Brexit Deal Rejection Could Force Pound-Euro Parity

Germany's Angela Merkel quashed hopes for further Brexit concessions last week. But the Brexit deal agreed between the E.U. and U.K. is unlikely to come into force without further European compromise. Image © European Council.

- May confirms contact with Brussels over coming days

- E.U. must allow for further concessions to allow deal to pass

- Pound Sterling could succumb to parity vs. Euro: Rabobank

Expectations are growing Theresa May will seek further concessions from the European Union in an attempt to ensure she can secure the backing of her party and her Northern Ireland DUP partners for her Brexit deal.

The deal - released last week - drew fierce criticism and determined commitments by some of her Conservative party MPs that they would not vote for the deal.

The British Pound fell sharply as the scale of dissent to the deal emerged.

"This implies that there is a real risk of a hard Brexit in March 2019. Understandably, GBP has come under significant pressure, though the defiance of the PM and her reluctance to entertain questions about a leadership challenge has helped settle some nerves," says Jane Foley, Senior FX Strategist with Rabobank.

Indeed, if we look at the data, the Pound is still at levels consistent with expectations for a Brexit deal ultimately passing through parliament: The Pound-to-Euro exchange rate is quoted at 1.1254, which is effectively the middle of the pair's longer-term range.

The Pound-to-Dollar exchange rate is near the bottom of its longer-term range at 1.2830.

If a 'no deal' were being contemplated as the likely outcome, the Pound would be a lot lower. Recall the post-referendum low in GBP/EUR is at 1.0790 while the GBP/USD low is at 1.1950.

What current price action indicates is the Pound is still holding out for a deal and we believe key to this assumption is a belief that Theresa May can still garner potentially the slightest of concessions from Brussels to allow her plan to pass.

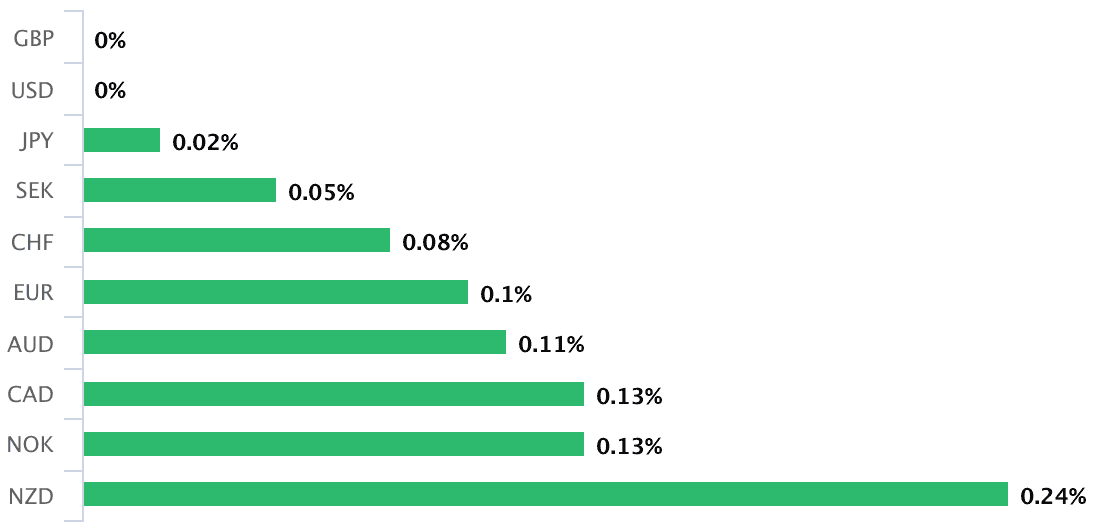

Above: A better start to the new week for the Pound.

In a Sky News interview May says the key to the outlook would be the next seven days, when her negotiators would be going back to E.U. officials and hammering out the "future relationship".

