Oversold Pound in Relief Rally, But Gains Could be Brief

- Written by: Gary Howes

- GBP in relief rally

- But momentum in favour of further losses

- As global investors battle a wall of worries

Image © Adobe Images

The British Pound rallied at the start of the new week but all signs suggest the move is a relief rally from oversold conditions as investors book profit on an increasingly congested trade.

The Pound entered the new week as a prime candidate for a counter-trend 'squeeze' higher; a move that typically happens when investors bet heavily against a currency and positioning becomes crowded.

The most recent positioning data from the CFTC shows GBP 'shorts' (bets against GBP) rose from -70K to -74K contracts in the week ending May 03.

These bets might have risen substantially in the wake of the Bank of England's downbeat interest rate hike last Thursday which sunk the Pound, leaving this a richly subscribed trade by the start of the new week.

In fact Sterling is now the second-most heavily shorted major currency after the Yen, meaning a sharp counter-trend snap back is increasingly possible.

This happens as investors exit profitable bets to realise gains and additional stop loss orders are subsequently triggered to close out additional positions.

This is therefore a technical phenomenon and not a fundamental vote of confidence in the Pound

The Pound to Euro exchange rate nevertheless rose a quarter of a percent to 1.1730 and the Pound to Dollar exchange rate went higher by two-thirds of a percent at 1.24. (Set your FX rate alert here).

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

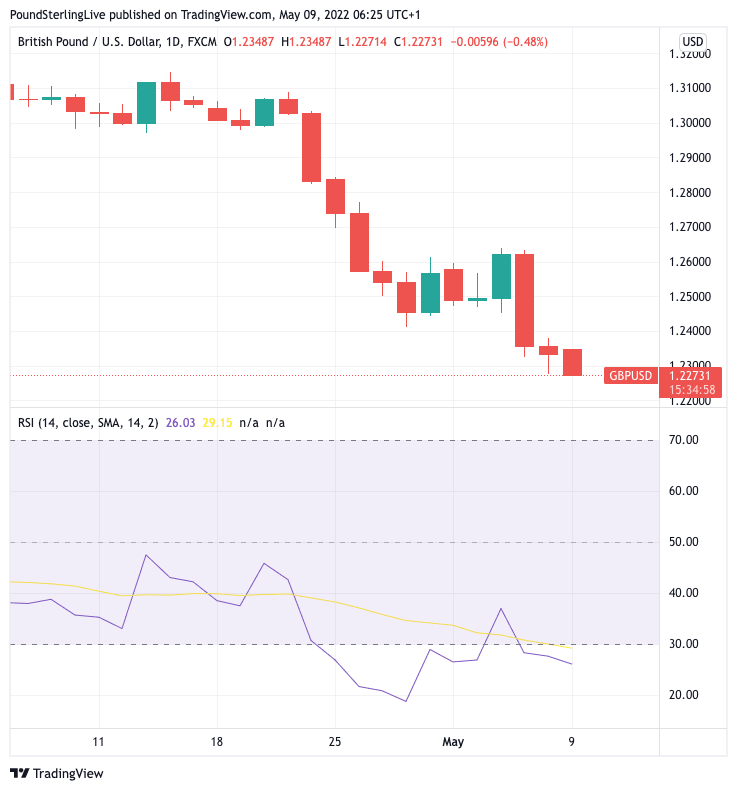

The Pound-Dollar exchange rate entered the new week looking particularly oversold, with the Relative Strength Index on the daily chart reading at 26.36; a RSI reading below 30 indicates a financial asset is oversold.

Often traders take these conditions to signal either a rebound or a stalling in the downtrend is due as oversold conditions don't tend to persist.

Analysts at UOB Bank say on Monday the "rapid and strong build-up in downward momentum suggests GBP could weaken further".

"Further weakness still appears likely even though oversold shorter-term conditions could lead to a couple of days of consolidation first," says analyst Quek Ser Leang at UOB in Singapore.

Above: GBP/USD daily with the RSI indicator in the lower panel.

Sterling plummeted last week after the Bank raised interest rates by a further 25 basis points but warned that the UK economic outlook had deteriorated significantly, leading investors to bring down their expectations for the number of future rate hikes at the Bank.

The strength of the selloff has meanwhile created significant downward technical momentum for Sterling exchange rates, meaning selling is likely to extend on the near-term horizon and near-term rallies are likely to still be viewed as temporary.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The consensus amongst currency analysts is that any strength in the Pound over coming days would likely to be short-lived given the unsupportive fundamentals posed by a slowing economy.

"As the UK economy rebounds out of the pandemic, it is now being confronted by a new shock, the rising cost of living, which is set to lead to a sharp slowdown in growth," says Fabrice Montagné, an economist at Barclays.

The Bank of England warned the UK economy would risk a protracted slump in economic growth over coming months were it to continue raising interest rates according to the market's current expectations and if energy prices also proceeded according to market expectations.

The Bank's economic modelling is relatively complicated from a layman's perspective: they don't offer a single forecast, instead they offer a number of forecasts based on a set of assumptions.

One of the most important assumptions is that the basic interest rate - known as Bank Rate - rises in line with market expectations.

Current market expectations are for enough rate rises to take Bank Rate to 2.5% by 2023 and according to Bank of England forecasts this will contribute to a number of quarters of negative economic growth in 2022 and 2023 if realised.

The implication is therefore that the market might be anticipating too many rate hikes and since the Bank's Thursday policy meeting these expectations have responded by coming down.

This has weighed on the Pound.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Ahead of the Bank's meeting the market was anticipating 130 points worth of rate hikes over the remainder of 2022, today there are approximately 120 points of hikes expected.

This is arguably still elevated and can come down further, potentially weighing on the Pound.

"We do not expect the BoE to hike Bank Rate as much as financial markets expect," says Montagné, "the post-COVID recovery continued into early 2022, little impacted by the Omicron wave, but has collided with a new shock: the rising cost of living."

With inflation surging in the UK and around the world Barclays economists say the extent of the economic slowdown in the UK will depend on whether households tap into accumulated savings, and the strength of nominal wage growth.

The Global Market Backdrop isn't Helping

Further weighing on the Pound is an ongoing decline in global stock markets, which signifies low investor morale.

The Pound is a pro-cyclical currency that traditionally rallies when investors are optimistic and speculative capital is flowing into the UK.

When these conditions reverse that speculative capital tends to leave the UK's significant financial services sector, in turn weighing on the Pound.

This is certainly the dominant theme at present and global indices are in the red on Monday as a familiar set of drivers remain entrenched:

1) the war in Ukraine continues with little end in sight and investors are wary of what Russian President Vladimir Putin might say at Monday's Victory Day celebrations.

"Putin’s speech is likely to provide a clue about what he plans to do with his “special military operation” in Ukraine: bring it to an end or extend it to a larger war," says Marshall Gittler, Head of Investment Research at BDSwiss Group.

2) The war is contributing to higher energy and commodity costs, further fuelling global inflation.

3) The Federal Reserve is in an aggressive rate hiking cycle that promises to suck liquidity out of the global economy over coming months, in turn weighing on global growth.

4) China continues to doggedly pursue its zero-covid approach to Covid-19 meaning harsh lockdowns continue in regions and cities of the world's second largest economy.

China is an engine of global growth and global manufacturing and until the Chinese economy recovers investors will likely remain defensive.

Chinese trade data for April was released Monday and showed imports down 0.1% in March and unchanged in April.

Exports were disappointed, coming in at 3.9%, down sharply from 14.7% previously.

"The restrictions in Shanghai are already having a chilling effect on economic output there, as well as port activity, or rather the lack of it, as container ships continue to sit off the Chinese coast waiting to be unloaded. Any prospect of supply chain concerns easing looks even further away than it was a few months ago," says Michael Hewson, Chief Market Analyst at CMC Markets.

This cocktail of global investor concerns help entrench the conditions for further weakness in the Pound.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks