Dollar-Yen Can Reach 155: TS Lombard

Image © Adobe Stock

The Dollar to Yen exchange rate is on course to test 155 as the differential between U.S. and Japanese bond yields advocates for further advances and the Bank of Japan shows a tolerance for a weakening Yen.

This is according to independent research and advisory firm TS Lombard following the Bank of Japan's October 31 decision to tweak its Yield Curve Control settings.

The decision to redefine 1.0% as an upper reference point for the Japanese ten-year yield proved to be a disappointment for some corners of the market that were expecting the Bank to take a bolder step towards exiting its ultra-loose policy settings.

But TS Lombard says Japanese authorities believe the multi-year fight against deflation has not yet been won, given their projections for inflation to fall back below 2.0% in 2025.

They will therefore keep a tight hold on bond yields but will prove more relaxed with regard to Japanese Yen devaluation.

Bond yields will therefore remain well below those of other Developed Market countries where central bank rates have moved higher.

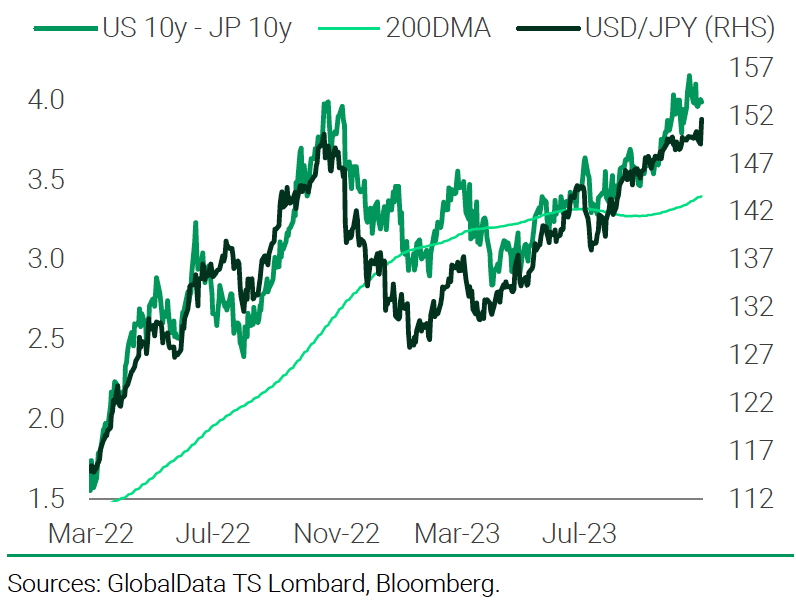

Researcher Skylar Montgomery Koning says the yield differential between the U.S. and Japan points to a further Dollar-Yen upside.

"From here, rate differential momentum clearly point to USD/JPY upside; and the BoJ allowing the 10y JGB to rise >5bp to exceed 1% amid a bearish UST market reaching for 5% is not going to change the bias in favour of the yen," she says.

Above: "Yields are the fundamental driver for the yen and they point to more upside" - TS Lombard.

The turning point for the exchange rate will be when the Federal Reserve turns more dovish, at which point betting on Dollar-Yen downside becomes an attractive proposition.

"Our view has long been that to get sustained USD/JPY downside, we need a turn from the Fed," says Koning, "the yen is our favoured long when that turn comes."

Regarding Bank of Japan currency market intervention, TS Lombard says authorities will allow the Yen a longer leash as previous episodes of intervention have proven unilateral intervention is rarely effective.

Besides, the Bank of Japan fundamentally maintains a view that a weaker currency is good for boosting Japan's competitiveness and helping overcome deflation which it still holds to be a longer-term issue.

Therefore, it falls to the Dollar side of the equation to turn the tide for Dollar-Yen.

"The bad news for yen bulls is that in recent months, the US economy has continued to surprise to the upside, pushing out Fed cuts and supporting the dollar. That means continued upward pressure on USD/JPY, with the next test the October 2022 highs of 152 before the cross reaches for 155. We are looking for a pullback to 150 to enter," says Koning.