Sterling Steadies Amidst Reports EU and UK Likely to Reach Breakthrough on Food Exports

- GBP sell-off eases

- Reports major Brexit impasse can soon be solved

- Stay bearish GBP says Rabobank

Image © European Union - European Parliament, Reproduced Under CC Licensing.

- GBP/EUR spot: 1.0810 | GBP/USD spot: 1.2858

- GBP/EUR bank rates: 1.0607 | GBP/USD bank rates: 1.2598

- GBP/EUR specialist rates: 1.0713 | GBP/USD specialist rates: 1.2742

- Learn more about market beating exchange rates, here

The British Pound was seen firmer moving through the mid-week period amidst suggestions by analysts that the currency has absorbed its full share of bad news for the time being and reports that the EU and UK could see a breakthrough on the matter of food exports.

UK food exports into the EU has been an unexpected flashpoint for the two sides, with the UK pushing forward contentious legislation that they say seeks to ensure the EU can never block the export of food from Great Britain to Northern Ireland.

The move has antagonised the EU and lead the market to raise odds of a 'no deal' Brexit by year-end, which in turn contributed to last week's biggest one-week decline in Sterling since March.

Nick Gutteridge, a freelance Brussels Reporter who contributes to all the UK's largest newspapers and who has an impeccable track record on Brexit negotiation developments, says it appears that the matter of food exports is on course to being solved:

"Behind the scenes the third country listing or 'food blockade' row isn't quite so dramatic. The EU wants the UK to provide details of its post-Brexit animal and plant health (SPS) rules by the end of next month. The UK says it will, and they're basically be the same as now."

The Sanitary and phytosanitary (SPS) measures are a detailed set of rules that third-party countries must meet if they are to export food into the EU.

News of real potential for progress on the SPS in coming weeks could see a major source of tension between the EU and UK resolved, as it was an argument around SPS rules that contributed to heightened tensions over recent days which in turn negatively impacted the value of Sterling.

"The EU wants this information so it knows the conditions under which its farmers will be able to export goods to the UK from January 1. This is a requirement for opening up its market to agricultural produce from Britain, and is demanded of every third country on the list," says Gutteridge.

The Pound has this week steadied as markets appear to have absorbed much of the political developments and recalibrated their expectations for a deal to be reached between the two sides. The Pound-to-Euro exchange rate is up 0.80% this week at 1.0885, the Pound-to-Dollar exchange rate is up 0.80% this week at 1.290 and the Pound-to-Australian Dollar exchange rate is up 0.30% at 1.7624.

An EU official tells Gutteridge the UK has pledged to transpose the Official Control Regulation, which gives the Commission oversight powers along the agrifood supply chain, as well as EU rules on animal and plant health 'with modifications'. They're now waiting for the domestic legislation.

"They won't have long to wait," says Gutteridge, quoting a UK spokesperson who says legislation to make the OCR operable in UK law will be put before Parliament next month "the UK is committed to maintaining the highest animal welfare and biosecurity standards. Our future rules will reflect this commitment."

"The EU will reserve judgement until it has seen the small print, in particular those modifications to its SPS rules. But if all is well the listing can be done in a matter of days. This is now settling down into a technocratic exercise, which is what it was always meant to be," says Gutteridge.

The news suggests a trade deal is still possible, despite heightened anxieties that the two sides are hurtling towards a 'no deal'.

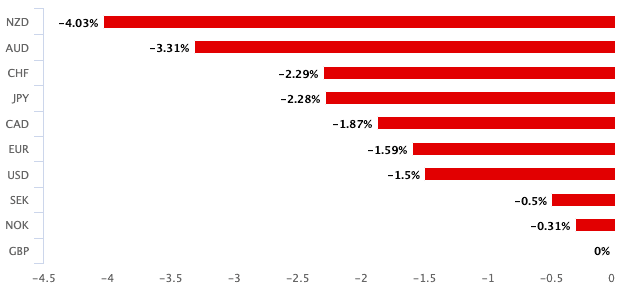

Above: The Pound is the worst performer over the course of the past month.

Anxieties rose last week when the UK tabled the Internal Market Bill which is designed to secure the functioning of the UK's internal market from the start of 2021 when the country exits the Brexit transition period. But in doing so, the Bill seeks to overturn some elements of the Withdrawal Agreement reached between the EU and UK in December 2019, leading to interpretations that the UK is effectively willingly breaking international law.

The UK says the move is necessary to ensure the future sanctity of the country amidst claims that the EU had said in negotiations it could use the Withdrawal Agreement to effectively ban the import of goods from the rest of the UK into Northern Ireland if Great Britain failed to be included onto their third-country food importer list.

The EU threatened to enact legal action or sanctions if the UK does not drop the legislation by the end of the month, however most analysts and political commentators don't believe they will pull the plug on the negotiations.

"Theoretically, the EU could break off the trade talks. It won't," says David M. Herszenhorn, chief Brussels correspondent at POLITICO. "If Johnson wants to torpedo the process, he will have to do so on his own. The EU negotiator, Michel Barnier, will work to the last minute to find agreement on all the issues, knowing neither the EU heads of state and government nor the European Parliament would ever approve the deal without an accompanying commitment by the U.K. to uphold the Withdrawal Agreement in full."

Expect Sterling to remain relatively supported as long as tensions between the EU and UK ease and the two sides continue talking.

Expect Sterling to rally should it become clear a deal can still be done.

"Beyond the very short-term we would see meaningfully lower odds of a "no deal" Brexit than the market appears to be implying—the outcome would be damaging to the UK economy, and the Johnson government has used similar negotiating tactics before. For investors willing to look through some near-term volatility, current levels for Sterling longs now look attractive, in our view," says Zach Pandl, an analyst at Goldman Sachs.

We meanwhile reported earlier this week that the EU was looking to delay a decision on granting EU companies access to the City of London's foreign exchange clearing houses for Euro transactions, linking the delay to the contentious issue of the Internal Markets Bill.

However, news out on Tuesday cast these worries aside after the EU said they would extend access to the City for 18 months.

"The European Commission is preparing to offer its banks an extension of 18 months on access to London’s clearing houses after the Brexit transition period expires at the end of the year. Not doing so would force EU banks to start the potentially disruptive task of removing business from UK’s houses next month even as the EU has little alternative venues with sufficient capacity," says Mathias Van der Jeugt, an analyst with KBC Markets.

Despite reasons to be cautiously optimistic on the prospect for a Brexit trade deal, and by extension on the Pound's outlook, foreign exchange analysts at Rabobank say they are staying bearish on the currency.

"Even though EUR/GBP sailed past our long-term target of 0.92 at the end of last week, we would not rule out further losses for the pound in the current environment and certainly see scope for more volatility," says Jane Foley, Senior FX Strategist at Rabobank.

"There is plenty of talk in the market this week that GBP may have reached ‘peak bearishness’. The pound suffered a significant sell off last week and such a move is often followed by a correction. However, we would argue that last week’s move was itself a correction from the slightly more constructive arguments that have been voiced in recent months about the outlook for GBP," adds Foley.