S&P 500 Rally: Far Too Early To Call a Peak Says City Index

Image © Adobe Images

Written by Fawad Razaqzada, Market Analyst at City Index.

With the major U.S. indices hitting repeated all-time highs this week, the trend is clearly bullish, and markets remain in the "buy-the-dip" mode, at least for now anyway.

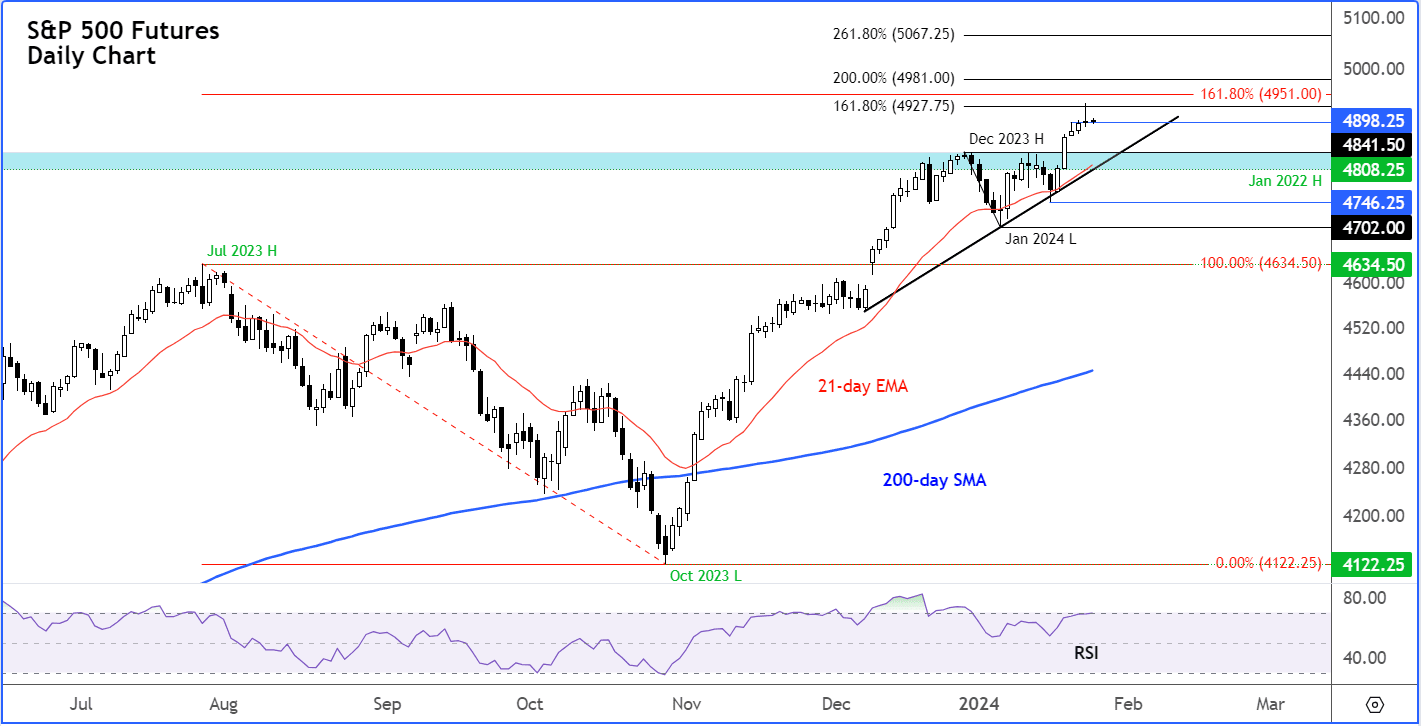

But the rally is starting to look a little over-stretched at these levels as one can see on the S&P Futures chart.

Momentum indicators such as the Relative Strength Index (RSI) are at or above "overbought" levels, which may encourage some profit-taking.

Image courtesy of City Index.

The market’s structure of higher highs and higher lows means the bears are largely sitting on their hands and will need to see a clear reversal pattern emerge before entering the fray in large numbers.

Wednesday’s small, inverted hammer candle, that was formed at around the 161.8% Fibonacci extension level at 4927 of the drop from the December peak may be an indication that traders will proceed with more caution moving forward, especially in light of Tesla’s earnings miss.

Wednesday’s price action will put short-term support around the 4890-4900 area into focus today.

