Pound Weakness a Near-certainty, According to This Bank of England Strategy Preview

- Written by: Gary Howes

Image © Adobe Images

According to a strategy note from TD Securities, the British Pound looks set to decline in value in the wake of today's Bank of England decision.

A preview of the event sees strategists place a 60% chance the Bank engages a 'dovish hold' whereby it keeps interest rates at 5.25% but releases guidance that prompts financial markets to bring forward expectations for rate cuts in 2024.

Under this scenario, "the MPC delivers a hold and softens its forward guidance language a touch given the weak data flow, by saying that "further tightening in monetary policy could be required" rather than "would". As such, the MPC signals that the bar for further rate hikes has increased. The vote is 8-1 for a hold," says James Rossiter, Head of Global Macro Strategy at TD Securities.

Under this scenario, the Pound is seen losing approximately 0.15% in value against the Dollar. All else being equal, the same could apply to Pound-Euro.

There is a 35% chance of a 'neutral hold' whereby the Bank holds rates but keeps its guidance roughly unchanged.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"While the recent data flow has been weak, the MPC stresses that UK data has been highly volatile lately and emphasises upside revisions to its medium-term inflation forecasts. The vote is 6-3 for a hold," says Rossiter.

Here, weakness in Pound Sterling is limited to approximately -0.10%.

Another scenario is a "very dovish hold (just a 5% chance), which would see the Bank hold rates and soften its language significantly, suggesting that the next rate move could be either a hike or a cut.

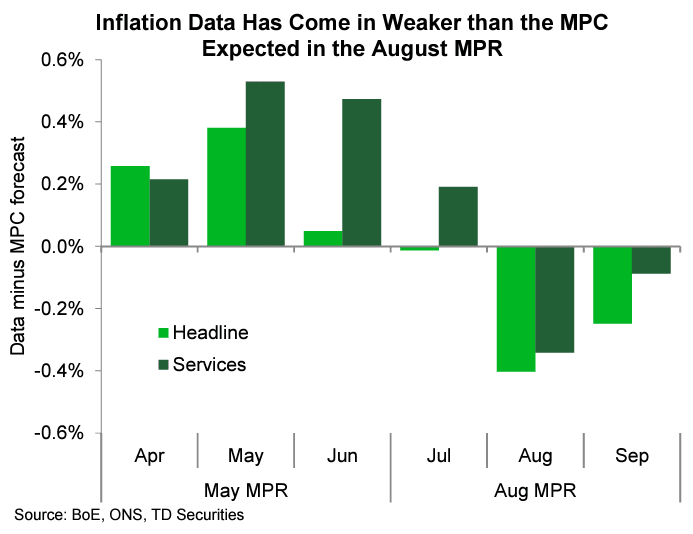

Above image courtesy of TD Securities.

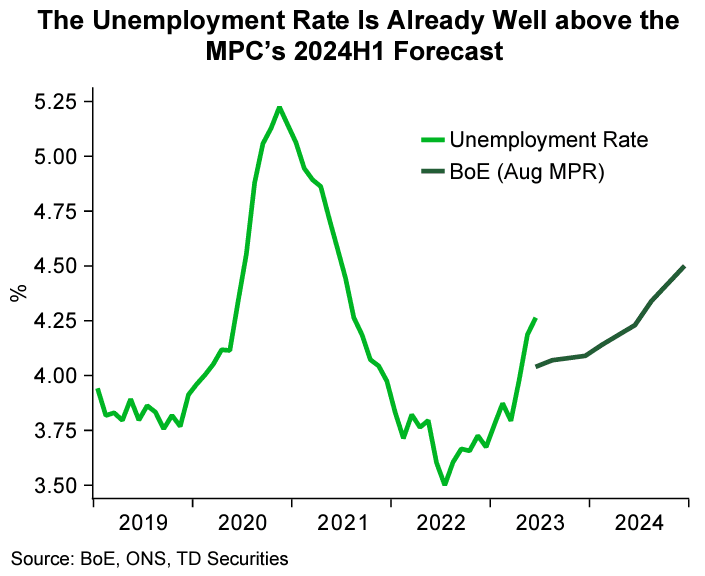

"The MPC removes past judgement to leave inflation forecasts broadly unchanged and focuses on a sharp downgrade to its growth projections and a higher path for the unemployment rate. The tone from the MPC suggests that cuts could come sooner than markets expect if downside economic momentum continues," says Rossiter.

Here, the Pound could fall by as much as 0.30%.

Tellingly, there are no 'hawkish' scenarios envisaged by TD Securities, reflecting the Bank of England's long-standing preference for presiding over a low-as-possible environment.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes