Pound Sterling Looking Vulnerable as Markets Consider Implications of Consensus-Busting Inflation Data

- Written by: Gary Howes

-

Image © Adobe Images

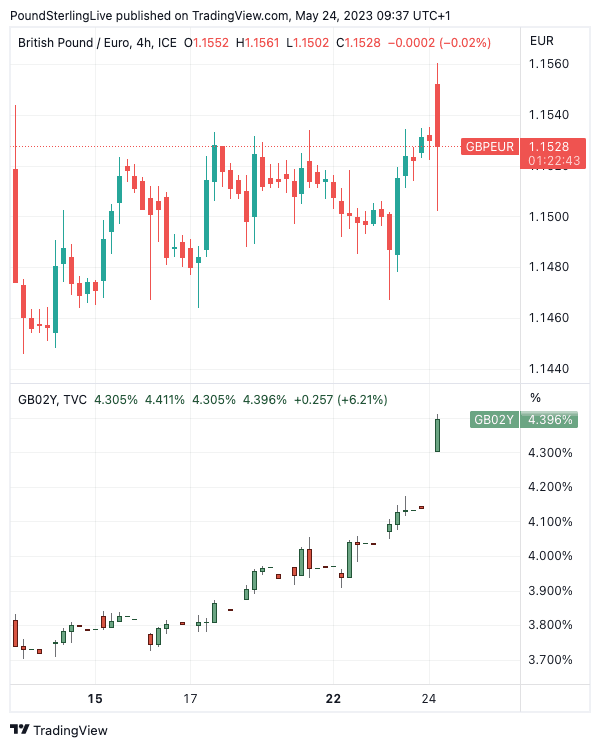

The British Pound spiked to its highest level against the Euro since December following the release of data showing UK inflation came in well above expectations in April but soon abandoned the advance amidst potential concerns the UK is facing a unique inflationary problem.

UK bond yields soared after the ONS reported headline CPI printed at 8.7% in the year to April, down from 10.1% in March, but well above the 8.3% reading the market was looking for and above the Bank of England's forecast for 8.4%.

Bond yields and Sterling initially rose in tandem as money markets revealed investors had raised their bets for the peak in the Bank of England's interest rate to 5.5% by year-end; this after core CPI inflation read at 6.8% year-on-year, which is above expectations for 6.2%.

But the Pound soon shed its initial advance in a potential warning that markets might be spooked by the persistence of inflation. In short, the worry is that elevated inflation and interest rates will lead to a significant economic contraction down the road, leading to a breakdown in the relationship between the Pound and bond yields.

The Bank of England has already raised interest rates to 4.5% in its efforts to bring inflation back under control, but the evidence presented by the ONS on May 24 suggests policymakers at Threadneedle Street might have massively underestimated inflationary pressures.

A particular worry will be services inflation, which rose from 6.6% to 6.9%, as the Bank has emphasised it will watch this figure closely because it gives clues as to how domestic firms and workers are contributing to inflation pressures. "The picture is one of stubbornly sticky inflation, as evidenced by the broad-based momentum in key elements of services inflation," says Victoria Clarke, UK chief economist at Santander CIB.

"Not enough good news in UK April inflation data to stop hiking," says Sandra Horsfield, an economist at Investec. "This is a disappointing set of numbers that will cause more angst among MPC members that the hoped-for disinflationary process is not as decisive as anticipated."

Above: GBP/EUR (top) and two-year bond yields shown at four-hour intervals.

The rule of thumb suggests bond yields and the Pound will rise when expectations for further rate hikes move higher. But, we wrote at the start of the week that this might not necessarily be the case for much longer if the market starts to worry the UK has a serious inflation problem on its hands. This is because inflation is eating away at living standards and business profits which seriously undermines the economic growth outlook.

That Sterling couldn't sustain its initial gain might prompt fears the UK economy faces a particularly acute inflationary problem.

The Pound to Euro exchange rate rose to a high of 1.1550 in the wake of the release, its highest level since December, but pared the advance back to 1.1525 by the time of this article's update.

The Pound to Dollar exchange rate rose a third of a per cent to 1.2465 before retreating back to 1.2422. "GBP/USD fell below 1.24 yesterday but found support this morning after the strong UK inflation data, raising market expectations of another BoE hike next month," says Hann-Ju Ho, an economist at Lloyds Bank.

For sure, the pullback in Sterling has not been steep (as of now), and it could yet find itself supported, but the inability to really push higher on this strong inflation beat is something to watch.

There will nevertheless be some relief that headline UK inflation has fallen back sharply when compared to a month ago when it stood at double digits at 10.1%. Inflation grew 1.2% in the month to April, which was actually a stronger monthly uptick than the previous month's 0.8% and a strong beat on the 0.8% the market was looking for.

The government and Bank of England will hope Thursday's Ofgem announcement that the energy price cap is too fall will help put some downside pressure on inflation expectations.

Regardless, the Bank of England will almost certainly be unable to abandon its interest rate hiking cycle any time soon when it considers the all-important core CPI inflation reading (which strips out energy and food and therefore gives a better understanding of UK-specific inflationary conditions).

Core rose 6.8% on the year in April, accelerating from 6.2% in March and beating expectations for a reading of 6.2%. Core inflation surged 1.3% in the month to April, ahead of expectations for a reading of 0.8% and accelerating on the previous month's 0.9%.

"UK inflation is undoubtedly moderating, but much more slowly than expected. There is little good news in the CPI data released, which probably leaves the Bank of England with little choice but to keep interest rates moving higher when they next meet. With much of the economy remaining robust, they will probably think that it can cope with tighter monetary conditions; the problem is that when that bites, it could lead to a sharper slow down," says Neil Birrell, Chief Investment Officer at Premier Miton Investors.

Economists we follow went into the inflation release with a bias for the numbers to come in below expectations, citing evidence that the labour market was starting to cool, as per last week's ONS data.

Following the data, some economists were of the opinion the Bank of England could afford to now pause the hiking cycle. "For a BoE that once again signalled its data dependence, this is strongly suggestive that a hold in rates will be the likely outcome of upcoming policy meetings," said Nick Rees, FX Market Analyst at Monex Europe, at the time of the labour market data release.

Above: Inflationary pressures remain broad-based, but energy inflation has turned a corner and could lead the charge lower over the coming months. (Click to expand). Image courtesy of Pantheon Macroeconomics.

"Incorporating the news from today though, a ‘data-driven’ approach by the MPC, which currently places less faith in its model-based forecasts than usual, points to further tightening. Our current thinking is that the Bank of England will decide to lift rates by a further 25bps at the upcoming June meeting," says Horsfield.

"More declines in headline CPI are likely in the coming months, with Ofgem due to announce a fall in its energy price cap for July on Thursday. Policymakers, however, remain concerned about risks of second-round effects on domestic prices and wages and ‘stickier’ services inflation," says Lloyds Bank's Ho.

"The BoE has little option but to continue hiking, we suspect. We maintain our view for further hikes at the June and August MPC meetings, taking Bank Rate to 5.00%," says Santander's Clarke.