Pound Sterling Suffers While Consumers Rejoice as UK Inflation Sits at 0%

- Written by: Gary Howes

The pound sterling is being sold as markets react to the latest inflation figures out of the UK.

Interest rate rises lie ahead, and sterling will rise as a result. Those hoping for a stronger exchange rate will however have to be patient and wait until wages and inflation start shifting higher again.

The latest data on price changes will come as a relief to consumers who are seeing their pay packets reach further.

The British pound did not like the data quite as much though; tucked away in the headline figures were data that may attract the interest of the decision-makers at the Bank of England.

With this data at hand, and focus on the impending election, we ask:

What REALLY Matters for the Pound?

The pound is testing 5 year lows against the US dollar at the present time and there is much chatter with regards to the UK election being the culprit.

In truth though there is little concrete evidence available to suggest this is the real cause of weakness in sterling-dollar.

If electoral uncertainty was the reason for GBP softness against the dollar, then why is the pound still within striking distance of 7 year highs against the euro?

Why have we recently seen strong rallies against the likes of the Australian dollar and South African Rand?

The answer is because the drivers of currency markets remain fundamentally unchanged: Central banks and relative interest rates remain key.

Focusing on the dollar side of the GBP-USD equation is the most suitable approach at the current time; the US Federal Reserve is tipped to raise interest rates in mid-2015, much earlier than the Bank of England. This has driven one of the best runs for the USD in decades.

"We begin Q2 on the heels of another ferocious USD rally in Q1. The USD rallied 4% in Q1 of 2015 after rising 10% in H2 of 2014. Very few currencies are keeping pace with the USD. Its movements have dominated the FX landscape, overshadowing other fundamental developments across the globe," says Greg Anderson, Head of FX Strategy at BMO Capital in Canada.

When we see suggestions that the Bank of England is starting to itch for a rate-rise then we will start advocating for a return to gains. In the meantime, watch the technical levels to gauge the pace of moves in this currency pair.

That said, we would expect some politically inspired volatility in pound sterling should the outcome of the election be decidedly inconclusive. Even in such an event this volatility should prove fleeting.

UK Inflation: These Figures are Important for GBP

With a focus on central banks and interest rates being central to the currency market outlook traders eagerly awaited the release of the latest inflation figures out of the UK.

As a rule of thumb, high inflation means interest rates must be raised as this serves to cool inflation. Higher interest rates in turn prompt a higher currency as investors buy the currency to take advantage of higher bond yield returns.

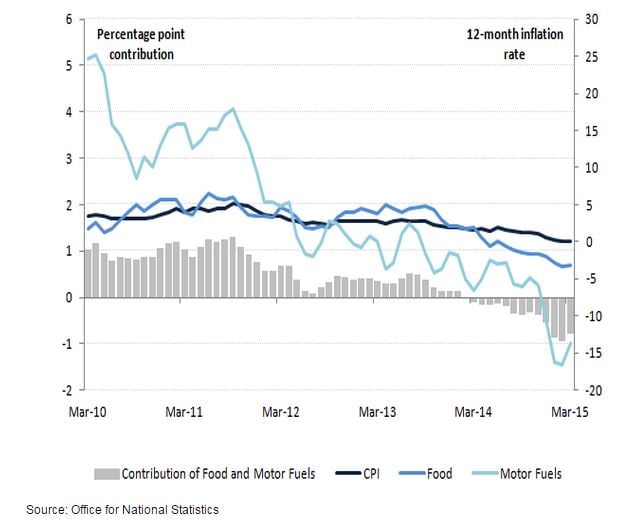

It was shown on the 14th of April that UK inflation for the previous month was flat at 0%.

CPI fell to zero percent. Markets expected this; when expectations are met currencies tend not to react.

We do need to dig deeper into the data to uncover why currency markets were really rattled.

“Core inflation, the figure that strips away food and oil, fell to 1.0%, its lowest point since July 2006, and a worrying indictor of the health of UK inflation when it isn’t being obscured by the unique situations in regards the oil and food sectors,” says Connor Campbell from spread trading providers Spreadex.

Oil prices are widely seen as being the current culprit for the low inflation. It is out of the Bank of England’s influence and therefore not seen as a justification to change policy.

But – it is now shown that those elements of inflation that the Bank can influence are also falling dangerously low.

Currency traders see this as a potential excuse for the Bank to push back their first interest rate rise from record lows.

Sterling is being sold accordingly.

Another View: This Data is no Threat

Markets are selling GBP in the wake of the price falls reported in April.

This could be an over-reaction suggests an analysis released by currency brokerage HiFX who suggest the Bank of England will be unfazed by the figures:

“We don’t envisage a situation where the UK faces a downwards spiral of prices that would require a response from the BoE, as has been happening in the euro zone. At the moment, the lower prices are on everyday essentials such as fuel and food that consumers can choose where they buy it from, but are unable to hold off waiting for prices to drop.

“Providing zero inflation doesn’t feed through into wage demands, then it leaves households with more monthly disposable income that recently they appear to be spending, supporting economic growth.”

HiFX do concede though that we’re unlikely to see an interest rate hike anytime soon which is why sterling weakened slightly.

“It is currently towards its lowest level against the dollar in five years due in part to expectations that the U.S. Central Bank will hike rates in June or September which has strengthened the dollar. However, against the euro it is towards its highest level in over seven years due to the stronger U.K. economy and the ECB’s Q.E. programme that has caused the value of the euro to plummet,” says HiFX’s Andy Scott.

As always we are therefore faced with a question over timing.

Interest rate rises lie ahead, and sterling will rise as a result. Those hoping for a higher exchange rate will however have to be patient and wait until wages and inflation start shifting higher again.

Expect the current pound sterling consolidation to therefore continue.