Pound / Euro Rate Seen Eyeing 1.19, Helped by Recovery Against U.S. Dollar

- Written by: James Skinner

- GBP/EUR back above 1.18 & could test 1.19

- GBP/USD attempting recovery above 1.3400

- After studies Omicron virus strain a mild one

- Market bets on BoE’s Bank Rate in 2022 rise

- Dampened European gas prices add support

Image © Adobe Images

Pound Sterling remained near December highs against the Euro and Dollar ahead of the festive break but could have scope to return to 1.19 against Europe’s single currency, according to strategists at Scotiabank, who’ve also flagged upside risks for GBP/USD.

Sterling remained one of the better performing major currencies of the week on Friday and had already been quoted as high as 1.1883 against the Euro on Thursday when global markets were lifted by further studies suggesting the latest strain of coronavirus is a lesser threat to public health than others.

Studies carried out in England, Scotland, and South Africa have recently found the risk of hospitalisation to be between 15% and 80% lower with the new Omicron strain than with the delta variant, according to a British Medical Journal summary of the relevant research.

The revelation late on Wednesday led to an apparent easing of market concerns about the UK economic outlook, with pricing in the overnight-indexed-swap market indicating that investors subsequently raised their expectations for Bank of England (BoE) interest rates next year.

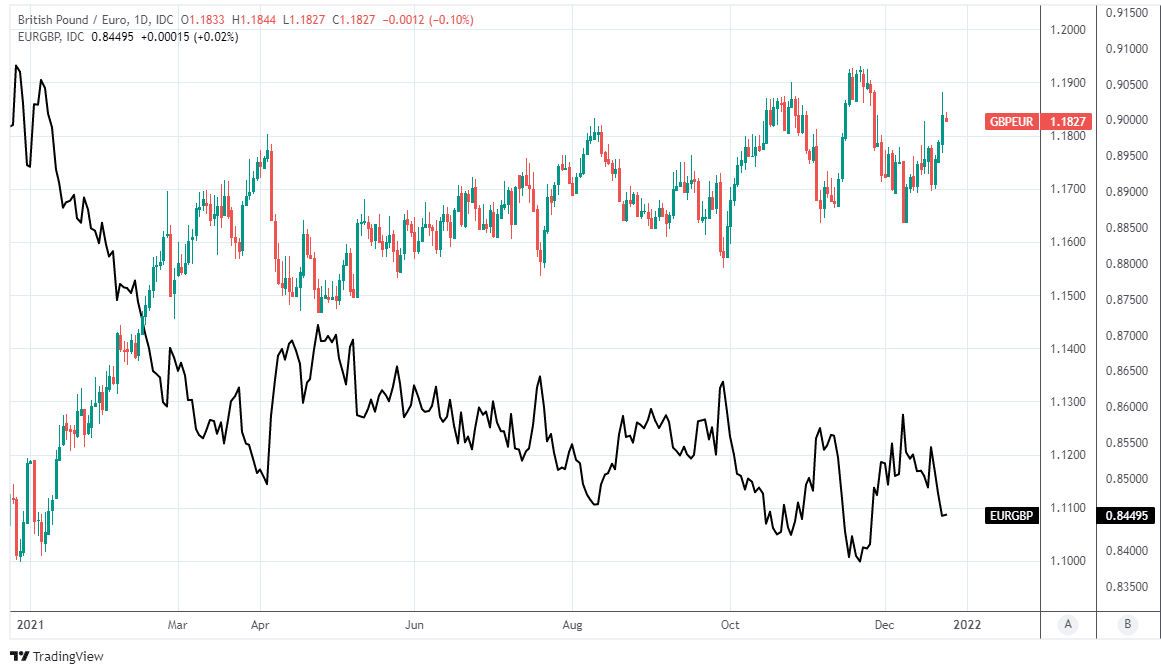

“As we had expected, the move in yields is pulling the EURGBP toward the 0.84 level [GBP/EUR toward 1.1904] and at 0.8439 at writing, the cross is trading at its lowest point since late-November,” says Juan Manuel Herrera, a strategist at Scotiabank.

“While the BoE’s tightening cycle will act as a key driver for GBP strength against the EUR over the medium term, to keep the cross under 0.86 [GBP/EUR above 1.1627], it may not provide much more ammunition for a move below 0.83 [GBP/EUR above 1.2048],” Herrera also said on Thursday.

Above: Pound to Euro exchange rate shown at daily intervals with EUR/GBP.

- Reference rates at publication:

GBP to EUR: 1.1822 \ GBP to USD: 1.3407 - High street bank rates (indicative): 1.1590 \ 1.3132

- Payment specialist rates (indicative: 1.1763 \ 1.3340

- Find out more about specialist rates, here

- Set up an exchange rate alert, here

Market pricing shifted to imply on Thursday that the BoE’s Bank Rate could rise close to 1.19% by the end of 2022, implying a high but quite likely mistaken probability that the benchmark for borrowing costs could rise to 1.25% next year.

That hawkish change in expectations lifted Sterling against most major currencies ahead of the festive break, enabling the Pound-Dollar rate to attempt a recovery of the 1.34 handle that was lost in late November as GBP/EUR rose back above 1.18.

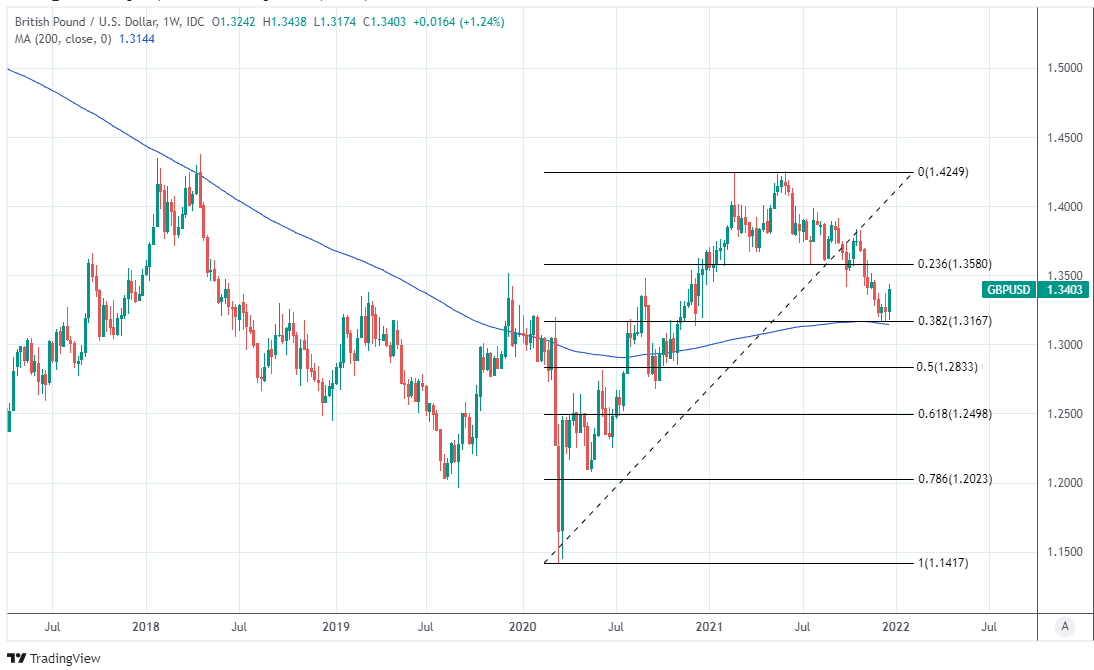

“A firm break past the mid-1.33s and a test of 1.34 (solid resistance) would turn the GBPUSD technical picture to bullish after bouncing off the 38.1% Fib retracement of the 2020-21 move at 1.3165. Support is the mid-1.32s zone followed by the figure,” Scotiabank’s Herrera also said.

Bets on BoE interest rates have been uplifting of the Pound in recent trading although it will eventually have to contend a possibly inevitable recollection by the market that the BoE said in August it plans to focus on running down its bond portfolio once Bank Rate gets to 1%.

There are other quantitative tightening measures the BoE intends to begin taking from when Bank Rate reaches 0.5%, which will likely slow any climb in the benchmark and may mean there’s little chance of the Bank Rate rising to 1.25% in 2022.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The market’s eventual reckoning with this could be a constraint upon the Pound over the coming months although before then it will have to navigate the risks posed by Federal Reserve monetary policy and any renewed runaway increases in European energy prices.

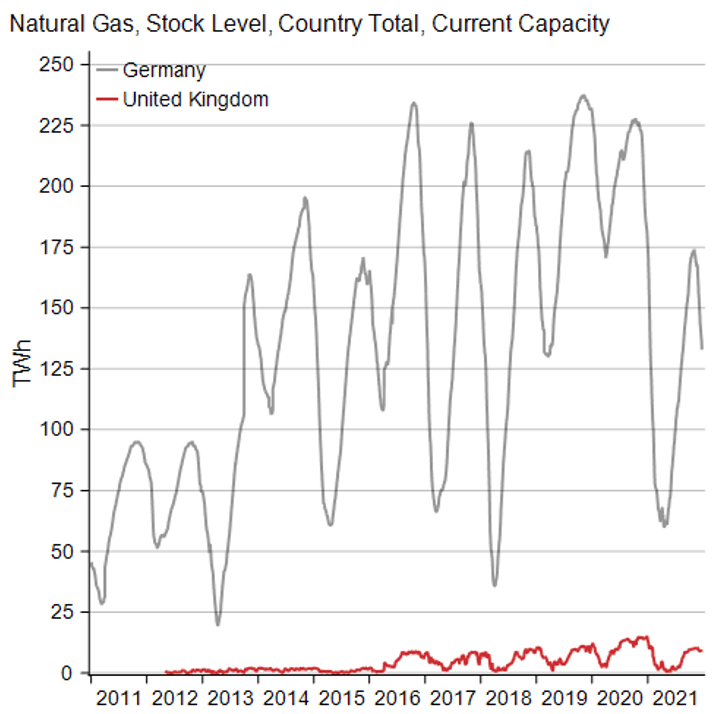

“It's worth noting the UK will be just as exposed to the energy crisis as Europe (the UK has even less storage of Gas) and the BOE is already pretty much fully priced for Feb and 100bp+ priced in for November next year - so I see more scope for US pricing to increase over the BOE (March Fed meeting could end up having another 10bps for example),” says Jordan Rochester, a strategist at Nomura.

“I'm short GBP/USD so naturally this move is concerning, but I suspect it’s largely a Xmas market random walk rather than the start of a new uptrend with the positive impulse from BOE rate hikes already largely priced in,” Rochester wrote in a Thursday research briefing.

The Pound and currencies of other energy importing countries were also buoyed on Thursday by reports suggesting that as many 30 tankers on route to Europe from the U.S. carrying liquefied natural gas after a period of runaway inflation in natural gas prices.

While Transatlantic supply dampened prices ahead of the festive break the Pound could potentially be vulnerable to any renewed acceleration of double and even triple-digit percentage price growth in some markets, if this has an uplifting impact on expectations for inflation.

Source: Nomura.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“Feb and March will be peak fear for energy markets and weigh on real yields and growth. The UK is much more vulnerable to a gas shortage due to significantly lower storage levels (comparison with Germany below) and risks the UK suffering from power cuts (yes it's quite possible hence the price action in Nat Gas). I don’t see an energy crisis boding well for GBP ahead if it comes to pass,” Nomura’s Rochester warned this week.

Although all countries have experienced sharp increases in energy costs this year - with global oil prices up around 50% and some prices of natural gas for future delivery up by nearly 500% this year - countries in Europe are widely seen as being at particular risk.

Price rises have been highly inflationary while their persistence was eating into the real terms or inflation adjusted returns earned by investors in Sterling assets before last week’s Bank of England decision to lift the Bank Rate rate from 0.10% to 0.25%.

Inflation expectations fell following the decision, leading real terms bond yields to rise in the UK relative to those in Europe and seemingly delivering an uplift to the Pound along the way, one which could leave it vulnerable to any further upturn in energy prices.

“The price of natural gas in the Netherlands has increased by a further 80% this month to a new record high. It now stands just over 40% higher than the peak from back in early October when gas prices last surged higher. Similar price action is also evident in the UK natural gas market,” says Lee Hardman, a currency analyst at MUFG.

“Recent price action has reinforced our view that the energy price shock w ill hit the European economies harder than the US and further boosts the relative appeal of the US dollar heading into early next year. It was only last week that the BoE and ECB had to raise their inflation forecasts again. The BoE signaled that they now expect to peak at 6.0% in April 2022,” Hardman and colleagues said in a Thursday note.

Above: Pound-Dollar rate shown at weekly intervals with major moving-average and Fibonacci retracements of 2020 recovery indicating likely areas of technical support.