Surging Inflation Data Nails on 50bp Bank Rate Hike

- Written by: Gary Howes

-

Image © Adobe Images

The British Pound was seen trading firm on the day it was reported UK inflation was higher than expected in June, shoring up expectations the Bank of England might have to go ahead with an outsized 50 basis point rate hike in August.

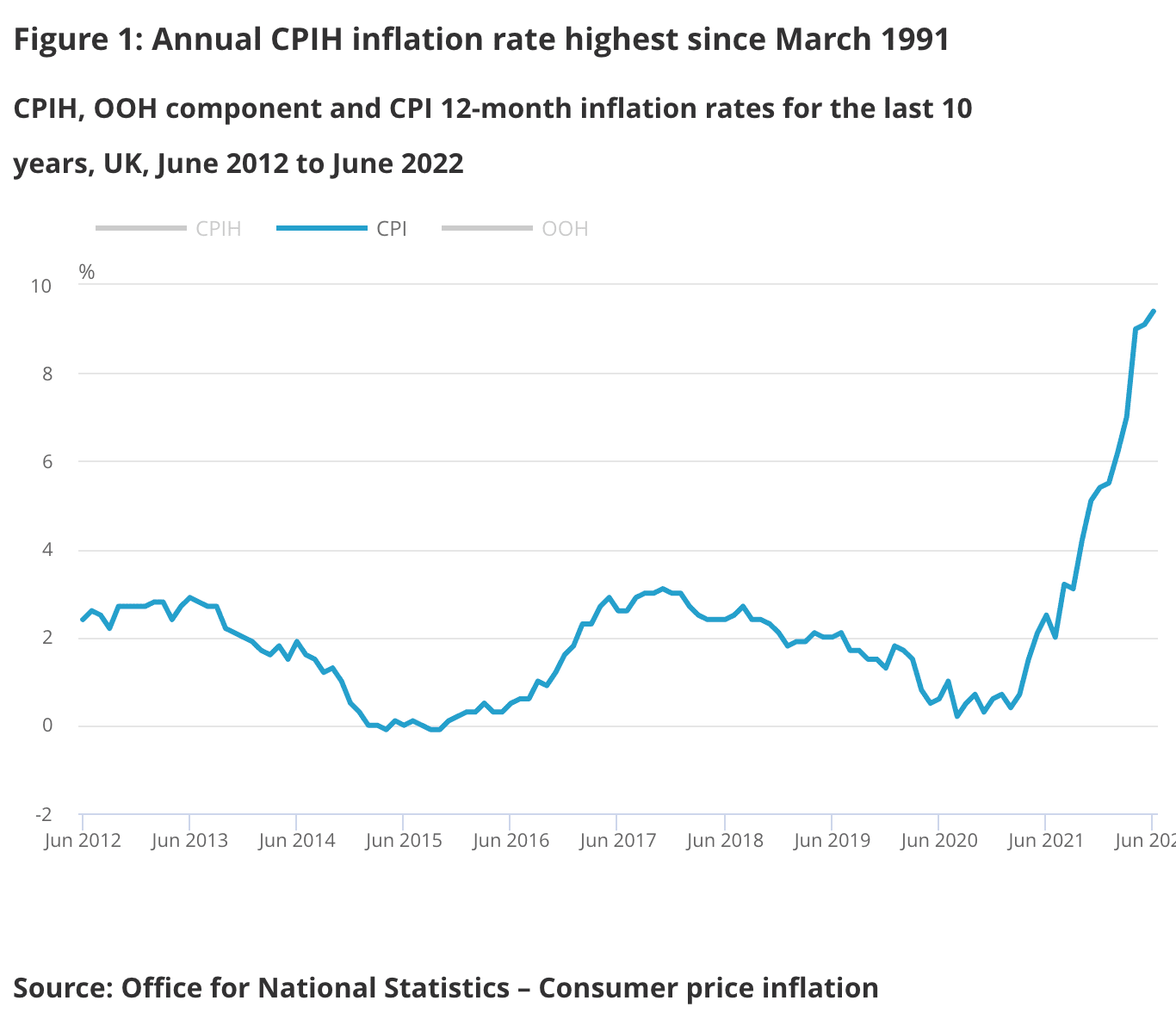

UK inflation read at 9.4% year-on-year in June said the ONS on Wednesday, a figure hotter than the market's expected 9.3% and up on May's 9.1%.

This after prices rose 0.8% in the month to June, ahead of the 0.7% expected by markets and the 0.7% rise in the month to May.

Core CPI - which strips out external drivers such as fuel - rose 5.8% year-on-year, which was in line with expectations and touch lower than May's 5.9%.

Inflation is well above the Bank of England's 2.0% target and higher than where they expected at the time of the May Monetary Policy Report (9.1% was the forecast). The data resonates with fears expressed by Bank of England Governor Andrew Bailey in a speech delivered Tuesday that "we see the balance of risks to inflation as on the upside".

As a result "a 50 basis point increase will be among the choices on the table when we next meet," Bailey told guests at the annual Mansion House dinner.

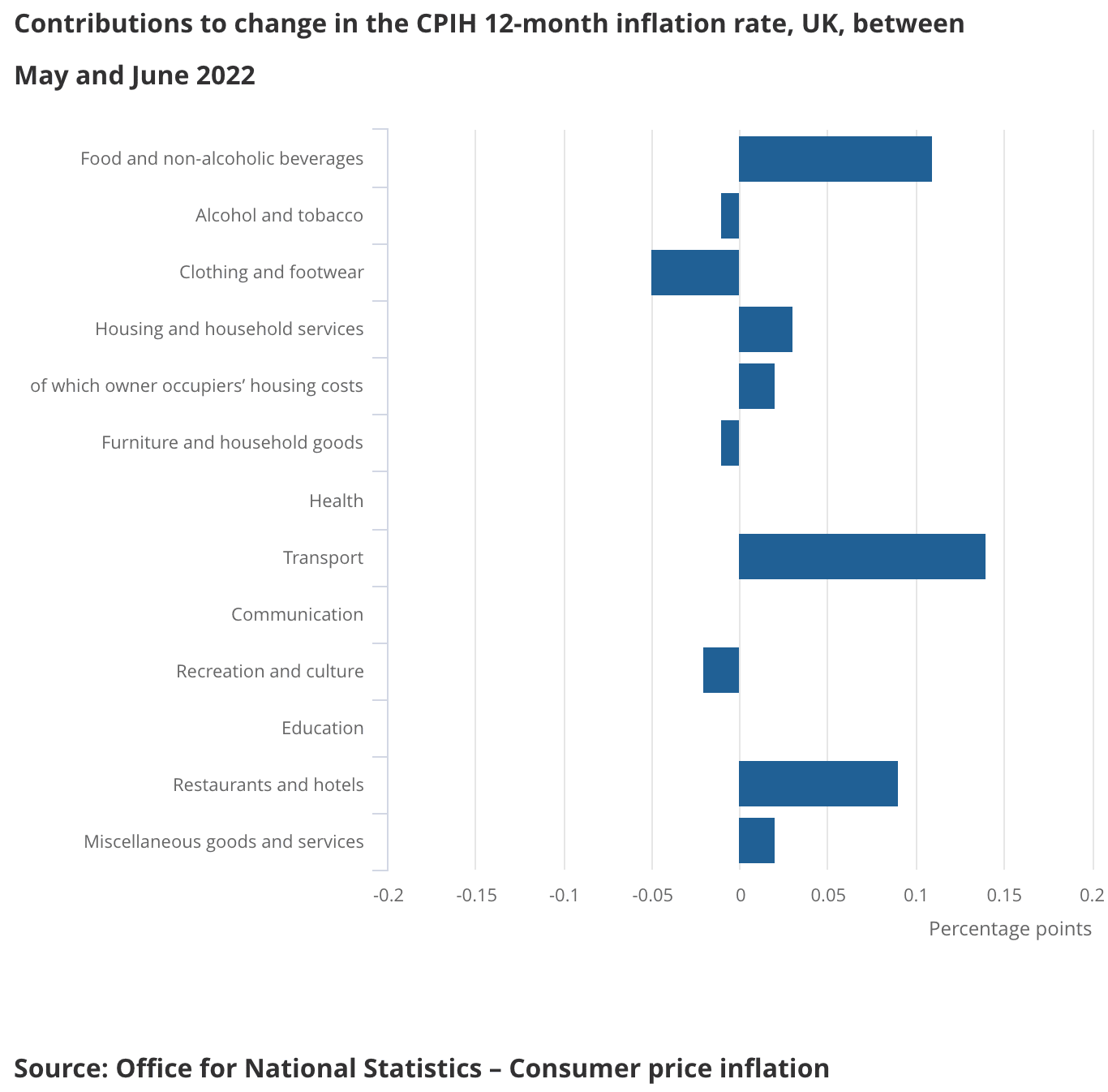

The ONS said rising prices for motor fuels and food made the largest upward contributions to the change in both the CPIH and CPI 12-month inflation rates between May and June 2022.

Bailey said he does however sees external drivers - such as fuels and commodities - starting to come down.

Indeed, August has seen motor fuel charges start to come down in line with a retreat in global oil prices.

But the stubborn core inflation data would suggest inflation is becoming more entrenched and the ONS data showed price rises were broad:

"Within the core, there are signs that an easing in globally driven price pressures are being replaced by domestically driven price pressures," says Paul Dales, Chief UK Economist at Capital Economics.

The Bank's main fear is that inflation will beget further inflation as workers and businesses respond to higher prices by demanding higher wages and charging more; "I would pick out the risks from domestic price and wage setting," said Bailey.

The prospect of a 50bp hike at the Bank of England appears to be supportive of Sterling, in so far as anything less from August's meeting would likely trigger a sell-off in the currency.

The Pound to Euro exchange rate is quoted at 1.1735 at the time of writing, but the majority of impetus behind this pair comes from the Euro side. The Euro shot higher Tuesday on news the European Central Bank was looking to hike rates by 50 bp on Thursday.

Thursday's ECB decision therefore appears to be the main event risk for this exchange rate over the near-term. Bank accounts are seen offering euros at 1.1500 for international payments, FX specialists are seen offering rates at 1.17.

The Pound to Dollar exchange rate is holding above 1.20, again, this is largely more a result of a broad decline in the USD. Bank accounts are offering rates around 1.1770, FX specialists at 1.1973.

"We think high inflation will mean the Bank of England continues to raise interest rates from 1.25% to 3.00% even when the economy is in recession, although it’s finely balanced as to whether the next hike is a 25bps or 50bps move," says Dales.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown says the UK economy "sorely needs to be doused by a bucket of ultra cold water, but the labour market is still red hot and promises of tax cuts by Prime Ministerial contenders risk seeing prices staying elevated as demand for goods and services is kept higher."

Samuel Tombs, Chief U.K. Economist at Pantheon Macroeconomics says the headline rate of CPI inflation now looks set to rise to nearly 12% in October.

But there is relief ahead says Tombs as core CPI inflation will remain on a downward path, easing to about 5.0% by year-end and to around 2.0% or so in one year’s time.

"Many commodity prices have fallen sharply in recent weeks; industrial metals and cotton prices now are 12% and 5%, respectively, below their 2021 averages, while agricultural commodity prices have returned to the levels seen before Russia invaded Ukraine," says Tombs.

"This suggests that producer output price inflation is about to crater," he adds.

Pantheon Macroeconomics are of the view the Bank of England is close to ending its current rate hiking cycle.

"We continue to think that a narrow majority of members will favour sticking to a 25bp increase in Bank Rate next month, and will stop the hiking cycle after one further 25bp increase in Bank Rate in September," says Tombs.

This would represent a massive undershoot against current investor expectations for the path of Bank of England interest rates.

The Pound is currently aligned to these investor expectations, therefore a massive downside readjustment in expectations could pose significant downside for the UK currency.