Pound Sterling Jolted by Bank of England Excitement, but Soon Flatlines on Forecasts for Subdued Inflation

Above: Bank of England Governor Mark Carney. File Image. © Simon Dawson, Bloomberg, Bank of England.

- Sterling jumps on growth forecast upgrades

- Inflation downgrades curb enthusiasm

- Carney warns markets against complacency on future interest rate rises

- But markets don't buy cautious Carney's bluff

- Sterling still on track for "superb week"

The British Pound is the best performing major currency of 2019, helped by fading 'no deal' Brexit fears and a Bank of England that remains the only major central bank that maintaining an interest rate raising policy stance.

At the Bank of England's May policy event it was confirmed it still plans to raise interest rates over coming months at a "gradual and limited" pace.

This stands in contrast to the policy stances adopted recently by other G10 central banks: For instance, the Federal Reserve and Bank of Canada have formally dropped their rate hike biases, the European Central Bank has delayed the timing of their first planned rate hike until at least in 2020, and the RBA and RBNZ have both signalled that they are seriously considering cutting rates.

"As a result, yield spreads have been moving in the Pound’s favour since late last year," says Lee Hardman, a foreign currency analyst with MUFG in London.

A currency tends to find support when its central bank is in a rate hiking mode as international investor capital tends to flow towards jurisdictions where returns are set to rise. The opposite is true when a central bank engages neutral or goes into reverse.

"We no longer expect the increase in August but now judge it most likely that Bank rate will be raised 25bp to 1.00% in November," says Phillip Shaw, an economist with Investec in London. "As investors latch on to the prospect of policy tightening, we expect this to provide a degree of support for the Pound."

A Mixed Bag for the Pound as Growth Upgraded but Inflation Downgraded

There was a spike in volatility in the British Pound after the Bank released their May policy decision and latest suite of economic forecasts.

The Bank's Monetary Policy Committee voted 9-0 to keep interest rate settings unchanged at 0.75%.

There heightened volatility in Sterling at the time of the Inflation Report's release was potentially because it contained some upgrades to growth.

Economists at the Bank lifted their growth forecasts and see quarterly GDP growth in the first quarter 2019 at 0.5%, up from 0.3% predicted at March’s meeting. The mean GDP-forecast for 2019 is increased from 1.2% to 1.5%.

It also upgraded its forecast for medium-term growth in 2020, from 1.5% to 1.6% and in 2021 from 1.9% to 2.1%.

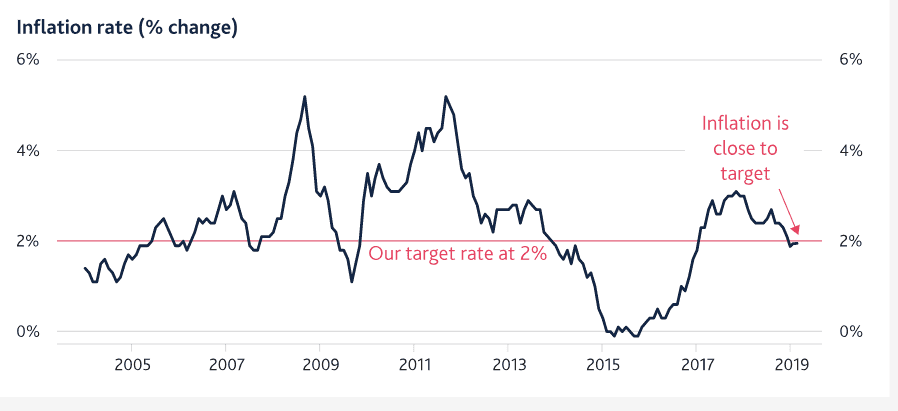

Inflation forecasts were however lowered with 2019 CPI inflation forecast at 1.6%, down from 2.0% forecast back in February. 2020 inflation is forecast at 2.0%, down from 2.1%, 2021 inflation is forecast at 2.1%, unchanged from previously.

The Pound spiked on the growth upgrades, but then fall back and is trading lower against the Euro and U.S. Dollar than where it was ahead of the report as markets swiftly reached the conclusion that policy-makers intend to keep policy settings firmly set at neutral.

The Pound-to-Euro exchange rate is quoted at 1.1636, the Pound-to-Dollar exchange rate is quoted at 1.3040 at the time of writing.

