U.S. Inflation No Gamechanger, Shelter's Outsized Impact Tipped to Fade

- Shelter components drive core inflation surprise

- This will fade say some economists

- But one economist warns upside price pressures are broadening again

Image © Adobe Images

U.S. inflation came in well above expectations in January, but some economists say this is a blip as leading indicators all point to ongoing declines in inflation over the coming months.

The spike in headline CPI to 3.1% year-on-year and Core CPI inflation to 3.9% y/y is largely driven by variables relating to housing, according to analysts we follow who say these pressures should subside.

"We expect the downshift in core inflation to continue after this blip, tracking the normalisation of leading indicators for rents, core goods prices, wages, and margins," says Ian Shepherdson, Chief Economist at Pantheon Macroeconomics.

The BLS reported shelter prices are still disproportionately pushing core inflation higher, with home rents accounting for over half of the January month-over-month rise.

"Shelter costs were a big part of this uptick, though these are expected to cool in the months ahead," says Jamie Dutta, Global Market Analyst at Vantage Markets.

The Dollar rose sharply as it tracked U.S. bond yields higher amidst a recalibration in market expectations for the likelihood of U.S. Federal Reserve interest rate cuts falling in the first half of 2024.

Pantheon Macroeconomics tells clients in a post-release briefing that some 0.05 percentage points of the overshoot in the core reading is due to an unexpected 0.56% leap in owners' equivalent rent (OER), the biggest increase since last April.

This occurred even though primary rents rose only 0.36%, the smallest increase since August 2021.

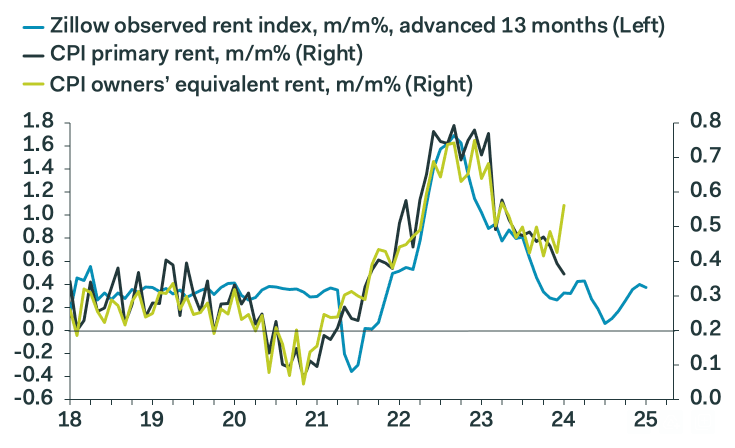

Image courtesy of Pantheon Macroeconomics.

Stephenson explains the OER is essentially primary rents - actual rents paid by real tenants - less utility costs embedded in some primary rents.

The BLS reports utility costs jumped 1.4% in January, but in the past, that could have been expected to bias OER to the downside, say Shepherdson, because the BLS appeared to overcompensate for the utility effect on primary rents, explains Shepherdson.

"That didn't happen this time, so this spike in OER is a mystery. But it will not persist, given the downtrend in primary rent inflation, tracking the plunge in the Zillow private sector rent numbers," he adds.

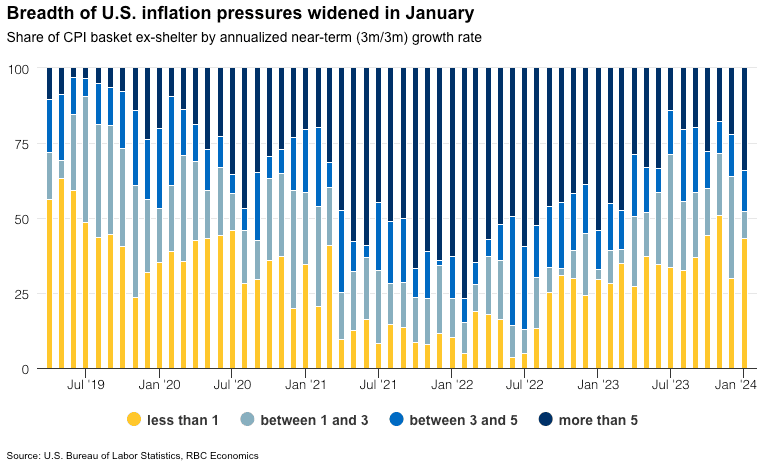

Image courtesy of RBC Capital Markets.

Markets have slashed their bets again on rate cuts, with the first 25 basis point cut now pushed back to June from May.

"This has given a bid to the dollar which has broken to fresh three-month highs. Hot inflation figures add to the U.S. exceptionalism story which continues to endure," says Vantage's Duta.

Nathan Janzen, Assistant Chief Economist at the Royal Bank of Canada, acknowledges shelter inflation has played a big part in the uptick in core inflation but also notes inflationary pressures appear to be broadening.

"Broader signs of reacceleration in inflation pressures coming in the wake of another surge in employment and faster wage growth in January," says Janzen.

The RBC economist notes the share of products growing at above a 3% annualised rate over the last three months rose to 47%, the highest share since May 2023 by our count.

"Price pressures showed signs of broadening under the surface," says Janzen, adding these developments reinforce "the risk that the Fed won't need (or be able to) pivot to interest rate cuts as quickly or aggressively as previously expected."