Pound Sterling Jumps v Euro and Dollar Again: Six Factors Helping to Fuel the Advance

The British Pound jumped against most of its peers on Thursday, February 18 as the currency's stellar 2021 maintained a high gear.

Of note is a 0.40% rise in the Pound-to-Euro exchange rate to 1.1550 and a 0.56% gain in the Pound-to-Dollar exchange rate to 1.3934.

Gains come against all major G10 currencies, confirming a decidedly Sterling-based flavour to the moves:

The gains started building when the London market opened for the day and the currency has beens steadily bid since.

The reason and trigger of the gains are by no means obvious and therefore pinning a single narrative to the advance would be fanciful.

"There were no fresh headlines to drive GBP enthusiasm this morning so presumably the themes of successful vaccine roll-out, no material dislocation from Brexit so far, and a stronger than expected Q4 20 GDP print continue to buoy spirits," says Daragh Maher, Head of Research, Americas at HSBC Securities.

Instead, a confluence of up to six or so drivers appear to be powering the advance:

1) Positive technical momentum

The currency is in established uptrends against both the Euro and Dollar, inviting further market participation in a broader foreign exchange market largely devoid of trending currencies.

"Our longer term target is offered by the 2018 peak at 1.4377. Near term dips should now see 1.3775 and 1.3760, the January high act as initial support. We will remain bid for now above 1.3520," says Karen Jones, technical analyst at Commerzbank.

"EUR/GBP breaks below significant support," say Bovell Global Macro, an investment fund. "We continue to favour long Sterling vs a basket of G8 currencies."

- Market rates at publication: GBP/EUR: 1.1550 | GBP/USD: 1.3938

- Bank transfer rates: 1.1320 | 1.3650

- Specialist transfer rates: 1.1470 | 1.3840

- More about bank-beating exchange rates, here

2) An ongoing post-Brexit realignment

The signing of a post-Brexit trade deal in December 2020 puts to rest a litany questions concerning the UK's outlook.

This could allow for a steady repositioning in UK assets and Sterling by the international investor community

"Due to the Brexit factor, the broad value of the GBP and GBPUSD are both cheap relative to their long-run averages," says Stephen Gallo at BMO Capital Markets.

"The UK’s more favourable valuations and its greater exposure to the sectors that are likely to benefit most from the recovery, such as consumer-facing, energy and financial, suggests that equities in the UK will rebound more rapidly than elsewhere," says Paul Dales at Capital Economics.

