Pound Sterling in Risk-Off Play Against Euro and Dollar

- Written by: Gary Howes

Image © Adobe Images

The British Pound looks vulnerable to further weakness against the Dollar but is better supported against the Euro and 'high beta' currencies following the strong U.S. inflation print that has jolted volatility.

A risk-off event has hit global markets as investors fear the U.S. Federal Reserve might not be able to cut rates until late in 2024, which boosted global bond yields and implies tightening financial conditions that can slow growth in the U.S. and globally.

Stock markets fell and the Dollar was the clear winner in FX following news U.S. inflation had risen again in March, and the disinflation process the Federal Reserve had anticipated to continue playing out has reversed.

Three-month annualised U.S. CPI inflation is now running at 4.5% after the year-on-year rate rose 3.5% in March. This annualised figure shows inflation is clearly going in the wrong direction for the Fed.

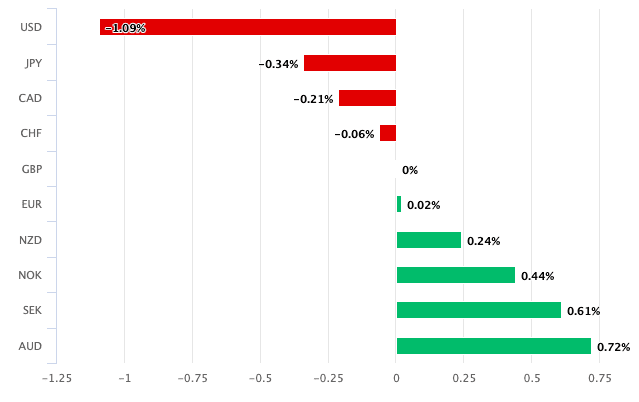

A look at the British Pound's performance in the hours that followed the data release shows it losing ground against all the classic safe havens, including the Yen and Franc. The Canadian Dollar also did well owing to its status as a 'mini USD' (and a neutral-sounding Bank of Canada policy decision also released midweek).

Above: GBP performance following the U.S. inflation release.

The Pound's biggest gains were against the 'high beta' commodity currencies such as the Krone, Australian Dollar and New Zealand Dollar. These currencies are positively correlated to global equity markets, which are themselves the purest play when it comes to investor sentiment.

As the chart above shows, Pound Sterling was in the middle of the G10 pack, which is the kind of behaviour we would expect when 'risk-on / risk-off' determines foreign exchange movements.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The market has now essentially given up on expecting a June interest rate cut at the Fed, with the odds of a July cut also coming down. Indeed, September is now likely the start date.

The rise in inflation in the U.S. prompted U.S. bonds to fall in value, raising the yield they offer to investors. Because bond yields determine the interest rate on personal, commercial and institutional lending products, the cost of finance in the U.S. is rising again.

But, the centrality of the U.S. in the global financial system means interest rates are rising elsewhere as investors reckon a delay to the Fed's easing cycle means other central banks will delay too. This is because central bankers don't want to risk moving ahead of the Fed in order to contain any risks to their own currencies and financial system.

"The chances of UK rate cut in June just dropped from 60% to 50% on the (not unreasonable) view that BoE & ECB will not want to front run the Fed and invite amplified imported inflation," says Simon French, an economist at Panmure Gordon.

"Rate cuts this year being priced out across developed world markets," he adds.

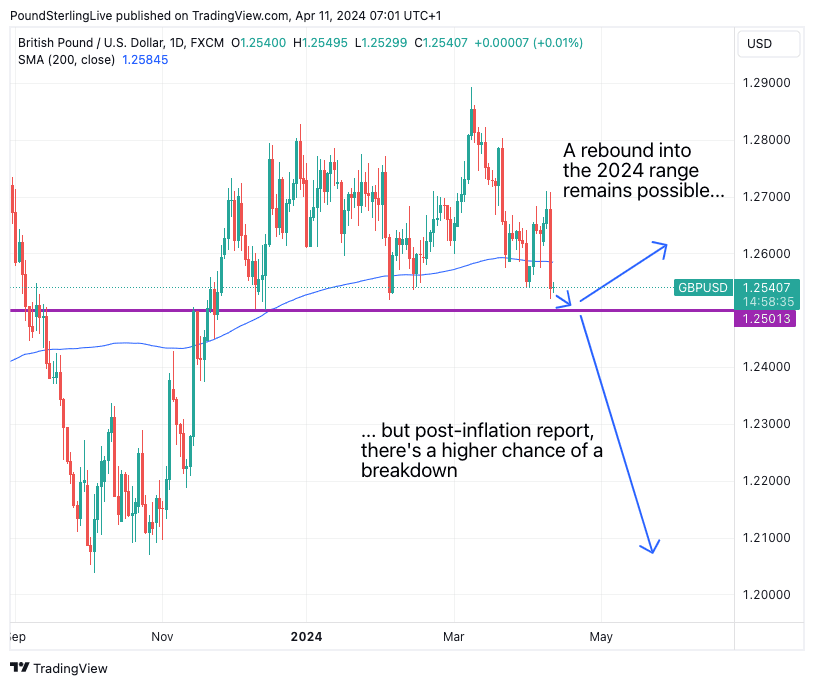

The Pound to Dollar exchange rate fell one per cent on the day to close at 1.2540. The below chart shows it is now near the lower end of the 2024 range.

Above: GBP/USD at daily intervals with scenarios annotated. Track GBP/USD with your own custom rate alerts. Set Up Here

Should the market continue to lower expectations for the quantum of Fed rate cuts in 2024 over the coming days, we anticipate a break below the 1.25 support line and a quick run to the September-October 2023 lows.

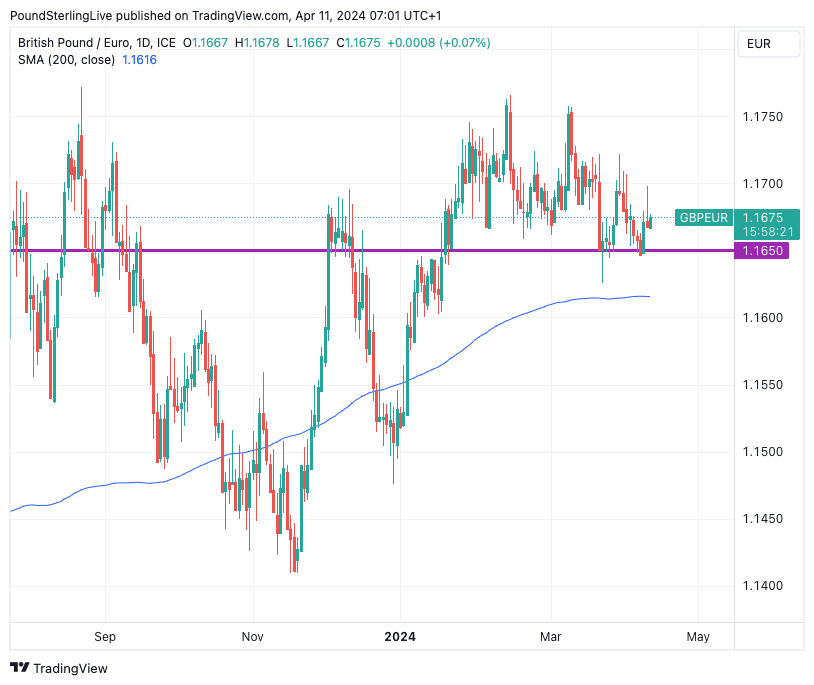

The Pound to Euro exchange rate has returned into the middle of its own 2024 range, and we have greater confidence that it will remain supported as the UK and Eurozone face similar economic and monetary policy outlooks.

Above: GBP/EUR looks well supported ahead of the ECB. Track GBP/EUR with your own custom rate alerts. Set Up Here

The key risk for the Euro is Thursday's European Central Bank update, where we expect interest rates to remain intact.

For markets, the key question is how the central bank handles the question of a June rate cut. The ECB has condoned market bets for the first cut to come in June as the disinflation process remains intact in the Eurozone owing to the region's struggling economy.

The ECB had, however, expected the Fed would also cut in June based, which would have provided some welcome cover for Frankfurt.

But it is clear the ECB will now be moving alone, and we wonder how it will respond to these latest developments in the U.S.