UK Equity: Flutter a Buy at Berenberg

- Écrit par Gary Howes

-

Flutter Entertainment’s (LON: FLTR) recent underperformance in the stock market has created a valuable buying opportunity for investors, according to a recent research report by Berenberg analyst Jack Cummings.

Despite the company’s shares being under pressure due to softer Q1 results and a tax increase in Illinois, Flutter's diversified operations and robust financial outlook position it well for future growth, according to a new report from Berenberg.

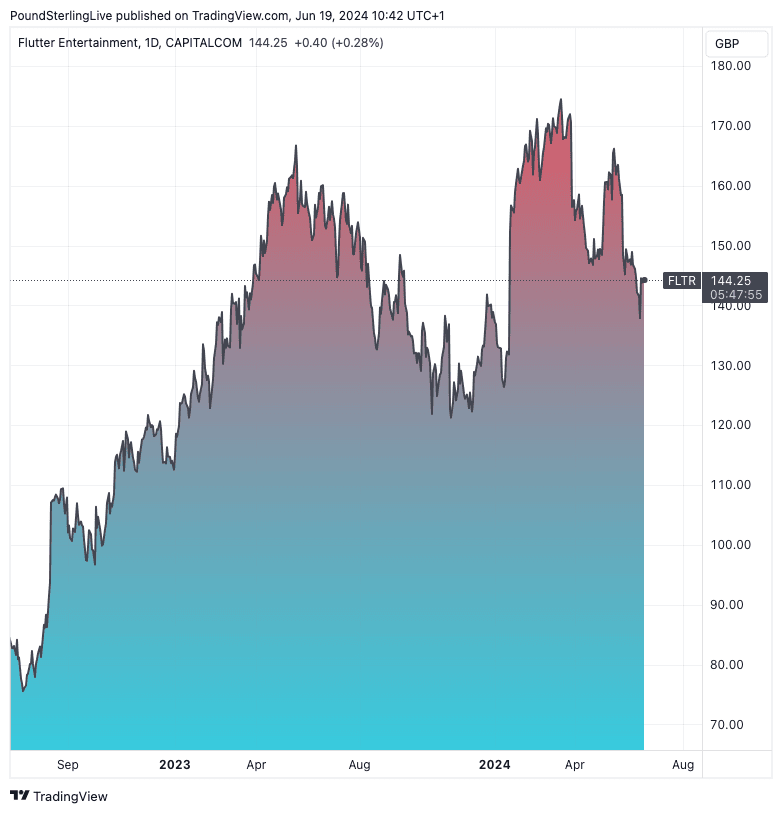

Flutter's shares, which peaked at £175 earlier this year, have experienced downward pressure primarily due to adverse sports results in Q1 and an impending tax hike in Illinois.

Cummings noted, "While the latter does impact earnings, Flutter is a well-diversified operator, which should insulate it against this type of regulatory and taxation risk." He added, "We think that Flutter’s current share price presents a valuable opportunity to buy into a high-quality, diversified operator with a solid balance sheet and a long runway for growth."

"Flutter is the world’s largest sports betting and iGaming operator with 12.3 million average monthly players worldwide in 2023," says Huxley Harris, a founder of Smart Pokies.

Its FanDuel brand a clear market leader in the U.S., "and we expect that to remain the case," says Cummings. Berenberg's rating on the stock remains Buy, with a price target of £186.

In the first quarter, Flutter's revenues were softer than anticipated at $3.4bn, primarily due to unfavourable sports outcomes.

Despite this, the company's U.S. market showed impressive revenue growth of +32% for the quarter, although there was a stark contrast between the periods before (+56%) and after (-51%) March 17. "Excluding the U.S., performance was solid, with EBITDA coming in ahead of expectations," Cummings said.

Flutter confirmed its full-year guidance during the Q1 results announcement, targeting $6bn in revenue and $710m in adjusted EBITDA for the US market. For the ex-US market, the company aims for $7.85bn in revenue and $1.73bn in adjusted EBITDA.

The tax increase in Illinois, effective July 1, will raise the progressive sports-betting tax rate to 20-40%, up from 15%. "We estimate an effective tax rate of approximately 36% for Flutter, resulting in an incremental $50m hit to FY24 EBITDA, growing to around $102m in FY25," Cummings explained. Despite the immediate impact, he noted, "Given the roughly 7% fall in the share price on the day of the announcement, we think the impact is more than priced into the shares."

Cummings also highlighted that while U.S. guidance appears conservative, the impact from Illinois does limit the potential upside. "We still think that revenue guidance is conservative and sit at the upper end of the range; however, factoring in the impact from Illinois, we now sit towards the bottom end of the EBITDA guidance range for the U.S. business," he said.