The Pound Looks to the Bank of England to Reboot its 2023 Rally

- Written by: Gary Howes

Above: File image of Governor of the Bank of England Andrew Bailey. Image: IMF Photo/Cory Hancock. Licensing: CC 2.0.

The British Pound reached new 2023 highs against the Euro and Dollar in July before the uptrend stalled in the second half of the month, but August's Bank of England policy meeting could revitalise the rally if deemed 'hawkish' enough.

The decision comes in the wake of the U.S. Federal Reserve and European Central Bank's July policy decisions that saw a 25 basis point hike apiece, but with both guiding that any further rate hikes were not guaranteed and would be entirely dependent on the nature of incoming data.

We note that with the two larger central banks leaning towards a pause the Bank of England might follow suit as it spots an opening to alter its guidance and let markets know it is not comfortable taking rates much higher given fears of an economic slowdown.

But it was July's release of inflation data for June - which came in cooler than expected - that first held the door ajar to such a move.

"After better inflation news in the UK, the BoE is poised for a smaller rate hike," says James Knightley, Chief International Economist at ING Bank. "The case for the MPC dropping back to a quarter-point hike has been bolstered by encouraging signs of moderating global inflationary pressures," says Nikesh Sawjani, Senior UK Economist at Lloyds Bank.

If the Bank does adopt a softer approach to the prospect of further rate hikes the British Pound would almost certainly come under pressure against the Euro, Dollar and the majority of its G10 peers.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The scale of the hike will be of initial importance as markets are roughly split as to whether or not the Bank will go with a 50bp hike, as happened in June, or a 25bp hike.

The latter would be an initial signal that the Bank is intent on slowing down, and could result in Pound Sterling weakness. "If the BoE does step back down to a 25bp hike, our constructive view on Sterling will become more challenged as it would validate the broad skepticism on the Bank’s scope for a more hawkish reaction function," says Michael Cahill, an analyst at Goldman Sachs.

The split of the vote on the Monetary Policy Committee (MPC) will also offer an early signal on where the Bank is heading, with the number of dissenters voting against a rate hike important.

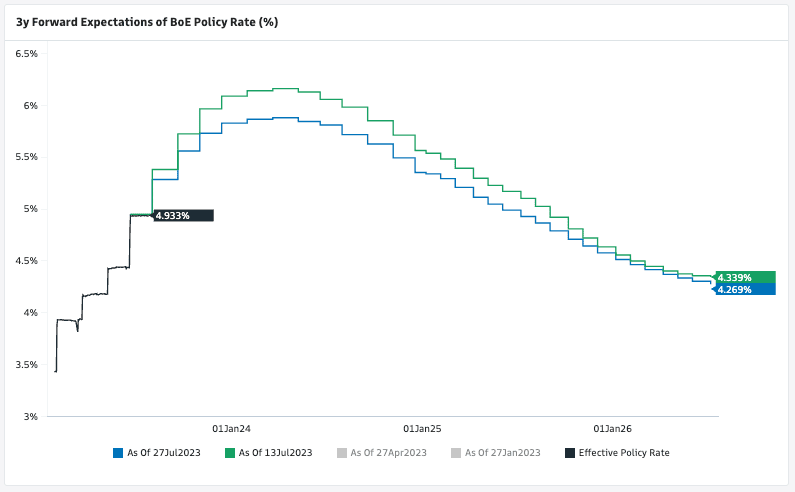

Above: Expectations for the peak in Bank Rate have come down through July, a development that corresponds with a weaker Pound in this period. Image courtesy of Goldman Sachs.

UK inflation data for June was softer than expected and has led markets to notably recalibrate expectations for the peak in Bank Rate from nearly 6.5% earlier in July to roughly 5.80% at the turn of the month.

This has been reflected in lower UK bond yields - bringing down quoted mortgage rates - and a weaker Pound, which tends to track global bond yield developments closely.

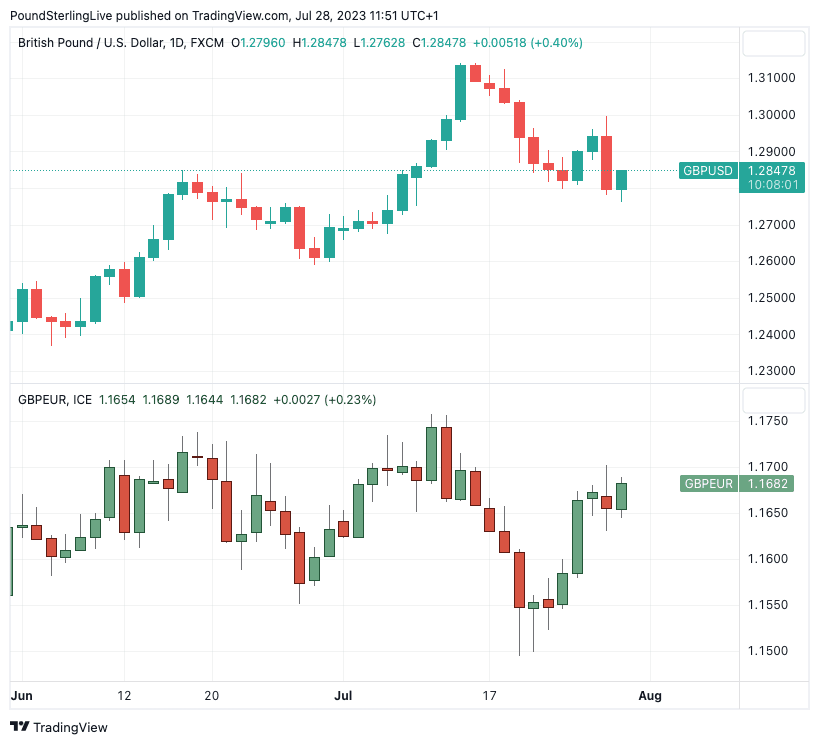

The Pound to Euro exchange rate has fallen from a 2023 high at 1.1758 back to 1.1682, although it had been lower at 1.1494 on July 19. The Pound to Dollar exchange rate has retreated from its high at 1.3140 to a low of 1.2762.

Above: Recent price action in GBPUSD (top) and GBPEUR.

The Pound, therefore, faces further downside risks should expectations decline further in the wake of the August 03 policy update.

But economists at Lloyds Bank see a 50bp hike being delivered, in what would amount to a 'hawkish' policy decision that would potentially support the Pound.

"We see grounds for the MPC following up June's 50bp hike with a move of similar magnitude at the upcoming meeting, and thus forecast Bank Rate being lifted from 5.00% to 5.50% in August," says Sawjani.

"We shouldn't rule out a 50bp hike though, especially if the committee concludes they think they’ll hike again in September. Governor Bailey explained at the ECB’s recent Sintra conference that this logic partly drove the Bank to enact a 50bp hike last month," says Knightly.

Lloyds Bank's economists note that while the headline rate of inflation was in line with the Bank's forecast from the May Monetary Policy Report (MPR) at 7.9% y/y, the detail of the latest inflation report showed worrying signs of stickiness in underlying measures of inflation.

In particular, services CPI inflation – a key gauge of domestic price pressures – was at 7.2%y/y in June, a half percentage point above the BoE’s forecast of 6.7% y/y.

"Stickiness here will do little to ease concerns of more persistent price pressures," says Sawjani. "Similarly, the continued rise in wage growth should, in our view, elicit additional concern since the last meeting in June."

The annual rate of headline pay growth edged up to 6.9% in the three months to May from 6.7% previously. In the same report, private sector regular pay growth printed at 7.7% over the same period – well above the 6.3% rate expected by the BoE for the second quarter.

The Bank will also deliver its latest forecasts in the Monetary Policy Report which will offer the market further guidance.

Of particular interest will be the Bank's inflation forecasts: should they be higher than in May then the Pound would potentially benefit as this would signal a 'higher for longer' approach will be needed when it comes to rates.

But a downgrade in forecasts would have the opposite effect. That said, the Bank has tended to place less emphasis on its forecasts when deriving policy, simply because the forecasts have proven inaccurate and led to accusations that the Bank was too timid and 'behind the curve' in terms of monetary policy.

Governor Bailey and his team will therefore likely place much emphasis on the need to react to incoming data, meaning August's inflation release will be another key moment for UK interest rate expectations, and the Pound.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes