Pound Sterling Rebound to be Severely Tested this Week

- Written by: Gary Howes

-

- Uncertainty as to how GBP will react to Bank of England

- Global markets to influence GBP trade

- JPMorgan spot desk retain bullish GBP stance

Image © Adobe Images

- Market rates at publication: GBP/EUR: 1.1714 | GBP/USD: 1.3909

- Bank transfer rates: 1.1486 | 1.3620

- Specialist transfer rates: 1.1632 | 1.3812

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

For the British Pound the main event of the week ahead will be the Bank of England's August policy report which falls on Thursday, but analysts say to keep a watch of both domestic and global Covid trends as they will also determine direction in the UK currency.

Economists have a clear idea of what to expect from the Bank, yet there is by no means a clear consensus amongst analysts as to how the Pound will react, which suggests some heightened volatility can be expected.

Remember too that August is a month that traditionally suffers from low volumes as market participants exit for the northern hemisphere summer, which will likely exacerbate volatility.

Should the Bank of England strike a 'hawkish' tone - i.e. one that is optimistic about the economic outlook and the need to tighten policy in coming months - the Pound can rally.

"We remain of the view that currencies backed by hawkish central banks are those with the best chances to outperform in the remainder of the year," says Francesco Pesole, FX Strategist at ING Bank.

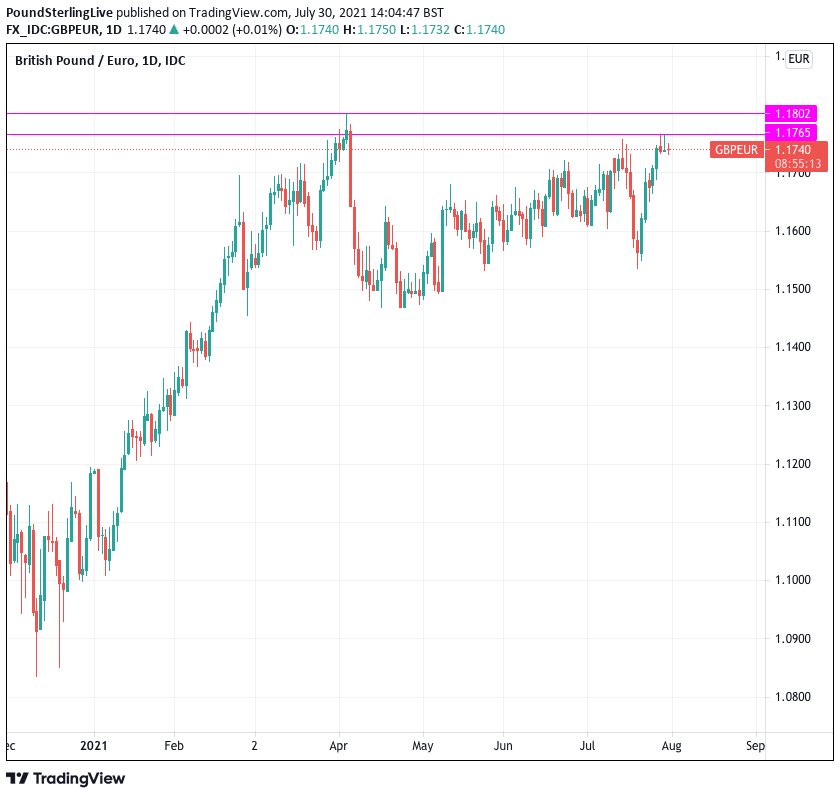

The Bank of England event comes at an interesting time for Sterling exchange rates from a technical standpoint as there are some key resistance levels that appear to be frustrating the Pound's ability to rise:

Above: Significant resistance layers in GBP/EUR continues to frustrate Sterling bulls.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

As can be seen 1.1764 in GBP/EUR (0.85 in EUR/GBP) is the start of a key layer of resistance that stretches to the May high at 1.1802.

The area is proving particularly difficult to cross and it will take a spark of energy to overcome.

Thursday's Bank of England event will likely provide that spark; if not then the market will be about to observe another failure at this barrier.

"The pound faces a tall event risk when the Bank of England on Aug. 5 issues a policy decision and new economic forecasts. A less dovish or even hawkish tone could raise the roof for sterling," says Joe Manimbo, Senior Market Analyst at Western Union.

The market expects the Bank's Monetary Policy Committee (MPC) to vote unanimously to keep the bank rate at 0.10% and the target stock of asset purchases at £895BN.

Inflation forecasts are expected to be revised sharply higher in the quarterly Monetary Policy Report, although a recent slowdown in the UK's economic rebound puts GDP forecasts at risk of a downgrade.

Sounding a cautious approach towards Pound Sterling ahead of Thursday's Bank of England appearance is Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole:

"Of interest for the FX markets, would be whether the updated economic projections would signal any change to the current cautious medium-term BoE outlook. We believe that this will not be the case, however, and remain sceptical that the BoE would ever join the camp of the hawkish central banks anytime soon."

"We thus maintain our relatively cautious outlook on the GBP."

Image courtesy of Barclays.

But, Bank of America analysts tell their clients they are of the view the Bank of England in fact sits in that camp of hawkish central banks.

They expect the Bank to raise interest rates to 0.25% in May 2022, which makes them one of the more hawkish in their expectations.

Gaétan Peroux, Strategist at UBS, is also in the hawkish camp as he expects the new quarterly Monetary Policy Report to show an upgraded growth outlook.

"We are likely to be served a more hawkish tone, but it will likely fall short of any policy announcement," says Peroux.

While the Bank of England forms the focus of the week ahead, keep an eye on global market sentiment and the trajectory of local domestic Covid infections.

"With nearly all restrictions now removed and COVID-19 cases falling back in the UK, we continue to believe sterling should outperform against both the dollar and the euro over the coming months," says Peroux.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

New infections in the UK have been falling over the course of the past week with the seven day average of daily new cases is now down to 424 cases per million, from a peak of 702 on July 21.

The development will likely generate confidence amongst consumers and businesses that the country is exiting the crisis on a sustained basis and could rejuvenate that strong economic growth seen earlier in the second quarter.

"The reduction of UK infections, in particular, following the sharp increase in previous weeks and despite the “experiment” with full reopening, is very encouraging—with GBP the best performing in G10 this week," says Athanasios Vamvakidis, Global Head of Foreign Exchange Strategy at Bank of America.

The JP Morgan trading desk in London retains a positive stance on the Pound from a tactical basis heading into the new week, noting "the positive Covid case count in the UK should continue to support GBP":

The desk retains a bullish stance on the Pound against both the Euro and the U.S. Dollar.

"The view is to buy GBP on dips ahead of 1.3900 in GBPUSD and sell 0.8550 in EURGBP looking for a test of 1.4000 and 0.8470/75," says the note.

News concerning the global pandemic could meanwhile be equally as important to Sterling as domestic developments.

Foreign exchange analyst Adam Ma at Western Union Business Solutions reminds his clients that the Pound remains sensitive to what broader markets are doing, noting that the pro-cyclical UK currency tends to benefit when global stock markets are on the rise.

"Escalating coronavirus concerns have revived the global growth concerns, weighing heavily on the market mood," says Ma.

How markets process the global covid situation over coming days and weeks could therefore have a bearing on where the Pound travels.

"Sterling's performance has tracked global risk sentiment in recent weeks, with the currency's performance in line with the direction of global stock markets" says Ma.

The market had a scare about rising cases driven by the Delta variant two weeks ago and the Pound fell, but this proved short-lived as investors showed their confidence in the effectiveness of vaccines.

Nevertheless, markets have a number of issues to keep their eyes on this August, including a potential deceleration in global growth and China.

And August is typically a month of negative returns for the S&P 500 which is the benchmark for global investor sentiment, which can help explain why global investor sentiment matters for the the Pound and why it has struggled every August over the past 10 years.