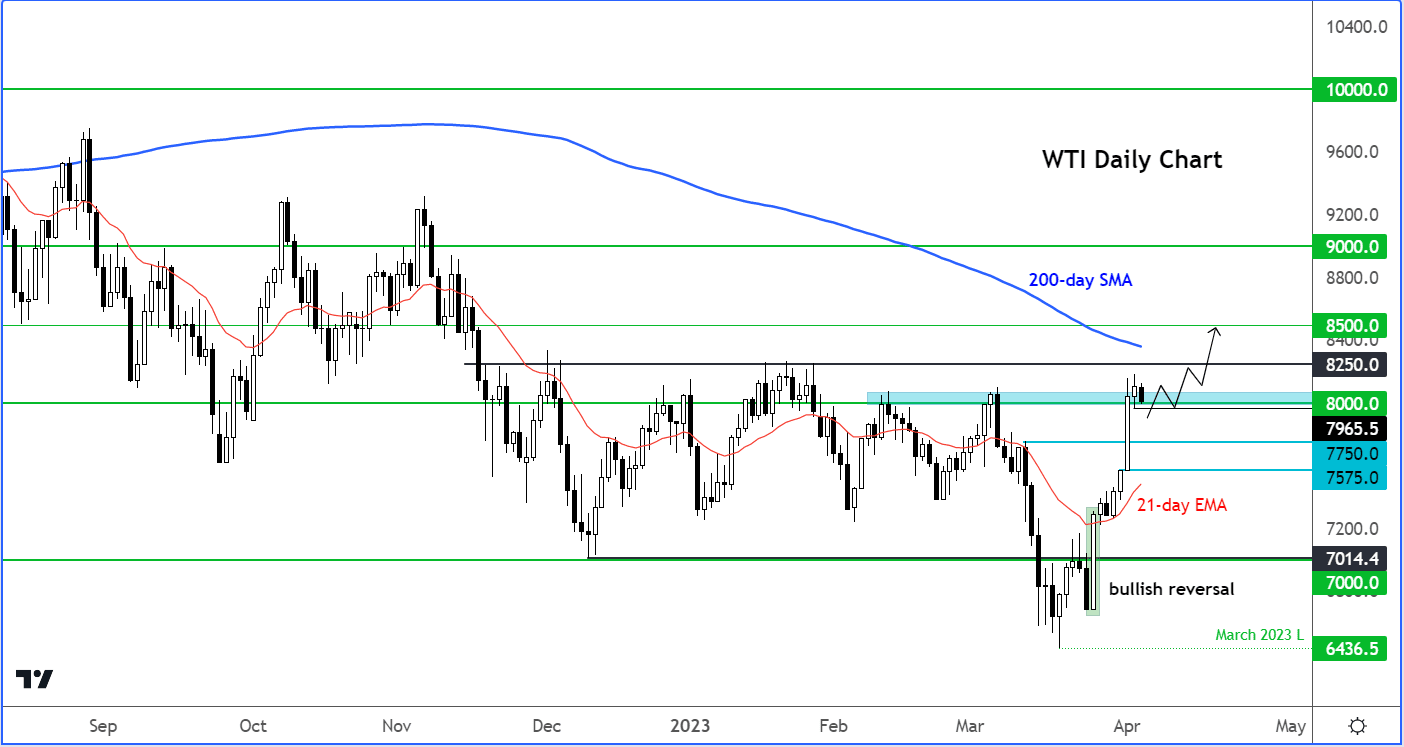

WTI Oil Price Forecast to Reach $85-$90" at City Index

- Écrit par Fawad Razaqzada, Analyst at City Index

-

Image © Adobe Stock

WTI crude oil hit a fresh post-OPEC high above $81.80 on Tuesday, before sliding more than $1 from there to find itself weaker on the session at the time of writing on Wednesday.

However, the path of least resistance remains to the upside following the big price upsurge on the back of the OPEC’s unexpected decision at the weekend.

Our WTI forecast is that it will reach $85 to $90 before any serious signs of weakness emerge.

The official US crude oil inventories data from the EIA is due for release later on Wednesday.

But this is unlikely to move prices significantly lower, given the privately conducted survey from the American Petroleum Institute (API) on Tuesday showed a large drawdown.

In the short-term, oil prices are going to be driven more by supply concerns than demand.

On the supply front, the big production cuts have fuelled speculation oil prices will reach 2022 levels and provide fresh inflationary jolt to world economy.

I, for one, think that the impact of the production cuts could send WTI to at least $85-$90 from here, before we potentially see some real weakness in oil prices again.

Read: OPEC cut shows weakness, only demand drives sustainably higher prices

Any short-term weakness in oil prices could prove to be short lived.

Obviously, a high oil price will hurt demand at a time when household and business finances are overstretched.

The thing about oil demand, though, is that it is very price inelastic.

So, unless something like Covid happens again, don’t expect to see a material drop in oil prices due to demand weakness.

People will not stop driving or travelling by plane because of high oil prices. Therefore, demand is only likely to get hurt moderately by rising oil prices.

This means that the weakness in US jobs data we have seen over the past couple of days, which has revived fears of a slowdown in the US economy, is unlikely to hold oil prices back.

Today we saw the employment component of the ISM PMI fall sharply from the previous month’s 54.0 reading but at 51.3 it still remained in the positive territory.

On top of this, the ADP Private Payrolls come in at 145K when 210K was expected. On Tuesday, we saw a big 630K drop in US job openings in February.

While the OPEC+ cuts are expected to tighten the oil market and may well provide further support to prices in the near-term, the longer-term outlook remains uncertain.

After all, a side effect of a sustained period of high oil prices will be inflation. This may mean tighter monetary policy will remain in place longer than expected. Even then, it will probably take a proper hard landing of the global economy to cause a severe dent in global oil demand.

Thus, the only way for oil prices to come under significant pressure again is from the supply side of the equation.

Specifically, if non-OPEC supply increases sharply. This is possible but will take some time for producers outside of the OPEC+ to ramp up their production.

If they ramp oil production so significantly than OPEC+ starts to lose market share again, then this will start another supply war between the OPEC+ and non-OPEC countries such as the US and Canada.

Bringing the focus back to the short-term, oil traders are now torn between waiting for a proper dip in order to buy oil or chase the market here so that they don’t miss out on further potential gains.

The big gap that was created at the weekend remains largely unfilled.

While gaps typically fill, they don’t always. This could be a breakaway gap in oil prices, given the big fundamental impetus that was announced. What oil traders will want to see here is some consolidation around or ideally slightly above the $80 level now.

This would give traders the confidence that they need that the market wants to push higher.

Alternatively, if WTI falls to fill most or all of its weekend gap, then, in that case, traders will want to see the formation of a bullish daily candle before looking for fresh long opportunities.

Fawad Razaqzada is an analyst at City Index