Norwegian Krone's Inflation Rally Drives Turning of the Tide in GBP/NOK

"We believe Norges Bank will respond more determined to stronger inflation outlook, the weak NOK and higher wage growth than forecast, and raise the policy rate by 50 bp in June" - DNB Markets.

Image © Adobe Images

The Norwegian Krone rallied broadly in the final session of the week as new highs for local inflation prompted the market to reconsider the outlook for Norges Bank interest rates and drove GBP/NOK further away from post-pandemic highs in what could be the beginning of a deeper setback for Sterling.

Economist surveys had suggested Norwegian inflation was likely to fall modestly in May but Statistics Norway said on Friday that annual measures of price growth had risen further last month following large increases in prices of food, non-alcoholic beverages and clothing items including footwear.

Norway's main inflation rate climbed from 6.4% to 6.7% while core inflation rose from 6.3% to 6.7% in contrast with Norges Bank forecasts suggesting a fall toward 6% was likely over the second quarter, leading financial markets to sell Norwegian government bonds heavily and raise yields sharply on Friday.

"The core numbers are likely to trigger the most concern from the Norges bank," says John Hardy, head of FX strategy at Saxo Bank.

"One contributing factor has to be the weak NOK, which has dropped over 10% this year alone against the euro," he adds.

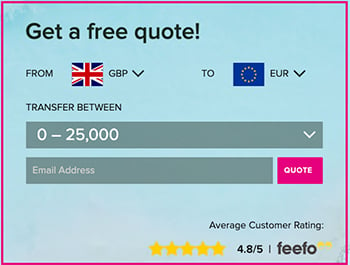

Above: GBP/NOK shown at 15-minute intervals alongside USD/NOK and EUR/NOK. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Norges Bank forecasts had suggested in March that Norway's main interest rate would peak around 3.5% in June but this was with inflation expected to moderate late in the first half of the year and Friday's data warned of a possible reacceleration while prompting analysts to wonder how much further borrowing costs might now rise as a result.

"These developments support our view for a rate top at 4% in September at the very least," says Kjetil Olsen, chief economist at Nordea Markets.

"After this figure, the risk that Norges Bank will have to raise rates above 4% has risen sharply and even the possibility for a 50bp rate hike cannot fully be excluded at the June meeting. For now, we hold our view for a 25bp rate hike in June," Olsen and colleagues wrote in a Friday summary of the data.

Rates in the overnight index swap market had suggested before Friday's announcement that some investors already expected the Norges Bank to lift its cash rate to 4% by year-end but the subsequent sell-off in the Norwegian government bond market was indicative of that assumption being reconsidered.

Three-month Norwegian government bond yields rose more than 100 points or 1% at one stage to reach a high of 4.19% for those maturing early in the final quarter, which was potentially a sign of how much further some might be expecting interest rates to rise.

Above: GBP/NOK shown at daily intervals alongside USD/NOK and EUR/NOK.

"If Norges Bank were to run its model today, we suspect the peak would be at 3.75% and perhaps slightly above. For now, we expect two more 25bp rate hikes, one this month and another in August or September. We certainly wouldn’t rule out a 4% peak," says James Smith, a developed markets economist at ING.

"Norges Bank has still plenty of room to provide support to NOK by cutting FX purchases more aggressively later in the year," he adds in a Thursday research briefing.

Friday's price action suggests a sustained uplift in market-implied expectations for the Norges Bank cash rate would help further reverse a market tide that saw the Norwegian Krone fall more than 10% against the Pound, Dollar, Euro and handful of others during the opening half of the year.

Many economists have said these losses further fuel inflation up ahead by lifting import prices but it's possible they are also the result of recent and current inflation, which has continued to rise in Norway even as it has declined in places like the U.S. and Europe where interest rates have risen more aggressively over the last year.

"We believe Norges Bank will respond more determined to stronger inflation outlook, the weak NOK and higher wage growth than forecast, and raise the policy rate by 50 bp in June," says Kyrre Aamdal, an economist at DNB Markets. "We expect the rate to be raised further in August and possibly also in September, to 4.25%."

Above: GBP/NOK shown at weekly intervals alongside USD/NOK and EUR/NOK.

Some exchange rates have shown a high sensitivity to inflation in recent years with a tendency to depreciate as it rises and to appreciate when it falls while EUR/USD and GBP/USD are each particular examples.

Both ultimately fell much further than was implied by their reported inflation rates late last year but recovered some of their losses as inflation moderated while each occasionally benefited from increases in central bank interest rates.

It's possible that recent heavy falls in the Norwegian Krone and other Nordic currencies like the Swedish Krona are simply a repetition of the same market behaviour and overall pattern but as far as this is the case it would be a reason for thinking GBP/NOK has now topped out following its 2023 rally.

GBP/NOK spent much of the post-pandemic period in an 11.14 to 12.41 range before breaking higher this year to approach its March 2020 high of 14.00 late last month and soon after Office for National Statistics figures suggested inflation also reaccelerated in the UK during April.

The latter is a headwind for Sterling's valuation goes while Friday's uplift in expectations for the Norges Bank cash rate has begun to reverse GBP/NOK's earlier supportive increase in UK-Norway interest rate and bond yield differentials.

Above: GBP/NOK shown at monthly intervals alongside spread or gap between 02-year UK and Norwegian government bond yields.