Pound-to-Krona Rate: Markets Eye Riksbank and Brexit after Swedish Parties Agree New Government Leadership

- Written by: James Skinner

© Pound Sterling Live

- PM Lovfen to take office on Friday as left abstains in parliamentary vote.

- Ending four-months of uncertainty, but Riksbank and Brexit matter more.

- GBPSEK to fall in 2019 as Riksbank hikes rates says Commerzbank.

Sweden's political parties have agreed the formation and leadership of a new government that will end a four-month period of political uncertainty, enabling markets to return their focus to the Riksbank interest rate outlook and Brexit, which are what matter most for the Pound-to-Krona rate.

Former and caretaker Prime Minister Steven Lovfen will be instated as PM again on Friday for the remainder of the current term after the Left Party said late on Wednesday that it will abstain from a parliamentary vote in order for him to secure another term.

Lovfen's Social Democrats struck a deal this month to form a minority government that largely preserves the status quo from a policy perspective while averting the need for co-operation with the anti-EU Sweden Democrats.

Vi ser till att Löfven blir statsminister - vi slipper SD och M.

— Jonas Sjöstedt (@jsjostedt) January 16, 2019

Vänsterpartiet får inflytande och våra fina reformer värnas.

Om Löfven vill införa marknadshyror eller attackerar LAS så är vi redo att fälla honom.

Nu ska vi stoppa högerpolitiken.https://t.co/anYx9yw3w5

"Speaker Andreas Norlén continues to work on the formation of government. He has proposed Stefan Löfven (S) as prime minister. On Friday, January 18, the proposal is examined in the Riksdag," says a statement from the Riksdag.

The agreement ends a four-month period of negotiations that followed September 2018's election, which shook up the Swedish political landscape. The Social Democrats saw their vote share fall from 30% to 28.3% in that ballot while former coalition partner The Greens saw theirs fall from 6.9% to 4.4%.

That meant the former coalition secured a combined 116 seats in the 349 seat Riksdag, well short of the majority required to pass legislation on an unfettered basis, which forced Lovfen to go cap in hand to smaller insurgent parties that actually grew their share of the vote in 2018.

"The deed has been done!," says Antje Praefcke, an analyst at Commerzbank. "As minority governments and precarious majorities have been known in Sweden for some time, politics only affect the krona in very rare cases. This time round that did not happen."

The Krona weakened during the morning session Thursday, although Praefcke says this move was unconnected to events in Swedish politics. The Pound, Euro and U.S. Dollar rose against all of the Nordic currencies in the morning hours.

Above: Pound-to-Krona rate shown at daily intervals.

What matters most for markets and the Pound-to-Krona rate is the outllook for Riksbank interest rate policy and Brexit. The bank raised its interest rate from -0.5% to -0.25% in December, its first hike since the European debt crisis.

The move came at the tail end of a year which saw Swedish inflation as well as core inflation both reach and hold the Riksbank's 2% target, even in the face of slowing economic growth.

Analysts and economists say inflation will decline slightly this year and the timing of the next rate change will be hinged on other developments effecting the economy, such as the pace of GDP growth.

"Riksbank will stick to its – admittedly very slow – rate cycle. It is unlikely to take action again before the autumn. Should the economic outlook deteriorate in the meantime, it will take an even longer break," says Praefcke.

Praefcke forecasts the Swedish Krona will strengthen against the Euro, U.S. Dollar and Pound Sterling this year, pushing the EUR/SEK, USD/SEK and GBP/SEK rates to 10.00, 8.20 and 11.23 respectively.

She says the currency will rise as the central bank reverses its negative interest rate policy, but warns this scenario could easily be scuppered if the economy slows further than rate setters currently expect.

The currency forecasts could also easily be impacted by the outcome of the Brexit process. Markets will learn more about the path toward the UK's exit from the EU over coming weeks, as the March 29 Brexit day draws closer. Readers can catch up on the latest Brexit developments here.

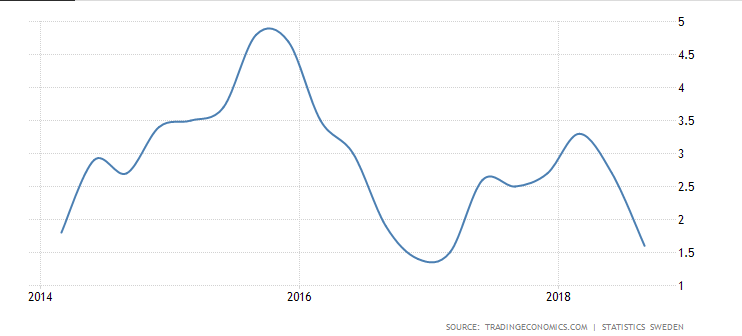

Above: Sweden's annual GDP growth rate. Source: Tradingeconomics.com

The Riksbank said in December it will now sit on its hands for while in order to observe the impact that last month's hike will have on indebted households and growth in the construction sector. That sector has been described by economists and policymakers alike as the greatest threat to the economic outlook.

Swedish GDP growth has been trending lower ever since the beginning of 2016 and given the Eurozone as well as broader global economies are expected to slow in 2019, risks to the outlook have been described by many analysts as tilted to the downside.

"The number of construction permits issued this year points to a contraction in new housing investment of about 25% in 2019. All else equal, this would push down investment spending by about 3.5%, reducing GDP by almost 1%," warns Pepijn Bergsen of Capital Economics, in a December note to clients.

Bergsen says there is scope for business investment in other sectors to temper the economic impact of declining construction output, but warns that domestic and global factors could easily see GDP growth slow further than the Riksbank expects, which would force it to abandon the idea of raising rates any further.

Bank-beating exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here