British Pound Battered and Bruised as Government Reiterates No Deal Threat

- Written by: James Skinner

- GBP down across board after Gov sets out Brexit position.

- No deal preparations to resume from June without agreement.

- Gov rejects range of EU demands, setting stage for a clash.

- Brexit squabbles may have renewed influence on GBP ahead.

- Comes as investors fear global coronavirus induced crisis.

- GBP/EUR must hold 1.1818, GBP/USD needs to hold 1.2842.

Above: Boris Johnson. © Pound Sterling Live. Still courtesy of Parliament TV

- Spot rates at time of writing: GBP/EUR: 1.1761, -0.78% | GBP/USD: 1.2876 -0.23%

- Bank transfer rates (indicative): GBP/EUR: 1.1454-1.1537 | GBP/USD: 1.2526-1.2616

- Specialist money transfer rates (indicative): GBP/EUR 1.1590-1.1660 | GBP/USD: 1.2684-1.2761 >> More details

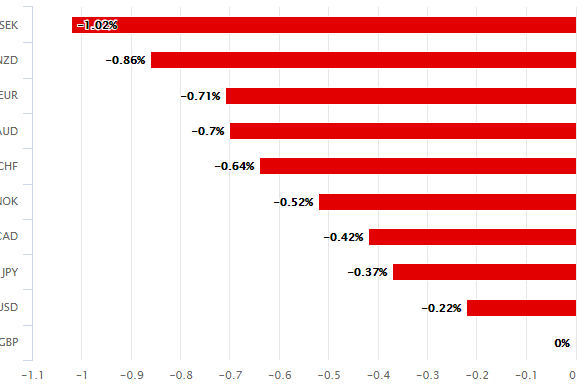

The Pound was deep in the red against all major currencies on Thursday after the government rejected a range of EU demands and warned it could begin planning for an 'no deal' Brexit from June if the broad outline of a future relationship agreement is not in place by then.

Prime Minister Boris Johnson published the mandate for UK trade negotiators on Thursday in which he has rejected EU demands for so-called 'level playing field' commitments that would see UK policy, laws and regulations closet indexed to those of the EU in a range of areas.

The EU insists those are necessary for their to be any preferential trade relationship with the UK.

"GBP is underperforming most major currencies because the likelihood of no UK‑EU trade deal by year‑end is high," says Elias Haddad, a strategist at Commonwealth Bank of Australia. "The EU insists on regulatory alignment on issues like the environment, state aid and worker’s rights. Negotiations on the UK’s post‑Brexit relationship with the EU start on Monday."

The Pound-to-Euro rate was among the biggest fallers and Haddad says it's now facing a decline back to 1.1428, a level not seen since October.

However, losses were exacerbated for that exchange rate by a strong +0.60% performance from the Euro-to-Dollar rate, which rose notably as investors also sold the U.S. currency heavily. The Dollar was the second worst performing major currency on Thursday, which is important because the Pound-to-Euro rate is simply the sum of GBP/USD divided over EUR/USD.

Above: Pound Sterling performance on Thursday. Source: Pound Sterling Live.

The government has rejected the idea of any role for the European Court of Justice in dispute resolution and has stated the agreement "should not constrain tax sovereignty in any manner," when the EU has sought to secure itself a seat at the UK's tax policy table via clauses against "social dumping." Such clauses would ensure a cartel-like arrangement that inhibits international competition between countries for companies and workers.

However, and most notably the government said that if it's not possible to negotiate a satisfactory agreement then "the trading relationship with the EU will rest on the 2019 Withdrawal Agreement and will look similar to Australia's," which is a newly minted code for a 'no deal' Brexit. Concerns over exactly that style of EU exit weighed heavily on the Pound for years heading into 2020 and were only alleviated by the withdrawal agreement that many saw as making a 'no deal' exit highly unlikely.

