Pound Sterling says Truss has Not Done Enough

- Written by: Gary Howes

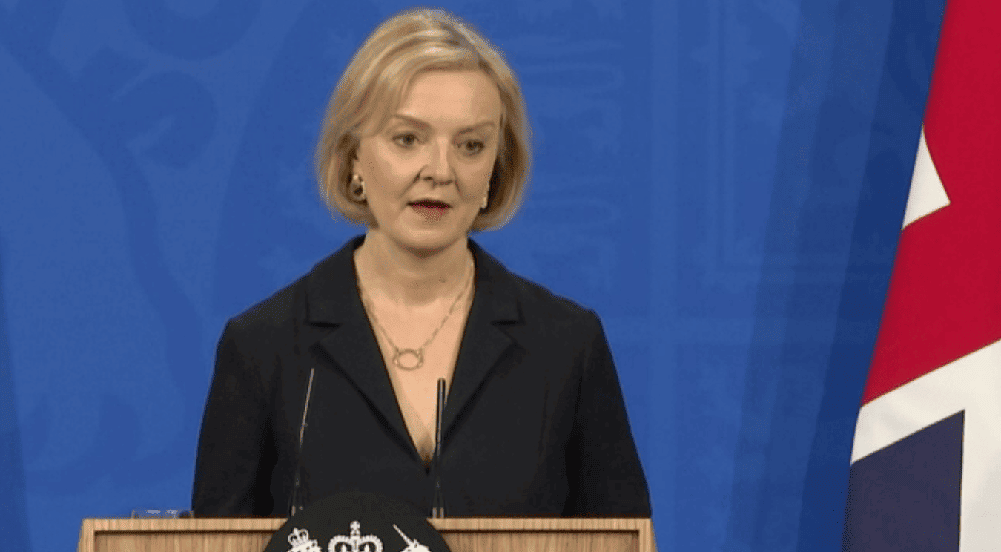

Above: Prime Minister Truss announces corporation taxes will rise in 2023. Image: Pound Sterling Live.