She will also be visiting Brussels, she added, and will talk to E.U. Commission president Jean-Claude Juncker as part of the week's discussions.

May needs further concessions, and the E.U. will be conscious the plan they have brokered requires some help, even if they have publicly stated they deal on offer is the final deal.

According to the BBC's Adam Fleming, E.U. Chief Brexit negotiator Michel Barnier and E.U. ambassadors acknowledged at a meeting in Brussels over the weekend the Westminster situation is "volatile".

And following today's meeting of the General Affairs Council (Article 50) Of note, Barnier has offered some soothing words that appear designed to shore up May and the Brexit withdrawal deal.

Barnier says negotiations have found a compromise to avoid a hard border between Ireland and Northern Ireland.

Crucially, "both sides, both parties want to avoid using the backstop."

And, in a verse that could have been penned by May herself, Barnier said:

"For the future relationship, both the EU and the UK will have full control of their own legislation and rule-making. This is essential, on our side, for the integrity of the single market. It is essential for the UK in terms of taking back control."

Whether or not the unified message between Brussels and London will actually translate into any concessions May can take back to parliament is of course the big unknown.

"The most likely outcome is that Mrs. May attempts to renegotiate with the European Commission," says Samuel Tombs, an economist with Pantheon Macroeconomics. "Our base case, then, remains that the Withdrawal Agreement receives parliamentary assent late in Q1."

Last week Angela Merkel appeared to quash hopes that the European Union could step in to rescue the Brexit agreement with further concessions, but Tombs argues the E.U. has always .

“We have a document on the table that Britain and the remaining 27 EU states have agreed,” Merkel said. “There is, as far as I am concerned, no question of further bargaining at present.”

Tombs does however point out that the Europeans have said time and again they will move if the U.K. gives ground on its red lines. This would entail the U.K. seeking a softer Brexit: Tombs argues May might do this in order to win over the support of Labour party MPs keen to avoid a 'no deal' at all costs.

"Ultimately, the unlocking of a no-change transition period of at least 21 months and a further softening of the end-state for Brexit would greatly bolster sterling," says Tombs.

However, relying on an opposition party that is intent on using your downfall to trigger a general election could prove too risky a proposition for May to stomach.

We believe May would rather try and eke out the slimmest of concessions from the E.U. to bring the DUP back on board. Having the DUP behind the deal would significantly increase pressure on Conservative party rebels.

Europe has invested a great deal of capital on achieving a deal, and the stakes are high for a bloc that has been built on negotiation. Therefore something is likely to be done over coming weeks and without European help the deal is dead.

Pound-Euro at Parity

We will also be keeping an eye out for word that 48 Conservative MPs have requested a vote of no confidence in the Prime Minister; something that should occur this week.

Political commentators are of the belief that Theresa May would win such a vote; however as we noted last week there are significant downside risks for Sterling should May lose.

May told the CBI conference on Monday that she believes she has struck a deal that is in the best interests of the U.K., she also delivered a clear message to those Conservative party rebels looking to unseat her:

"Let no one be in any doubt: I am determined to deliver it."

We expect market nerves to remain heightened and Sterling to be jittery as a result.

"The coming days will be difficult for PM May. She has an uphill challenge in holding down her job and bringing together her government and a potentially an even bigger task in trying to persuade parliament to back the deal she has struck with the EU. Any sign that the PM is succeeding is likely to be met by a relief rally in the Pound," says Foley.

But, there is a clear warning from Foley concerning the outlook for the Pound-to-Euro exchange rate in the event of a 'no deal' Brexit becoming likely.

"Investors are set to remain cautious. If it appears that the UK is on course to crash out of the EU next year, EUR/GBP could lunge towards parity," says the strategist.

We see the only way towards a deal being secured is via further E.U. concessions and as long as it sounds as though the door is open, we would expect a tense, wait-and-see mode to dominate sentiment towards the U.K. currency.

Advertisement

Bank-beating GBP exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here