Pound Sterling Benefits as Investors Slash Bearish Bets, Data and Brexit Headlines Hold Key to Near-term Moves against Euro and Dollar

- Traders slash bets against the Pound

- ING warns of misplaced optimism

- Brexit trade negotiations resume in Brussels today

- Bank of England's Haldane in upbeat assessment of UK economy

Above: File image of Bank of England Chief Economist Andy Haldane. Image courtesy of the Bank of England, accessed Flickr. Reproduced under CC conditions

- GBP/EUR spot: 1.1048 | GBP/USD spot: 1.3140

- GBP/EUR bank rates: 1.0840 | GBP/USD bank rates: 1.2870

- GBP/EUR specialist rates: 1.0950 | GBP/USD specialist rates: 1.3022

Learn more about market beating exchange rates, here

Investor sentiment on the British Pound has turned increasingly positive over recent weeks, with data showing traders are exiting the bets they had built up against the currency. This has in turn helped push the Pound higher the Dollar and kept it relatively well supported against a broadly stronger Euro.

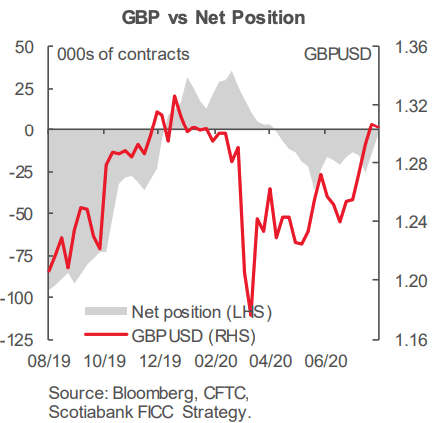

CFTC data for the week ending 11 August showed a "fierce trimming of GBP shorts," says Francesco Pesole, FX Strategist at ING Bank N.V. "The net positioning on Sterling moved into neutral territory for the first time since April."

The data showed the amount of active bets in favour of a weaker Pound were cut back from 34% to 28%.

"The GBP short-squeeze helps us understand the recent resilience in sterling, although CFTC data appears to be lagging the jump in GBP spot by a couple of weeks, considering that GBP outperformance was mostly concentrated in the second half of July but the short squeeze became apparent in positioning data only in August," says Pesole.

The move into neutral territory does however suggest to Pesole there might be "some excessive complacency in the markets towards Brexit risk and warrants some caution on future GBP rallies."

ING continue to see a non-negligible risk for GBP shorts to be rebuilt in the near future as UK-EU negotiations take centre stage again and uncertainty around the outcome pushes some investors to price in no-deal.

EU and UK Brexit negotiators will meet in Brussels on Tuesday in an attempt to thrash out an agreement on the remaining issues that are holding back a post-Brexit trade agreement. The stumbling blocks include EU access to UK fishing waters and the degree to which EU rules apply to UK industry in order to ensure the UK does not gain what is perceived by the EU to be an unfair advantage.

"The latest formal round of negotiations on the future relationship of the UK and the EU are set to begin today. Discussions are set to cover some of the key issues where the two sides are said to still be some way apart. Those include competition rules, fisheries policy and state aid," says Rhys Herbert, Senior Economist at Lloyds Banking Group.

"There are growing whispers that the EU’s demand of so-called 'level playing-field rules' — in reality, continued red tape and Britain bound to Brussels law for ever — could be too much to overcome," says Harry Cole, Political Editor at The Sun.

He adds there is "rising talk of shelving trade deal hopes for now. But that’s better than being bounced into a deal that will stop Britain bouncing back."

Should Cole's sources be correct we would expect a significant sell-off in Sterling to ultimately unfold as the market races to prepare for a 'no deal' outcome to trade negotiations.

However, this view does contrast to other briefings that suggest a landing zone is in sight for negotiators and that ultimately some form of agreement will be in place by the Autumn.

"The headlines from both sides continue to be disappointing. Significant differences remain, in particular with regards to the UK's post-Brexit approach to state aid," says Shreyas Gopal, Strategist at Deutsche Bank. "However, beneath the surface there has been some progress on the structure and governance of the deal. On balance we continue to see a deal as more likely as not in the autumn, though the market may first get more nervous over the prospect of a no-deal exit as noise picks up over the coming weeks."

Brexit trade negotiations are likely to become more of a driver of Sterling as we approach a tentative October deadline and we would therefore recommend those with Sterling international payments consider locking in current exchange rates, or look to automatically book rates when they are triggered on future sizeable moves. Our partners at Global Reach are able to assist in this matter.

Strong Economic Recovery Continues says BoE's Haldane

Brexit sentiment is one driver of Sterling in the current environment, another crucial pillar is the performance of the economy and whether or not the Bank of England will provide further support to the economy before the year has turned.

Bank of England Chief Economist Andy Haldane said at the weekend that strong consumer spending has already helped the UK claw back as much as half of the losses triggered by the pandemic and that he expects the economy to expand by more than a fifth in the second half of the year, which would be "by far the fastest rise" since quarterly records began.

The calls suggest Haldane remains the a source of optimism on the Bank of England's Monetary Policy Committee who earlier this month opted to keep interest rates and quantitative easing unchanged while taking a cautiously optimistic view on the economy's outlook.

"The foundations for an economic recovery – a rapid one – are already in place, hiding in plain sight. Economic activity in the UK is not falling like stone, in fact it has now been rising for more than three months, sooner than anyone expected. It has also recovered far faster than anyone expected," said Haldane in an article for the Daily Mail.

Should Haldane continue to impart this 'glass half full' view of the economy onto his fellow MPC members at subsequent policy meetings the market will likely ease back on expectations for further quantitative easing and the possibility of negative interest rates.

Sterling appears to be reactive to shifts in sentiment on the economy and Bank of England policy, and we therefore view Haldane's ongoing optimism to be a net benefit for Sterling.

"The Pound has enjoyed a summer surge against the Dollar, built largely on the greenback’s rapid decline and scaled back expectations of the Bank of England adopting negative borrowing rates," says Joe Manimbo, Senior Market Analyst at Western Union.

The comments from Haldane come ahead of a key UK economic data release later in the week in the form of flash PMIs for August, which will give a first insight into how the economy performed this month.

The UK PMIs are out at 09:30 on Friday 21 and with relative economic performance being an increasingly important factor for foreign exchange markets to consider, a beat or miss of consensus forecasts could influence direction in the Euro and Pound.

The UK Services PMI is forecast at 57, up from the previous month's 56.5 while the Manufacturing PMI is forecast at 53.6, up from July's 53.3. The Composite PMI is expected at 56.6, down on the previous month's 57.

How the UK recovery compares to the recoveries of other economies matters when it comes to exchange rates, as we are in a world where economic outperformance is beginning to matter again.

"The intense discussion about negative interest rates in the UK, which was kicked off by the Bank of England earlier this year, seems now to have subsided. At the August MPC meeting, the economic assessment was more relaxed than in previous months. In our view only a strong deterioration in economic activity and a lack of fiscal support in the coming months would persuade the Bank of England to follow the ECB into the negative territory. We do not think that this will be the case," says Thomas Flury, Strategist at UBS.

UBS are looking for EUR/GBP to be towards 0.89 by year-end, which gives a Pound-to-Euro exchange rate of 1.1236.