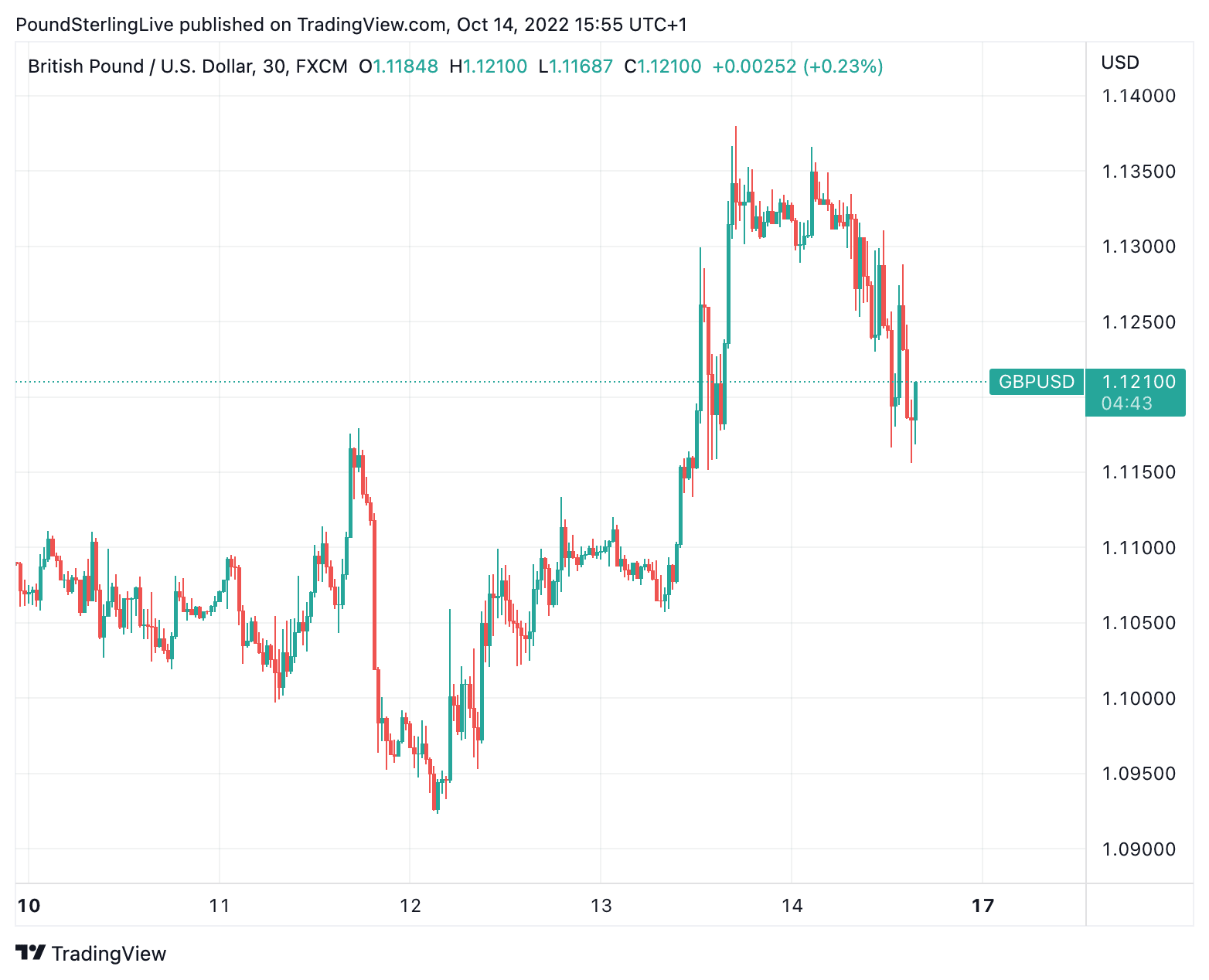

The British Pound was sold into the weekend as investors judge Prime Minister Lizz Truss has not done enough to restore confidence in UK assets.

Owing to "current market issues" Prime Minister Liz Truss announced the government would proceed with 2023's corporation tax hike, reversing a major policy pledge to cancel the hike, which was made during her campaign to be elected as Conservative party leader.

This move forms the latest attempt by Truss to restore market confidence in her government. Corporation taxes will now rise to 25% for profits above £50k.

But the Pound is lower and UK yields are up again in afternoon trade, suggesting markets wanted more. However, it might not be until next week before we get a clear sense of the final verdict.

"Surprised to see gilt yields up c.20bp over the last two hours, and now essentially back to where they were yesterday afternoon. Credibility not even close to being restored yet," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

Above: GBP/USD at 30-minute intervals, showing price action this week. To better time your payment requirements, consider setting a free FX rate alert here.

The Pound first got wind of a u-turn on the corporation tax move on Thursday and it rallied against the Euro, Dollar and other major currencies.

Friday's price action therefore hints at the market perhaps looking for a more comprehensive u-turn.

Ahead of an afternoon press conference held in 10 Downing Street Truss fired her Chancellor Kwasi Kwarteng, the joint architect of September 23's infamous 'mini budget'.

It was this 'mini budget' that saw the announcement of a raft of tax cuts that were unfunded, meaning borrowing would need to increase to maintain current levels of spending.

The market baulked at the announcement and the Pound fell while bond yields surged, driving up the cost of borrowing through the economy.

In another attempt to restore credibility with markets, Truss announced Jeremy Hunt as Kwarteng's replacement.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Hunt is a veteran senior Conservative politician who has held the brief of health secretary while backing Truss' rival in the leadership election, Rishi Sunak.

He is expected to oversee a more orthodox set of policies at the Treasury.

The Pound to Euro exchange rate is currently quoted at 1.15, down 0.60% on the day and up 0.90% on the week.

The Pound to Dollar exchange rate is down 0.90% on the day at 1.1195 and up 0.95% on the week.

"With traders not trusting the new UK government and remaining worried that aggressive hikes by the BoE will assist in dragging the UK economy into recession, the path of least resistance for the British currency may still be to the downside," says Charalampos Pissouros, Senior Investment Analyst at XM.com.

Truss said she remained committed to a low-tax and pro-growth reform agenda, but acknowledged the market's resistance to the moves.

But the tax cuts come alongside her government's plan to spend billions on capping household and business energy bills, risking the UK's debt burden.

These stimulatory fiscal initiatives also come at a time of multi-decade high inflation and are therefore considered inflationary in nature.

The market is, in essence, demanding tighter fiscal policy at a time of elevated inflation and rising interest rates.

However, media speculation suggests Truss' own future is less than assured, leaving markets to contemplate ongoing UK political uncertainty.

This could ensure the Pound and UK assets maintain a risk premium.

"It all smacks of incompetence. There will remain an underlying lack of confidence. After all, Kwarteng was merely the mouthpiece for Truss's economic agenda," says Nigel Green, CEO of de Vere Group. "There’s likely to be a brief relief rally in financial markets, but it will not be sustained."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes