Swiss Franc Outlook: SNB to Hike 50bp Despite Credit Suisse Turmoil

Image © Adobe Images

The Swiss Franc will overcome recent weaknesses and can count on another 50 basis point interest rate hike at the Swiss National Bank (SNB), according to a new analysis.

"We doubt that the recent Credit Suisse collapse argues against more hikes, as its issues are related to credibility and not to financial stress due to higher rates," says David Alexander Meier, a strategist at Julius Baer, the Swiss private bank.

Julius Baer expects the SNB to proceed with another 50 basis point interest rate hike on Thursday, just days after it facilitated the rescue of Credit Suisse by its Swiss rival, UBS.

The decision could boost the Franc as it speaks to the SNB's confidence that the wider Swiss financial system remains robust.

The higher interest rates on offer in Switzerland would meanwhile provide another avenue of support for CHF.

"We expect the SNB to hike by 50bps on 23 March, taking the policy rate to 1.5% from 1.0%," says Emiko Bowles, an economist at Standard Chartered. "Hawkish policy comments, higher-than-expected February inflation and a widening interest rate differential with other major central banks support our view."

The SNB meets only once per quarter, meaning it does not have the luxury of temporarily pausing rate hikes in light of recent events, lest inflation pressures persist.

Ahead of Thursday's decision, the Franc is rising against the Pound and U.S. Dollar as it tracks the recovery in Eurozone and Swiss banking shares amidst easing fears for the sector.

The Franc's recovery comes after it lost 1.40% last week as fears for Credit Suisse rose.

The recent price action suggests it can recover further against the Pound and Dollar if fears continue to subside.

The Swiss currency is meanwhile flat against the Euro which is also tracking the fortunes of domestic share prices.

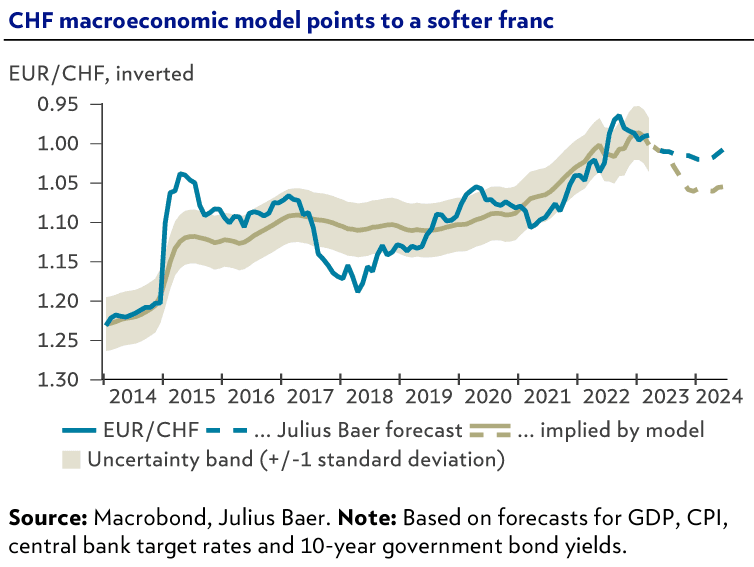

Above: Julius Baer sees the CHF edging lower again.

Julius Baer joins a host of other institutions in expecting the recent banking sector turmoil to fade, allowing familiar drivers to take a hold of currency markets.

"Going forward, the franc looks fundamentally solid, but is likely to soften, as risk appetite remains robust should banking issues not escalate further, and the total return from interest rates is lower than for peer currencies," says Meier.

"Furthermore, as high inflation outside of Switzerland is coming down, the inflation differential that benefited the franc is narrowing," he adds. "Ultimately, a SNB hike this week would simply keep the interest-rate differential constant."

Julius Baer maintains a bearish 12-month forecast of EUR/CHF 1.02 and acknowledges that a recession could lead to renewed Swiss franc strength if the major central banks tighten too much.