British Pound Recovery Extends Post-Vote Gains, Cox said to be Considering Changing Advice

Above: File photograph of protestors outside the UK parliament. Image © Pound Sterling Live, Al Jazeera.

- Cox could revisit legal guidance on backstop

- Opens door to third vote on May's deal

- Sterling higher as markets remain confident UK headed for a 'softer' Brexit outcome

Pound Sterling is the best performing major currency in mid-week trade with markets holding the view a solution to the current chronic Brexit uncertainty is achievable, with talk of the Attorney General reviewing his guidance being of particular interest to us from a currency perspective.

It was the guidance of Attorney General Geoffrey Cox that sunk Sterling, and Prime Minister May's hopes of seeing her deal pass through parliament, when on Tuesday he said the UK can still be caught in the Irish backstop indefinitely despite recent changes to the Brexit deal.

But, we are hearing Cox could alter his view.

The BBC's Assistant Political Editor Norman Smith has said on Wednesday Attorney General Geoffrey Cox had further legal advice which might help Prime Minister Theresa May win over lawmakers to her Brexit deal.

"Am hearing the Attorney General has further legal advice that might help (the prime minister) and win over Brexiteers," Smith said on Twitter.

Cox's advice was crucial in firming up DUP and Conservative Brexiteer opposition to the prime minister's deal - "any softening could enable them to get back on board," says Smith.

The news coincides with a strong recovery in the value of the Pound: the Pound-to-Euro exchange rate is quoted 0.88% higher on the day at 1.1675, the week's low is at 1.1524, the high is at 1.1792. The Pound-to-Dollar exchange rate is at 1.32, the week's low is at 1.2960, the high at 1.3287.

While we suspect many MPs would be sceptical of any material shift in Cox's advice, believing political interference from Downing Street is behind the move, developments suggest to us that the prospect of a third vote on Brexit is being lined up. To maximise pressure on MPs, any third vote might occur between Brexit day on March 29 and the European Council summit on March 21-22.

If Cox can find a very specific change he requires to materially alter his guidance, and May asks for this specific legal change, the EU might offer a final concession and MPs might finally fall behind the deal. We are not talking about whole-sale changes to the Irish backstop, but rather shifts in legal language that can push the AG's guidance.

This also suggests to us the Brexit deal still has a pulse, and the development is therefore on balance positive for the British Pound.

Viraj Patel, a foreign exchange strategist with Arkera says the Pound's midweek rally comes on "markets either sniffing an opportunity for a second referendum or a deal passing. "

Pound Outperforming Rivals

The British Pound pushed higher against all major currencies in mid-week trade with analysts telling us the outlook for the currency remains positive, despite the ongoing uncertainty surrounding Brexit.

"Medium term, technical structures remain constructive," says Robin Wilkin, an analyst with Lloyds Bank, but he warns, "intra-day volatility remains high."

The Pound has undergone a rollercoaster 24 hours with strong gains in the Monday-Tuesday morning session giving away to a sharp reversal as it became clear that the Government would not see its flagship Brexit policy passed by the House of Commons. The Government ultimately suffered a 149 vote defeat which has seen political commentators suggest any hope for May's deal to succeed has effectively been killed off.

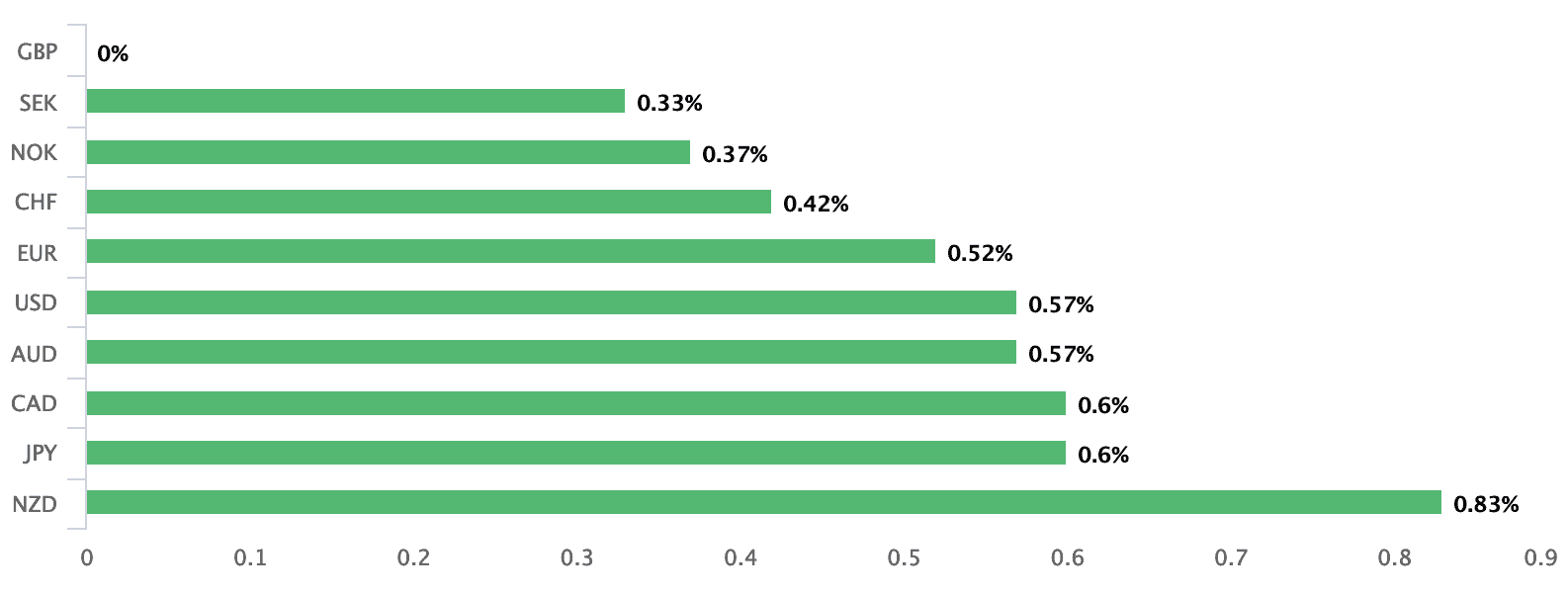

Above: Sterling is the day's top-performing major currency, but is still well below the highs achieved over the course of the past 24 hours.

But, why is the Pound holding its ground amidst the chronic uncertainty over Brexit.

In short, it's all about the direction of travel. The defeat of the Brexit deal for the second time opens the door to another Brexit deal, but crucially, one that might be materially different.

Our reading from the market's reaction is that traders expect the shape of any new deal to deliver a 'softer' Brexit, one that can command the support across parliamentary lines and would therefore have to pivot towards the Labour Party's preferred Brexit which involves the UK agreeing to a form of customs union with the EU.

Another positive driver behind Sterling is an apparent shift in the market's pricing of a General Election.

Deutsche Bank on Wednesday cut expectation for an early election to 20% to 10%, saying the second defeat for Prime Minister Theresa May's Brexit deal on Tuesday evening has made the path to exit the European Union clearer.

Deutsche Bank kept all its other probabilities unchanged.

"The direction of travel in the next two and a half weeks has become clearer," says Oliver Harvey, a currency strategist with Deutsche Bank.

We believe a General Election would bode negative for Sterling, as all votes tend to do, owing to the significant uncertainty they pose. Therefore, reduced market expectations for an election could be playing positive for Sterling.

Long Extension Better than a Short Extension for Sterling

The House of Commons will tonight vote on whether to accept a ‘no deal’, an outcome which is not expected to pass owing to the current arithmetic in parliament. Failure to OK a 'no deal' then allows a vote tomorrow night on whether to delay Brexit by asking the EU for an extension to the Article 50 process.

"Positive for the Pound is probably the fact that Thursday will see a vote on an extension of the Brexit deadline of 29 March, which could, if successful, deliver some relief for the currency," says Daniel Trum, an analyst with UBS.

Any delay would only likely be granted by the EU if the UK were considering a major shift in policy.

Prime Minister Theresa May told parliament on Tuesday night: "the EU will want to know why we want that extension. The house will have to answer that question: does it want to suspend Article 50, does it want a second referendum, or does it want another deal, but not this deal."

We expect the House of Commons to therefore potentially indicate a clear shift in stance on the matter and the only room open to a House of Commons that is numerically heavily pitted against a 'no deal' Brexit is that to a softer Brexit.

"I'm against every extension if it isn't based on a clear opinion of House of Commons for something they want. Please make up your minds in London because this uncertainty can't continue, not for us, not for Britain and certainly not for our citizens," says Guy Verhoftstadt, the European Parliament's Brexit coordinator, in Strasbourg on Wednesday.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

On the topic of extensions, we have seen the Pound react positively to rumours that any extension forthcoming from the EU would be a long extension, with talk last week suggesting an extension lasting up to two years is a strong possibility. The problem is a short extension - unless granted for purely technical reasons - poses problems for Europe which goes to the polls in May.

"For GBP traders, a long extension to article 50 would be preferable to a short one, unwinding some of the fears that have built up as we head into the 29 March deadline. The timeframe to any such extension would likely be dictated by the late May European Parliament elections, which largely rules out the possibility of a widely heralded three-month extension," says Joshua Mahony, Senior Market Analyst at IG.

The Pound's behaviour of late, while at times erratic around big political events, betrays a market that remains biased to believing Brexit will resolve itself in a positive manner.

"This week financial markets have awoken to the fact that many options are still on the Brexit menu," says Trum. The UBS analyst does however warn against complacency and urges a defensive approach to Sterling.

"We think GBP levels have been closer to a 'deal' outcome than a 'no dea' outcome in recent weeks. Hence, we advised not to chase the rally, as long as the downside risks like no-deal or general elections remain on the table," says Trum.