Sterling to Remain Soft Amidst Renewed Market Anxieties Centred on Oil Prices

- GBP shows sensitivity to global investor sentiment

- Oil price collapse turns investor sentiment negative

- GBP outlook remains soft short-term

- But rout seen back in early March unlikely

Image © Adobe Stock

![]() - Spot GBP/EUR rate at time of writing: 1.1325

- Spot GBP/EUR rate at time of writing: 1.1325

- Bank transfer rates (indicative): 1.1029-1.1108

- FX specialist rates (indicative): 1.1089-1.1223 >> More information![]() - Spot GBP/USD rate at time of writing: 1.2291

- Spot GBP/USD rate at time of writing: 1.2291

- Bank transfer rates (indicative): 1.1960-1.2050

- FX specialist rates (indicative): 1.2032-1.2182 >> More information

For the Pound, the mood of the global investor community remains key and the currency will swing between gains and losses based on whether equity indices are on the way up or down; on Wednesday April 22 the market is looking a little more constructive and this might put a temporary hold to the UK currency's recent declines.

But we would expect Sterling to lose further ground against the Euro, Dollar, Yen and Swiss Franc should investors turn defensive once again, which is a distinct possibility amidst dire incoming economic data and an ongoing oil market rout.

The UK currency is up slightly in mid-week trade but retains a broadly negative short-term tone, having dipped by over a percent against its major peers over the course of the past 24 hours as markets reacted to a collapse in global oil prices by selling stocks and other commodities, suggesting the reality of the scale of the global downturn is yet to be fully appreciated.

There remain signs that the oil market's woes are not yet over, with Brent crude losing a further 10% in value and WTI crude losing 5% on Wednesday.

"The Pound is also likely being liquidated following its torrid rebound from 35-year lows last month to cover oil market related losses," says Joe Manimbo, foreign exchange strategist at Western Union.

Throughout the coronacrisis we have seen Sterling decline when markets decline, and rally when they recover. A small, open economy such as the UK is exposed to capital inflows and outflows based on global investor sentiment, particularly as the country runs a current account deficit.

That the UK has an outsized financial services sector only adds to this dynamic as significant demands are placed on the sector when the global investor community turns bearish, resulting in capital outflows from the UK which in turn supresses the value of Sterling.

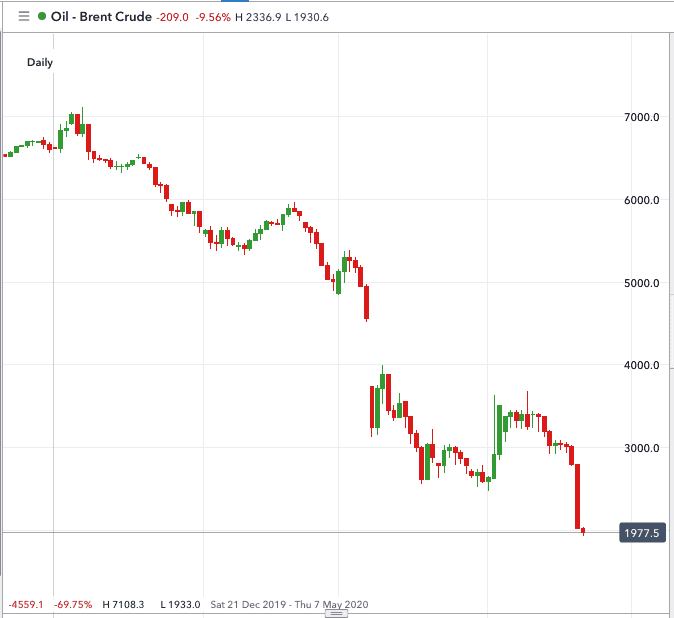

Above: Brent crude prices continue to slump, image courtesy of IG

The slump in global oil prices is a clear signal to investors that the global economy is experiencing a substantial drop in activity, something that is not yet adequately priced by global stock markets which have been propped up by the gargantuan supply of newly-minted currency by the world's central banks.

In short, stocks no longer offer a clear reflection of the underlying economic fundamentals, whereas oil demand cannot be manipulated to the same extent as assets that are sensitive to central bank wizardry.

"Oil prices are back in the forefront of investor minds, with Brent crude plummeting to levels not seen in 18 years. From a market perspective, the FTSE 100 has been impacted more than most, with the likes of BP, and Shell helping drive a 2% decline in the index," says Joshua Mahony, Senior Market Analyst at IG.

The losses on global markets have fed back into softer valuations in Sterling: the Pound-to-Euro exchange rate has fallen back to 1.1322, having been as high as 1.1494 earlier in the week, meanwhile the Pound-to-Dollar exchange rate is quoted at 1.2284, having been as high as 1.2409 earlier this week.

Above: Sterling was one of the worst performers on Tuesday, April 21 amidst a fresh deterioration in investor sentiment.

Going forward we would expect the tug-of-war between the perennially optimistic stock market and the sober reality exposed by commodities and economic data to continue, with Sterling reacting accordingly.

We expect Sterling to remain soft as long as global markets are nervous and investors are prepared to shed exposure to equities.

However, we are also aware that with covid-19 infections and death rate curves flattening across the world, the worst of the crisis might have passed and therefore we struggle to see a repeat of the declines witnessed in early March repeating.

Therefore any weakness will likely be short-term in nature and we would not expect to see the March lows in GBP/EUR or GBP/USD revisited even if Sterling adopts a softer tone.

In addition, because the outlook for Sterling is now apparently closely linked to the fortunes of oil, we also question whether the recent rout in oil can continue indefinitely.

"We expect stabilisation to come from fundamental market dynamics ahead. In our view, the current levels of oil prices will force producers to (continue to) cut back production but as demand recovers (at least partially) when lockdowns are eased, the inventory build should ease. In our base case of a sharp, but not very prolonged, global recession, this should help to form a bottom in prices in H2; we see Brent averaging USD35/bbl this year, rising to USD44/bbl on average in 2021m" says Christin Tuxen, Chief Analyst at Danske Bank.

We are also looking for an imminent intervention from U.S. President Donald Trump who on Tuesday said an aid package to rescue the sector was in the making.

"The likely decline in U.S. shale is a significant worry, with negative prices and a lack of storage or demand pointing towards a potentially catastrophic collapse for small oil producers in the U.S.," says IG's Mahony.

Trump tweeted Tuesday that he instructed the secretaries of the Energy and Treasury departments to "formulate a plan" to "make funds available" to help oil and gas companies.

No further details were announced, but Trump said the goal is to ensure that "these very important companies and jobs will be secured long into the future."

While we would not expect political actions to definitively end oil's woes we would expect it to inject some stability into the outlook for the sector, and potentially allow producers to significantly scale back activity.

There is also talk that the U.S. government would make their strategic storage reserve tanks available to producers to free up storage space; after all the dramatic drop below 0 in the May WTI contract on Monday was linked to storage issues.

Therefore, such a development might ease downside pressures in other contracts, and ultimately in the spot price.

However, others are more sceptical that the rout can be stabilised.

"It is needless to say that, at the point we stand, fixes to daily oil production would do nothing to better the mood in the oil market. With mounting worries that the global capacity to store tens of million barrels of extra oil per day is diminishing at an alarming pace, nothing less than a full halt in oil production would give a meaningful sigh of relief to this market," says Ipek Ozkardeskaya, analysts at Swissquote Bank.

But Ozkardeskaya does make the point that the link between the rout in oil prices and falling equity prices - and by extension the Pound - is not set in stone. After all, falling oil prices do tend to act as a shock absorber for the global economy which will tend to benefit from lower prices.

"If losses in equities remain less than what we have seen a couple of weeks earlier, it is because the decline in oil prices is not bad for everyone per se. It is of course dreadful for oil producers and energy-heavy economies, but cheap oil is positive for the global economic recovery, as it should help boosting growth, together with massive fiscal and monetary measures deployed by governments worldwide," says Ozkardeskaya.

If stock markets start to ignore oil markets once more, we could see the recent recovery reassert itself, which should aid Sterling valuations.