Japanese Yen and BoJ's Decision to Yield: Analyst Views, Strategy and Forecasts

"If these market conditions persist, this could have a negative impact on financial conditions such as issuance conditions for corporate bonds" - Bank of Japan

Image © Adobe Stock

The Yen has surged with significantly increased trading in Japanese exchange rates amid speculation about a possible change in the longstanding Bank of Japan (BoJ) monetary policy stance but analyst views on the outlook for the currency are far uniform and some are still willing to bet against it.

Japan's Yen rallied further against all major counterparts on Wednesday in price action that lifted the currency's one-week gain to more than five percent against the Pound, Australian Dollar, Swedish Krona and New Zealand Dollar.

The Yen's widespread appreciation also exceeded three percent against other currencies and comes amid a substantial increase in trading volume following Tuesday's surprise decision by the BoJ to lift the upper limit of a carefully controlled 10-year government bond yield.

Tuesday's uplift enables the yield to rise as far as 0.5% and will have similar effects to a small tightening of monetary policy but the BoJ has said its intention was "to improve market functioning and encourage a smoother formation of the entire yield curve, while maintaining accommodative financial conditions."

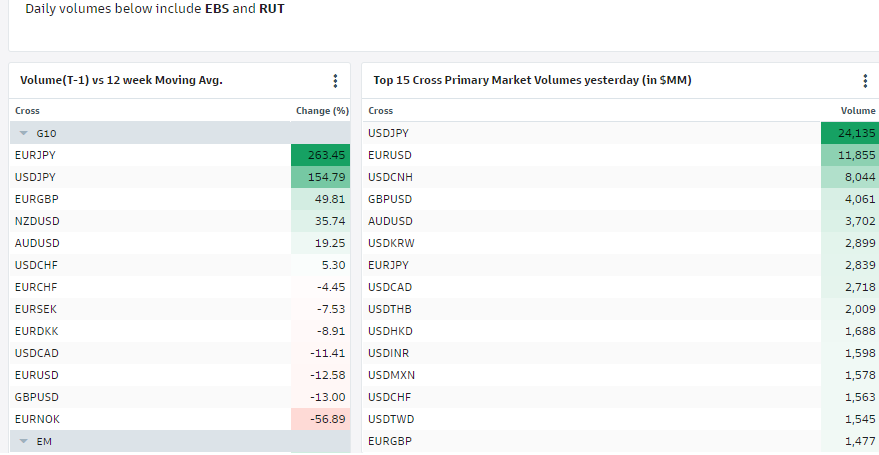

Above: Changes in interbank market trading volumes on Tuesday 20 December. Source: Goldman Sachs Marquee.

Above: Changes in interbank market trading volumes on Tuesday 20 December. Source: Goldman Sachs Marquee.

The BoJ's stated preference for "maintaining accommodative financial conditions" and details it gave of the context in which the yield target was increased leave Tuesday's decision appearing to be a tightening of monetary policy that was foisted upon the BoJ by the market.

"The functioning of bond markets has deteriorated, particularly in terms of relative relationships among interest rates of bonds with different maturities and arbitrage relationships between spot and futures markets," it said.

"Yields on Japanese government bonds (JGBs) are reference rates for corporate bond yields, bank lending rates, and other funding rates. If these market conditions persist, this could have a negative impact on financial conditions such as issuance conditions for corporate bonds," it added.

Uncertainty about whether further similar steps will be taken in the near future has divided analysts in their interpretations of the outlook for BoJ monetary policy and the Japanese Yen, some of which are set out below.

Bipan Rai, North American head of FX strategy, CIBC Capital Markets

"On its own, widening the tolerance band for 10-year JGBs doesn’t mean much. But as a signal, it suggests that the BoJ’s view on inflation has evolved, and this is likely the first step towards acknowledging a regime shift."

"This is also incredibly important for the global macro – not least as yields in Japan rise. Remember that low yields in Japan have been a critical reason for why the country is now the world’s largest net creditor. A reversal of the net capital exports from Japan would have ramifications for both spot and funding markets."

"Meanwhile, the near-term pressure on spot is for USD/JPY to trend lower towards the 125-130 area. Moves beyond there will be contingent on moves in the long-end of the UST curve and on further BoJ adjustments to YCC."

Kamakshya Trivedi, co-head of global FX strategy, Goldman Sachs

"If this is a technical realignment as the BoJ has suggested, then there should be fairly limited spillovers for the Yen, especially given that the 4% move down in USD/JPY already exceeds our model estimates for an end to YCC. However, to the extent this signals the start of a regime shift in Japan, then there is clearly more room for the currency to run."

"For now, our assumption is more of the former—a technical adjustment and a sign that policy rates could be adjusted further in coming months, but still working under the same basic framework as before. In that scenario, US rates will continue to have more “degrees of freedom” than JGBs, and remain the primary driver for USD/JPY over time."

"Under our baseline view that markets are over-pricing US recession odds and under-pricing the Fed cycle, USD/JPY should move back higher over coming months. Indeed, the Yen is no longer even an outlier, or the worst performing G9 currency year-to-date, suggesting that there is limited sign of a special “YCC discount” anymore. However, in the near term we expect markets to raise the odds of a more material BoJ shift, which remains a real possibility."

Brent Donnelly, CEO and FX trader, Spectra Markets

"It's tempting to think of last night’s YCC change as a watershed event, but it’s worth remembering that every past change in YCC (including its enactment) was a fade."

"It is curious that yields didn’t shoot straight to the 50bp cap today, but perhaps that is a matter of time as the BOJ bought bonds last night and that may have dampened the selloff. While it’s exciting to think of this BOJ move as a watershed event, perhaps it’s just another part of the very slow, grinding unwind process of YCC."

"With nothing to look forward to from the BOJ or the MOF, USDJPY should go back to being a USD story now, not a JPY story."

"Bigger picture it is hard to ignore the epic double bottom in the JPY TWI (see first chart on page 1) so selling rallies makes sense in USDJPY but selling here feels fraught."

Derek Halpenny, EMEA head of research, MUFG

"The yen has gained 15% versus the dollar since the close on 20th October and will if sustained act as a powerful disinflationary force next year. It will certainly help protect Japan more from global energy price inflation."

"It may have been one reason why Governor Kuroda was so adamant yesterday on the need for continued monetary easing."

"The yen is likely to remain under upward pressure and positioning liquidation risks as year-end approaches could see further notable declines in USD/JPY into the high 120’s."

Brad Bechtel, head of global FX, Jefferies

"Most strategists see this as an open door to the road to normalization, a first step taken by Kuroda on his way to retirement in just a few months."

"We are pretty overextended to the downside at current levels with the market moves fast and furious for the JPY, so some consolidation here between 130 and 135 would not surprise. But it is JPY and as we saw in 2022 on the way up, the pair likes to move in 5 big figure increments when it does move. Stay on your toes."

"Only time will tell where we end up here and what the likely impact on JPY will be. Some think we will see the JPY strengthen further from here as the US Fed is close to done hiking which means that real rates in the US are done rising and will moderate a bit, taking pressure off of the USD."

"The wage growth side of the equation is crucial regardless, and with the end of the fiscal year coming for Japan in March, any sort of organized labor wage round negotiations will be critical to watch."

Nick Bennenbroek, economist, Wells Fargo

"While today's policy tweak has added uncertainty to the BoJ outlook, we continue to lean toward BoJ policymakers making no further policy adjustments through the end of 2023. Inflation pressures are expected to ease, which should lessen the BoJ's motivation for further policy moves."

"In addition, our base case is that monetary tightening from major global central banks is likely to come to an end in the first half of 2023, which could lessen the upward pressure on Japanese government bond yields."

"We view the Bank of Japan's policy tweak as clearly consistent with and supportive of yen outperformance over the medium-to-long term. We have previously noted the yen as a likely outperformer in 2023, with risks now tilted toward even stronger yen gains than our current medium-term USD/JPY exchange rate target of JPY130."

Ulrich Leuchtmann, head of G10 FX research, Commerzbank

"The BoJ has taken a first step toward tighter monetary policy by widening the target range for bond yields. In doing so, it is responding to the current inflation shock, but may have destroyed the chance of a long-term re-inflation outlasting this inflation shock."

"Every person, every institution makes mistakes. They become epic when the same person, the same institution repeats the same mistake over and over again. That seems to me to be exactly the case here."

"As in 2000, as in 2006/07, it is starting to tighten its monetary policy. Not by raising interest rates, as then, but by widening the corridor of long-term yields, i.e. de facto by accepting higher yields. Initial, cautious signs of self-sustaining inflation momentum are thus likely to be stifled once again."

"Don't get me wrong. This does not mean that overall and core inflation in Japan will fall from now on. Import price inflation, which is still high, is affecting overall and core rates. But the key question is what inflation will be left once this inflation shock has subsided."