“We’re seeing many businesses holding off from making financial decisions until trade talks are well underway. For the time being, with coronavirus dominating the headlines, possible delays to budget spending commitments, and an increasingly likely BoE interest rate cut, businesses could be forgiven for taking their eye off this particular trade-talk shaped ball. It’s something we’ve had to remind our customers about over the previous few weeks. However, with negotiations set to begin on Monday, it is a crucial time for SMEs to get a competitive exchange rate,” says Lee McDarby, managing director of corporate foreign exchange and international payments, at moneycorp.

The Pound is not only contending with fresh Brexit fears but also rapidly souring investor sentiment as financial markets the world over increasingly appear to be pricing-in a global coronavirus-induced crisis. The virus is now spreading faster outside of China than inside, stoking fears about the global economic toll that Chinese style quarantine measures could take if implemented elsewhere.

Stock markets slumped sharply alongside other risk assets Thursday and it's probably no coincidence that the two worst performing currencies were the Pound and Dollar, given that both underwrite the world's two foremost financial centres where assets under management dwarf the combined GDP of the two countries. Both currencies were underperformers during the Eurozone debt crisis and global financial crisis.

Above: Pound-to-Euro rate shown at hourly intervals alongside Pound-to-Dollar rate (red line).

"Sterling is trading nervously, ahead of the UK-EU trade talks in March, as differences of opinion with the EU on regulatory alignment and level playing field arrangements raise questions about UK access to the single market," says Daniel Been, head of FX strategy at ANZ. "We understand that despite robust language on both sides, the pragmatic desire for a trade deal is paramount and both sides are keen to avoid a ‘no deal.’"

Political theatre around Brexit could now potentially even undermine the uptrend against the Euro and Dollar over the coming days. This is despite the first semblance of a meaningful deadline is not until the end of June when the UK must decide if it wants to extend the transition period beyond December 31.

"GBP/USD continues to struggle with the 55 day moving average at 1.3040 and the short term downtrend," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank. "EUR/GBP has rallied to the downtrend at .8432, which currently is being eroded."

Jones says the Pound-to-Euro rate would likely fall as far as 1.1614, a level that's not been seen since early November, if the nearby 1.1818 threshold gives way. She's told clients to sell the Pound on rallies to 1.1897.

She also says Sterling needs to overcome the 1.3040 level against the Dollar if the charts are to give it a green light for a return toward December's highs.

And in the absence of that, dips lower need to be arrested before 1.2842 for the Pound-to-Dollar rate to avoid declines back below the 1.27 handle.

"The potential falling wedge is still viable but only a close above 1.3040 will complete it. This should be enough to trigger recovery to initially 1.3285 and the 2015- 2020 resistance line at 1.3402," Jones says.

Above: Pound-to-Euro rate shown at daily intervals alongside Pound-to-Dollar rate (red line).

And traditional fundamentals as well as the movements of other currencies will also play a role too. Fundamentals weighed on Sterling Wednesday amid speculation suggesting that some major spending commitments could be delayed until after the March 11 budget, due to uncertainty over the outlook, the economy's need for stimulus and the affordability of any pledges made.

"The UK economy is doing better, as evidence of a post-election normalisation in activity across the manufacturing and service sectors is accumulating. Jobs growth is strong and the housing market is showing signs of revival. Brexit uncertainty has receded and business confidence is recovering. The UK’s departure from the EU provides a diversification alternative within Europe. We remain constructive on GBP, viewing dips as medium-term buying opportunities," says ANZ's Been.

Any budget decision to delay spending increases might then incite the Bank of England (BoE) to an interest rate cut that was only narrowly avoided just last month. And financial markets are not currently positioned for a BoE rate cut before August 2020, which could mean downside risks to Sterling. The Pound's recent resilience against the Dollar and Euro dates back to a January BoE decision to eschew an rate cut pending the outcome of the budget and data measuring New Year growth of the economy.

But speculation in the political press now suggests the government may want to keep its fiscal firepower dry for a while given that coronavirus could have a major impact on many economies and considering that 2021 is expected to bring a UK exit from the EU in spirit as well as letter. The UK formally left the EU on January 31 but little is able to be changed until the end of the transition on December 31 and some argue this is when the economy will be at its most vulnerable to the potential adverse effects of the vote to Brexit.