U.S. Fed Eases Global Financial Conditions

- Written by: James Skinner

“Next week we will be looking to the UK, where inflation is proving much harder to shake” - Markets.com.

Image © Adobe Images

Pound Sterling remained the outperformer among major currencies for the year in the final session of the week but the rally is at risk of inviting increased prices of imported goods with potential implications for inflation, Bank of England (BoE) interest rate policy and the UK economy further down the line.

Sterling clung to the top spot in the major currency league table for the year on Friday after a midweek rally carried it above 1.30 against the Dollar as the latter fell widely in the sell-off that followed Wednesday's release of U.S. inflation figures for June.

Dollar exchange rates fell broadly after the Bureau of Labor Statistics said inflation had fallen to 3% that month, placing it near the top end of the 2% average inflation target of the Federal Reserve (Fed), while also driving a rally across global markets.

“The miss in June CPI is important – largely because it’s triggered this ‘mission accomplished’ type feel,” says Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

“Sure, the Fed could hike one more time by 25bps, but the disinflation trade is in vogue right now,” he adds.

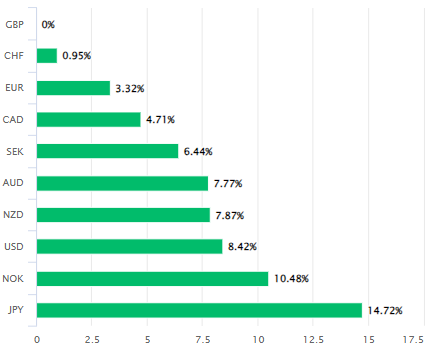

Above: Pound Sterling relative to G10 and G20 currencies in 2023.

Rai and the CIBC team say the announced decline of U.S. inflation will lift the real or inflation-adjusted interest rate paid by U.S. government bonds and place the prospect of interest rate cuts on the Federal Open Market Committee meeting table.

But with the Dollar falling, risky assets rallying and other advanced economy currencies climbing as a result, there is also potentially another scenario in the making and one that could see the Fed hesitating to cut its interest rate.

This is because the ongoing global market price action leads to a loosening ‘financial conditions’ as well as a stimulus for all economies around the world but particularly for those of Europe and China where the bulk of manufactured goods are produced and exported.

That would be much more problematic for the UK economy and Bank of England than it would be for the Fed, however, given the stalling of the “disinflation” process since April and the subsequent increase in the UK’s core inflation rate.

“Next week we will be looking to the UK, where inflation is proving much harder to shake,” says Neil Wilson, chief market analyst at Markets.com.

Above: Pound to Dollar rate shown at daily intervals with selected moving averages.

“Headline CPI inflation remained at 8.7% in May, refusing to come down as expected, whilst the core reading jumped even higher,” he adds.

UK inflation had fallen between October 2022 and April this year but the declines have since given way to a stalling of the “disinflation” process while any fresh increases in imported goods prices would only risk further obstructing the return of inflation to the 2% target.

This could have implications for the so-far resilient UK economy, and particularly if it leads to further increases in the BoE Bank Rate.

“Against this backdrop, market speculation is likely to persist that the BoE will have to do much more to get inflation under control. This should prevent a significant depreciation of the pound for the time being,” says You-Na Park-Heger, an analyst at Commerzbank.

“However, given the BoE's hesitant stance, we cannot imagine that it will actually proceed as aggressively as currently priced in. Especially since price pressures are also likely to ease further in the UK in the coming months,” she adds.

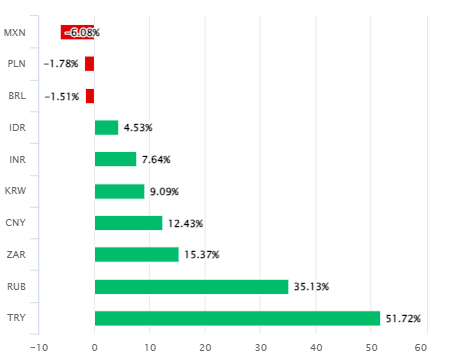

Above: Pound to Dollar rate shown at weekly intervals with Fibonacci retracements of 2021 and 2022 downtrends indicating possible areas of technical resistance for Sterling.

Bank Rate was raised from 0.1% to 5% between December 2021 and June this year as part of the BoE response to the increase in inflation, which originated from the commodity price increases seen in the pandemic but was boosted further following the Russian invasion of Ukraine and has since spread within the domestic economy.

“What we've had is a sequence of [supply shocks] and there's no air gaps between them and that of course makes them much more persistent and much more difficult to deal with,” Bank of England Governor Andrew Bailey told the House of Commons in May.

“I also would just make the point that we were the first major central bank to you know to tighten monetary policy so yeah this was a problem here then a challenge that others were having as well,” he added in testimony to a parliamentary committee.

The effects of the BoE interest rate response to high inflation are yet to be fully felt by the UK economy but it is in the pipeline while the typical two and five-year mortgage interest rate fixing periods would suggest the impact might not be all that far off.

This could mean the risk of an economic ‘hard landing’ is high and would rise further if imported goods prices turn higher again in the near future with possible implications for the Pound to Dollar rate, which is ‘fairly valued’ anywhere between roughly the 1.20 and 1.33 levels if the author’s valuation model is anything to go by.

Above: Pound to Dollar rate shown at monthly intervals with Fibonacci retracements of 2016 fall indicating possible areas of technical resistance for Sterling.