The minutes to the Bank's May policy meeting does show the MPC reckon more than one interest rate hike is required in the future to keep a lid on growing inflationary pressures.

This should, on balance, have been positive for Sterling.

However, the Pound had been riding high ahead of the event, and we saw another example of those classic 'buy the rumour, sell the fact' FX market reactions that have so often characterised previous Bank of England policy events.

"With GBP back in familiar ranges vs both USD & EUR, the MPC may provide some tradable near-term direction. We do not, however, expect the BoE to launch Sterling on a new longer-term trend until fresh catalysts emerge," says James Rossiter, an analyst with TD Securities.

Above: Sterling volatility rises as markets digest latest guidance from the Bank of England.

The Bank did also retain a strong message that much will depend on the evolution of Brexit negotiations.

"The economic outlook will continue to depend significantly on the nature and timing of EU withdrawal, in particular: the new trading arrangements between the European Union and the United Kingdom; whether the transition to them is abrupt or smooth; and how households, businesses and financial markets respond. The appropriate path of monetary policy will depend on the balance of these effects on demand, supply and the exchange rate. The monetary policy response to Brexit, whatever form it takes, will not be automatic and could be in either direction," read the minutes.

"The Bank of England is not as hawkish as the market would have wanted. No clear tightening signals for second-half 2019. Retains a gradual and limited pace of tightening. Nothing new for GBP markets here," says Viraj Patel, a foreign exchange strategist with Arkera.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement

Bullish Expectations Dashed

Ahead of the event we heard from a number of analysts that there was a good chance the Bank would take today as an opportunity to warn markets that a 2019 interest rate rise would be likely, particularly considering wages continue to grow in robust fashion which is in turn expected to put upward pressure on inflation over coming months.

Central banks tend to raise interest rates to counter rising inflation, rising interest rates in turn attract capital inflows from yield-hungry investors, which in turn bids Sterling higher.

While the economy continues to show robust growth, and wages are rising, the uncertainty posed by Brexit appears to remain a cause for caution.

Speaking to the press, Carney said investors were too relaxed about the pace at which the Bank could resume its gradual rate increases. Currently, the market expects only 30bps of monetary policy tightening over the next three years, this is effectively just one quarter-point increase.

"There are insufficient hikes in the current market curve to be consistent with our remit," Carney said.

Carney's view that higher borrowing costs will be needed in future represents a more hawkish stance than either the U.S. Federal Reserve or the European Central Bank.

This would typically be seen as a dichotemy that would work in favour of Sterling against both the Euro and U.S. Dollar as capital tends to flow towards jurisdictions were interest rates are expected to rise in the future.

Sterling's lacklustre response to the Bank of England's guidance could be interpreted as suggesting relative interest rate expectations are no longer the driver for currency markets they once were.

"FX in general is far more about relative growth prospects at the moment, than it is about the outlook for monetary policy," says Kit Juckes, a foreign exchange strategist with Société Générale.

There are suggestions the market had decided it would price in a more proactive message from the Bank, and therefore the bar to further Sterling advances was already set rather quite high.

"On Thursday BoE Governor Mark Carney may hint at another hike as soon as August, even if Brexit remains unresolved heading into H2 2019," said one analyst, Kallum Pickering at Berenberg.

This, and similar views held by other analysts, have been dashed by the steady-as-you go approach ultimately adopted by Carney & Co.

"The Bank of England’s Governor stuck doggedly to his script, outlining a policy that can best be described as tactical ambivalence," says Ulas Akincilar, Head of Trading at INFINOX. “While Mr Carney sees the global backdrop as increasingly benign, and the Bank is now predicting a gradual rise in inflation, Mr Carney’s concerns over what he described as the ‘fog of Brexit’ have clearly trumped his hawkish impulses."

While the Pound might not have taken extra impetus from the Bank of England event, it is still worth keeping in mind that the currency is one of global FX's outperformers at present.

"Sterling is on track for a superb week against the US Dollar, hoping to snap its 2-week losing streak. At its peak, the pound has appreciated by nearly two cents against the greenback this week. Appetite for the British Pound has partly increased on reports that cross-party Brexit talks have improved, and the Conservative government has shown willingness to shift on its Brexit stance to break the impasse in Parliament," says Joe Manimbo, a foreign exchange analyst with Western Union.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement