Pound Sterling to "Take a Turn for the Worse" says HSBC

- Written by: Gary Howes

Above: Bank of England Governor Bailey sounds like someone who wants to cut rates sooner rather than later. File image, edited from original @ Association of British Insurers, reproduced under Creative Commons Licensing.

The British Pound is a "castle made of sand" and "could face a difficult period", according to a new analysis from HSBC.

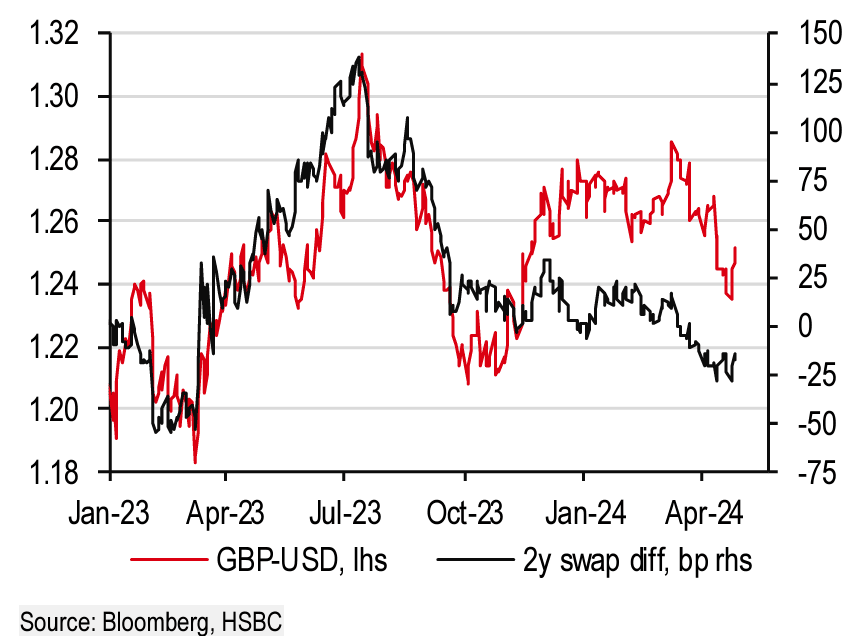

The bank says the UK currency is potentially overpriced relative to its relationship with the all-important bond market, and a looming Bank of England interest rate cutting cycle will weigh.

"GBP has been supported by its high yields but this looks to have gone beyond what the relationship with the latter implies," says Paul Mackel, Global Head of FX Research at HSBC.

He adds that "the start of the BoE’s rate-cutting cycle and persistent external imbalances could erode GBP’s recent gains."

The call comes following a strong 2023 for the Pound, which was the year's second-best-performing G10 currency. This outperformance has also extended into 2024, with the currency second to the USD in the performance stakes. The Pound to Euro exchange rate is up 1.34% in 2024, while the Pound to Dollar exchange rate is lower by nearly 2.0%.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

But HSBC turned 'bearish' on Sterling last year, and is sticking with its thesis."The start of the BoE’s rate-cutting cycle should see GBP weaken," says Mackel. HSBC expects the Bank to begin cutting rates in June.

Market pricing shows the Bank is expected to cut interest rates twice in 2024, with the first cut potentially falling in August.

Foreign exchange analysts are unanimous in their view that the Pound is vulnerable to weakness if the start date is brought forward to June, as this would mean the Bank would potentially be an early mover amongst its peers.

Above: GBP is the second-best performer in the G10 for 2024.

It is the divergence in policy between the central banks that matters for currencies, with the bigger and earlier cutters triggering currency weakness.

The research also warns the Pound is particularly vulnerable to a deterioation in investor sentiment in which volatility rises and 'hot' money leaves UK shores.

Periods of significant weakness have been associated with these events in the past; for example, the Pound's lowest-ever valuation against the Euro was during the Great Financial Crisis of 2008, while its weakest level against the Dollar followed the mini-budget crisis in 2022.

Above: GBP/USD looks overvalued relative to bond market dynamics. Image courtesy of HSBC.

The trigger and timing of the next crisis is, of course, near-impossible to predict, but the Pound's vulnerability in these periods speaks of the UK's weak external dynamics, most notably the chronic current account deficit.

"The UK’s current account deficit remains persistent and is also primarily plugged by ‘other investment’ inflows, which are shorter term in nature and can be volatile. Sizeable other investment flows are a hallmark of the UK’s status as a financial hub but highlight a point of vulnerability for GBP, especially if market volatility suddenly increases," explains Mackel.

The key near-term risk for the Pound is next Thursday's Bank of England interest rate policy decision, where the Bank is expected to turn more 'dovish' in preparation for its first rate cut.

Track GBP with your own custom rate alerts. Set Up Here

How the Bank approaches this pivot is crucial: there are a number of moving parts that could send a signal to markets as to how aggressive it intends to be.

Recent comments from Bank of England Governor Andrew Bailey that inflation is on course to fall to the Bank's target and that UK inflation is not as problematic as U.S. inflation single him out as a 'dovish' central bank head.

The Pound will come under pressure if these credentials shine through the Monetary Policy Committee's voting patterns and guidance next week.

"We believe the start of the BoE’s easing cycle can gradually chip away at the sterling carry trade. This may not mean a sudden unwinding on GBP carry trades could come soon, but it remains a currency exposed to a sudden deterioration if volatility increases," says Mackel.