Pound Vulnerable as Bank of England Risks Being First Major CB to Signal It Is Eyeing Rate Cuts

- Written by: Gary Howes

Above: File image of Swati Dhingra. © Pound Sterling Live. Image still: Royal Economic Society.

This week, a key danger to the British Pound is that the Bank of England becomes the first of the major central banks to signal it is now considering cutting interest rates.

Thursday sees the Bank's latest interest rate decision and policy guidance update, where rates are likely to be kept unchanged and a clear message communicated that rates will stay at these high levels for an extended period.

The 'higher for longer' theme is one communicated by all the major central banks, which have more or less reached the end of their hiking cycles. This communication is aimed at convincing markets to avoid pricing in rate cuts in the future.

Doing so would lower longer-term bond yields, easing the cost of money and ultimately working against efforts to keep conditions sufficiently tight to bring down inflation.

The Bank of England has been keen to stress this is its preferred route, with Chief Economist Huw Pill deploying the Table Mountain analogy in a recent speech, but the votes on the Monetary Policy Committee (MPC) could ultimately undermine this message.

In particular, there are suggestions that Swati Dinghra could vote for a rate cut.

Dhingra said in a December 12 interview with the BBC that "if growth falls by much more than it expects from here, a cut may happen sooner."

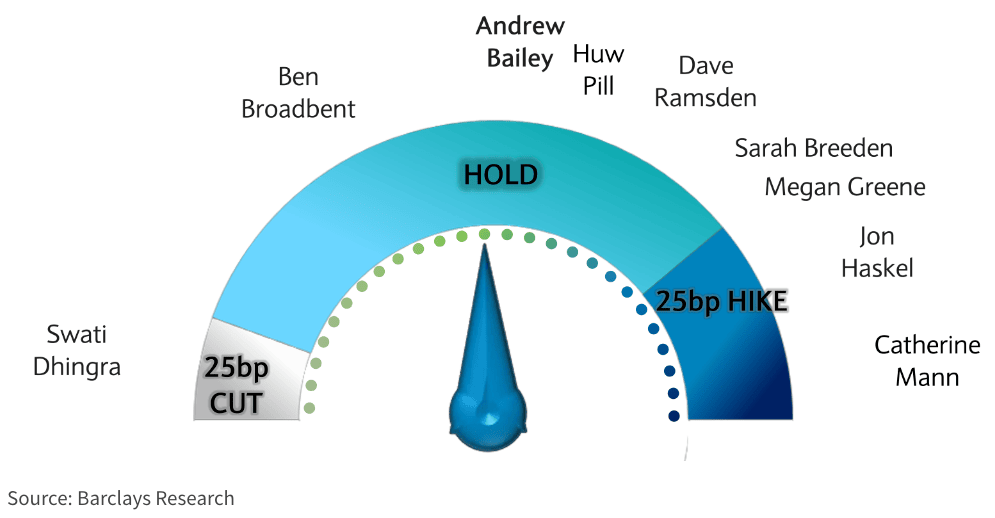

Economists at Barclays expect Dhingra to vote for a cut on Thursday, saying in a research note: "We expect the MPC to hold Bank Rate at 5.25% at the 2 November meeting, with a base case of a split vote of 1-6-2, reflecting the finely balanced nature of the decision and plausible arguments on both sides (Dhingra to vote for cut and Mann and Haskel to vote for hike)."

Should Dhingra vote for a cut, the MPC will be signalling rate cuts are actively being discussed, making the Bank of England the first to overtly communicate that an easing of policy is now on the horizon.

Therefore, this single vote and necessary acknowledgement in the accompanying minutes risks undermining any unity on a 'higher for longer' message the Bank is trying to convey.

Money markets will likely bring forward expectations for rate cuts in 2024, pressuring UK bond yields relative to those of the Eurozone and U.S.

The mechanical transfer of these expectations to foreign exchange markets would imply a weaker Pound.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes