Pound Sterling Slides against Euro and Dollar as Markets Expect a 'Dovish' Bank of England

- Written by: Gary Howes

- GBP sold at start of the new month

- Market confidence over a Nov. rate hike starts to waver

- GBP/EUR can go to to 1.1764 says ING

- GBP/USD could go to 1.3570

- Beware "sell the rumour, buy the fact" price action

Image © Adobe Stock

- Reference rates at publication:

GBP/EUR: 1.1757 \ GBP/USD: 1.3640 - High street bank rates (indicative): 1.1530 \ 1.3360

- Payment specialist rates (indicative: 1.1700 \ 1.3574

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

The British Pound is on the back foot against the Euro, Dollar and a host of other major currencies with some analysts saying this could be a sign investors are recalibrating their expectations ahead of Thursday's Bank of England policy meeting.

The Bank of England will issue its latest policy decision which will come alongside the quarterly Monetary Policy Report and the odds of a rate rise are set high.

The market has over recent weeks cultivated an expectation the Bank will raise the Bank Rate by 15 basis points to 0.25%, an expectation that strategists say has contributed to the appreciation by Sterling against some currencies over recent weeks.

But the falls at the start of the new week suggests investors are beginning to shift their expectations and are anticipating a delay to the rate hike and/or a more cautious guidance to accompany a hike.

"GBP has started to underperform a little and it looks as though investors are starting to adjust positions ahead of Thursday's BoE meeting," says Chris Turner, Global Head of Markets and Regional Head of Research for UK & CEE at ING Bank.

Above: Daily chart for GBP/USD (top) and GBP/EUR (bottom).

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"We are in the camp arguing that the BoE will struggle to deliver on all the hawkish pricing packed into the GBP money market curve and that EUR/GBP can correct up to the 0.8500 area on Thursday," he says.

A move in the Euro to Pound exchange rate to 0.85 equates to a decline in the Pound to Euro exchange rate to 1.1764, a level that has already been surpassed by the time of writing on Tuesday which suggests a disappointment is being priced into the market ahead of the event itself.

ING economists expect a 15bp rate hike from the Bank of England on Thursday, following recent hawkish comments from some members of the Bank's Monetary Policy Committee.

But they say markets are overestimating the scale of future tightening, expecting "some modest pushback from policymakers in the form of lower medium-term inflation forecasts and a split rate hike vote".

The rule of thumb under a scenario where a central bank underwhelms against 'hawkish' expectations is that the currency in question would tend to weaken.

ING also expects some Dollar strength to feature this week - note the Federal Reserve issue their policy decision on Wednesday - which should see the Pound to Dollar exchange rate extend its recent pullback.

"Given our preference for a stronger dollar this week, that probably means Cable can retest strong support at 1.3570/3600 area," says Turner.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Turner says the Pound-Dollar's behaviour will also depend to a degree on how the Euro-Dollar trades.

"We suspect how EUR/USD trades at major support at 1.1500 will determine whether Cable needs to fall a lot further," says Turner.

Faced with surging inflation members of the Bank's Monetary Policy Committee (MPC) have spoken about the need to raise rates in order to ensure inflation expectations amongst businesses and consumers do not start running higher.

The decision to raise rates would therefore be in keeping with the Bank's central role of guarding price stability in the economy.

It is however worth bearing in mind that the odds of a November hike have fallen over the duration of the last week while the odds of a December rise have increased, according to money market pricing:

Above: "A BOE RATE HIKE EITHER IN NOVEMBER OR DECEMBER IS EQUALLY PRICED INTO THE UK OIS CURVE" - UniCredit.

The repricing in favour of a December rate hike over recent days might go some way in explaining why Pound Sterling has come under pressure of late.

Economists are meanwhile as split as market participants with a Bloomberg survey of institutional analysts showing 13 out of 29 expect a hike.

"A 5-4 vote to keep rates on hold at the MPC's November meeting is plausible, and we suspect that outcome would largely be a function of a few middle-ground MPC members wishing to wait for more post-furlough labour market data before committing to a hike," says James Rossiter, economist at TD Securities.

Regarding Sterling, strategists at TD Securities say they like fading GBP/USD ahead of the 200 day moving average and would look to reload on breaks to 1.35 (see the 200 day moving average annotated in the top graph).

"That said, the carry cushion also means that EURGBP remains a sell on rallies ahead of the 0.86 level," says Rossiter.

"It would be quite surprising if BOE did not hike on Thursday and GBP would then take a hit," says Anders Eklöf, Chief FX Strategist at Swedbank.

"The question is how much of rate hikes the bank sees as consistent with inflation at the target towards the 2 year horizon," he says.

As such, the inflation forecasts contained in the Bank's Monetary Policy Report could be key to how Sterling ends the day.

Swedbank's economists says they anticipate a "couple of hikes" to be delivered, which will take the Bank Rate back to 0.50% over the next 3 months.

"That may be enough to give GBP a near-term boost vs the EUR," says Eklöf.

Market pricing currently shows a number of rate hikes in 2022 are expected, which would take the Bank Rate back to 1.00%, which would put it at a post-financial crisis era high.

Many economists we follow view this as being too an aggressive stance and markets will ultimately be disappointed.

"Still we doubt BOE will be raising rates to the extent that is currently priced in, i.e. 100 bp until Q3 next year," says Eklöf.

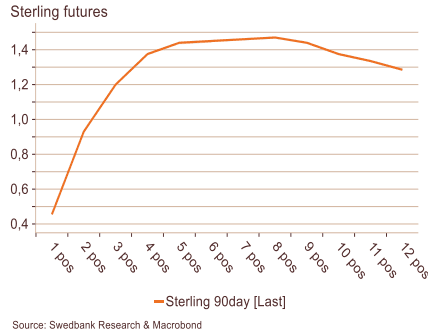

Above: "BoE priced for front loaded hikes" - Swedbank.

Foreign exchange analysts at Goldman Sachs have told clients they are 'bearish' on the Pound's prospects in the near-term as the Bank of England will disappoint.

"The 'rubber meets the road' for the Bank of England, and markets have set a high bar for the MPC to deliver, essentially fully pricing a 15bp hike for this meeting and close to 60bp cumulatively through February," says Zach Pandl, an economist with Goldman Sachs.

The Wall Street bank says it will prove difficult for the Bank of England to significantly over-deliver at this point, and sets up room for disappointment if the MPC guides towards a more "measured" pace.

Such a "measured pace" would be a 15bp hike in November, followed by 25bp in February, which is Goldman Sachs' current expectation.

"This means that the risks are skewed towards GBP downside over the near term," says Pandl.

Currency reactions to central bank policy events can often be explained by 'buy the rumour, sell the fact' price action.

Or, 'sell the rumour, buy the fact', depending on the mood.

Whatever the Pound decides to do ahead of Thursday could see a reversal on the day and over following days.

Therefore, if the currency remains under pressure into the event itself then the market might be in the process of positioning itself too pessimistically, meaning the bar for a 'hawkish' surprise and a rebound is in fact set quite low.