March PMIs Show Rising Inflationary Pressures at UK Businesses

- Written by: Gary Howes

Image © Adobe Stock

The British Pound will find support from news that March saw the UK economy record another solid upturn and rising inflationary pressures.

The Pound to Euro exchange rate held onto gains made earlier in the day after the S&P Global PMI report showed ongoing expansion in the private sector in March, with the dominant services sector leading the way, although an impressive rebound in manufacturing is of particular interest.

To be sure, the services PMI at 53.4 was below February's 53.8 and below expectations for 53.8, which will limit any upside in the British Pound.

The report's star was a solid upturn in the UK's manufacturing production sector, which "turned a corner in March, ending a twelve-month period of decline, amid the fastest rise in new orders since May 2022," reported S&P Global. The manufacturing PMI rose to 49.9 in March, a 20-month high that was well above the 47.5 print in February and the consensus expectation of 47.8.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The manufacturing output index meanwhile rose to 50.2, a 13-month high that places it in expansion territory.

What is remarkable is that the UK manufacturing recovery comes despite the Eurozone's manufacturing powerhouse, Germany, seeing a deterioration in manufacturing activity (Germany's manufacturing PMI is deep in contraction territory at 41.6).

The composite PMI, which balances the data to give a better account of the broader economy, read at 52.9, which was softer than February's 53 and below expectations for 53.1.

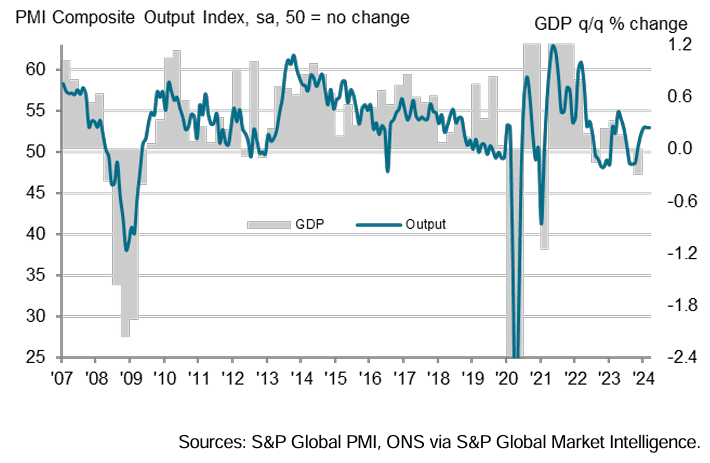

Above: The PMI upturn is consistent with a rebound in growth.

The FX market reaction shows limited damage to the Pound Sterling from the undershoot in the composite and services figures. This is potentially because the downside misses were relatively minor and the big picture is fully consistent with an economic recovery.

Also limiting GBP downside are signs of rising inflationary pressures: firms reported input prices continued to rise at a sharp pace in March, with the rate of inflation the second-fastest since August 2023.

This will concern the Bank of England, which will deliver its latest policy decision at midday.

The Bank is expected to hold rates at current levels until June or August for fear of a reboot to inflation, which the PMI report suggests might be underway.

Price pressures are broad-based: "Service providers reported elevated wage pressures as the main factor leading to strong cost inflation, while manufacturers cited higher transportation bills and rising commodity prices," says S&P Global.

The combination of rising costs and resilient demand caused output charges across the UK private sector to rise at the fastest rate for eight months in March.

These findings suggest this is not an economy crying out for a rate cut and underpin the 'higher for longer' policy on interest rates at the Bank of England.