A decisive break below this level could see the S&P drop back to the shaded area on the chart around 4808 to 4841, an area corresponding to the previous two all-time highs hit in January 2022 and December 2023, respectively. Even if the market falls to this area, this won’t necessarily be a bad thing or a sign of a peak.

For indeed, many dip-buyers might be lurking to get onboard any short-term dips.

But if we then start to see a breakdown in the market structure of higher highs and higher lows, that is something that will catch the attention of the bears.

At the current state of the markets, the low from last week at 4746 might be the line in the sand for many short-term bullish traders. A potential move below this level would create a lower low and break the short-term bullish trend line. It would therefore present an objective exit signal for the bulls.

So, if that level is breached, only then can we expect to see some follow-up technical selling. Any weakness in the interim should be seen as a normal pullback you tend to see in a rising trend.

Index futures have been stable overnight, despite Tesla’s underwhelming earnings that took some shine off the tech euphoria, with the electric carmaker warning of "notably lower" sales growth before the launch of the new model next year.

Investors will be eyeing the ECB rate decision, as well as a slew of US data that includes GDP ahead of next week’s Fed meeting.

The key question is whether Wednesday marked at least a temporary top in this current phase of the rally, or do we just continue ploughing ahead despite concerns over valuations, the Red Sea situation, and the delay in interest rate cuts?

Tesla aside, we had seen some good earnings, especially Netflix, while the Composite PMI of the manufacturing and services sector rose to its highest level since June, adding to a string of forecast-beating data we have seen off late.

Among other US data releases that have beaten expectations lately, include retail sales, jobless claims falling to their lowest level in more than a year and UoM’s consumer confidence survey rising sharply to 78.8 from 69.7. On top of this, China’s latest efforts to shore up its struggling equity markets also helped to boost investor confidence.

But is the rally about to run into a bit of resistance at these levels?

Following the dovish rate-cut euphoria that propelled stocks to record highs in the last month of 2023, you would have thought the start of 2024 might see the markets stage a bit of a correction as expectations over the Fed’s rate cuts have been pushed back.

Well, we did get a tiny correction in the first week of the year, but then the markets have continued to push into unchartered territory even as the probability of the March rate cuts have continued to fall.

To some degree, the market’s resilience suggests investors are happy to see strength in US data despite high interest rates.

Investors are confident that we have reached peak interest rates and monetary policy will be loosened anyway, if only a little later than expected.

Still, sceptics would argue that investors are under-pricing risks they are facing. Rising shipping costs as a result of the Red Sea situation is only going to boost input costs and lead to more global inflation, and thereby delay interest rate cuts even further.

Another factor that might worry investors is the lack of participation from non-tech stocks. Some 14% of the S&P 500 is made up of Microsoft and Apple, alone. Any weakness in these or the other big 5 tech stocks in the so-called Magnificent Seven could lead to an outsized correction in the S&P 500.

With Tesla’s underwhelming results, some investors are now left wondering whether they have pushed stocks too high, too soon.

Indeed, it is the pace of the rally that has some investors worried, arguing that the optimism surrounding artificial intelligence could be a sign of irrational exuberance, especially with many companies yet to monetize generative AI effectively.

US investors have also ignored the struggling Chinese markets and concerns about the health of the world’s second largest economy. There are also fears, as indicated by rising yields, that major central banks around the world will not be in a rush to cut interest rates after all.

Today, the ECB President is likely to suggest that borrowing costs will not come down before the summer because of concerns over inflation.

In the US, the markets have been soaring in recent months because of AI optimism and expectations over the Fed rate cuts in 2024.

But the rally could stall moving forward. Gold, FX and bond market investors have already shown concerns over the Federal Reserve's potential inclination to maintain higher interest rates for an extended period beyond market expectations.

Equities have been propelled to new highs mainly because of the top 7 tech companies and the A.I. optimism. There is a risk that once this optimism fades, US markets may face a correction from these overbought levels.

The trigger could be if we see signs of inflation remaining sticky or rebounding again. The Fed’s favourite inflation measure, the core PCE price index, is due for release on Friday.

We have already heard hawkish talk from several Fed officials. In fact, even the centrist Raphael Bostic was a bit more hawkish than expected, mirroring several other of his FOMC colleagues who have spoken lately. The Fed might provide a more hawkish policy decision next week than it conveyed in December