after the ONS said the UK unemployment rate rose to 4.4% in April, which surprised the market that was expecting the rate to remain unchanged at 4.3%. An increase in jobless claims to 50.4K in May was also reported, up from 8.4K previously.

The Pound to Dollar exchange rate fell to 1.2726 but has ultimately recovered losses to quote at 1.2727 at the time of this update. Pound-Euro has since recovered to record a gain for the day at 1.1842.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Pound's recovery is courtesy of still-strong UK wage rates, which will keep inflation elevated and means the Bank of England won't be able to cut as fast and soon as markets had expected just one month ago.

Average earnings, with bonuses included, rose 5.9% in April, which was faster than the 5.7% expected by the consensus. Pay rose 6.0%, in line with estimates, when bonuses are not included.

"The pound’s weakness would have been more widespread if the average earnings growth figures did not remain stable with the indicator that excluded bonuses printing again at 6% year-on-year growth," says Achilleas Georgolopoulos, Investment Analyst at XM.com.

For sure, these pay rates are not consistent with the Bank of England's mandate of bringing inflation back to 2.0% on a sustained basis.

"Both rates of pay growth could be seen as too high to justify a rate cut from the Bank of England in August. The swaps market is currently pricing in a 44% chance of a rate cut from the BOE in November, and we do not expect this labour market data to shift the dial too much, unless we get a surprise reading, particularly for wage data," says Kathleen Brooks, an analyst at XTB.

Above: GBP/EUR and GBP/USD (bottom) showing the post-labour market FX reaction. Track GBP with your own custom rate alerts. Set Up Here

Despite the rising headline unemployment rate, Richard Carter, head of fixed interest research at Quilter Cheviot, says the labour market "remains to be in a fairly robust shape and earnings growth remains strong as we head towards the general election."

He says the number of payrolled employees in the UK decreased by 36,000 (0.1%) between March and April 2024 but rose by 201,000 (0.7%) between April 2023 and April 2024.

"What the Bank of England crucially wants to see is wage inflation fall more than it has, especially with the headline rate of inflation very much near target," says Carter. "The BoE will be incredibly cautious to cut rates at a period when spending power is high for consumers and potentially triggering a fresh inflationary bout."

If the unemployment rate rises more in the coming months, the pressure on wages will start to wane and this will potentially reflect in falling domestic core inflation rates. This would be a scenario that would make the Bank of England more confident when approaching interest rate cuts.

"With employment falling sharply and the unemployment rate climbing, we think wage growth will soon be back on a firm downward path," says Ruth Gregory, Deputy Chief UK Economist at Capital Economics.

Although some members of the MPC want to cut now (Ramsden, Dhingra), most will want to see clear evidence of the economy turning. They will see little justification in pursuing the ECB's strategy of cutting rates and then waiting for months before following up with another cut.

All eyes now turn to next week's UK inflation release and Bank of England decision, which are the marquee events for the Pound in the month of June.