3) UK's lead in the vaccine race

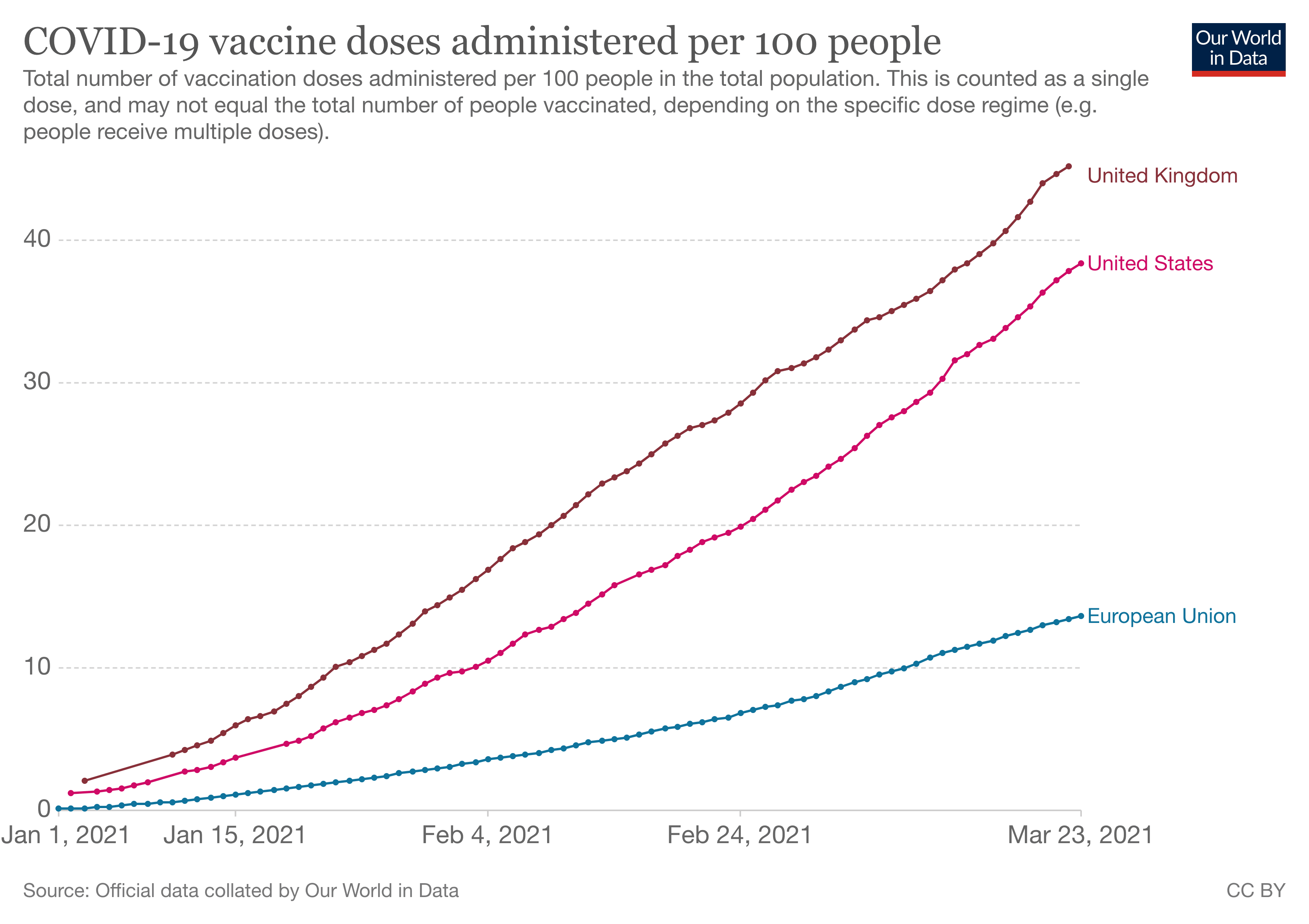

The UK tops the EU and U.S. in terms of numbers vaccinated. The FX playbook suggests this will allow the UK economy to normalise ahead of peers, leading to a potential outperformance in activity, UK assets and the Pound.

"FX investors have rewarded currencies that are in the frontline of the vaccine rollout and similarly punished those seen to be slow in vaccinating," says Ray Attrill, Head of FX Strategy at NAB.

"The ‘G10 vaccine champion’ GBP could remain the only major currency that is able to hold its ground vs the USD," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

4) Negative interest rates at the Bank of England now Unlikely

The Bank of England on February 04 sent a clear signal that negative interest rates are unlikely in the forseeable future, dashing expectations in a market that were resolute in expectation for the Bank to cut rates to 0% or below by the end of 2021.

"A quick start to vaccine rollouts and the BoE signalling it is unlikely to need negative rates has boosted GBP," says Paul Meggyesi at JP Morgan.

Above: The Pound ticked higher as future markets quit a belief the Bank of England would cut interest rates to negative.

5) Broadly supportive global equity markets trends

Investors remain in a resolutely bullish mood, testified to by the fact U.S. stock indices remain near all-time highs.

With Brexit ceasing to be a concern for markets, the Pound appears to be attracting a bid when markets are on the rise and analysts say the UK currency's positive correlation with U.S. stock markets is rising.

"The pound has been behaving more like a risky asset than a safe haven one since the start of the pandemic. Indeed, the correlation between the FTSE 100 and the pound has risen sharply since the start of 2020. So even a small further rise in investor sentiment should benefit the pound," says Paul Dales, Chief UK Economist at Capital Economics.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

6) Potential buying of Sterling by global central banks

A more stable outlook given the signing of the EU-UK trade deal has lead to suspicions of increased buying of GBP by central banks keen to add to their reserves and help weaken their own currencies.

"During the last 5-year period, the GBP has not been a key beneficiary of the steady decline in the USD’s share of global FX reserves. There is scope for this to change," says Stephen Gallo at BMO Capital Markets.

"GBP could see its fair share of renewed reserve manager interest now that hard Brexit risk is in the rear view mirror," says Richard Franulovich, Head of FX Strategy at Westpac.

Image courtesy of Westpac.