Ships Rerouted via Cape of Good Hope Finally Fill UK Docks

Above: Tilbury dock, Essex. Image © Adobe Images.

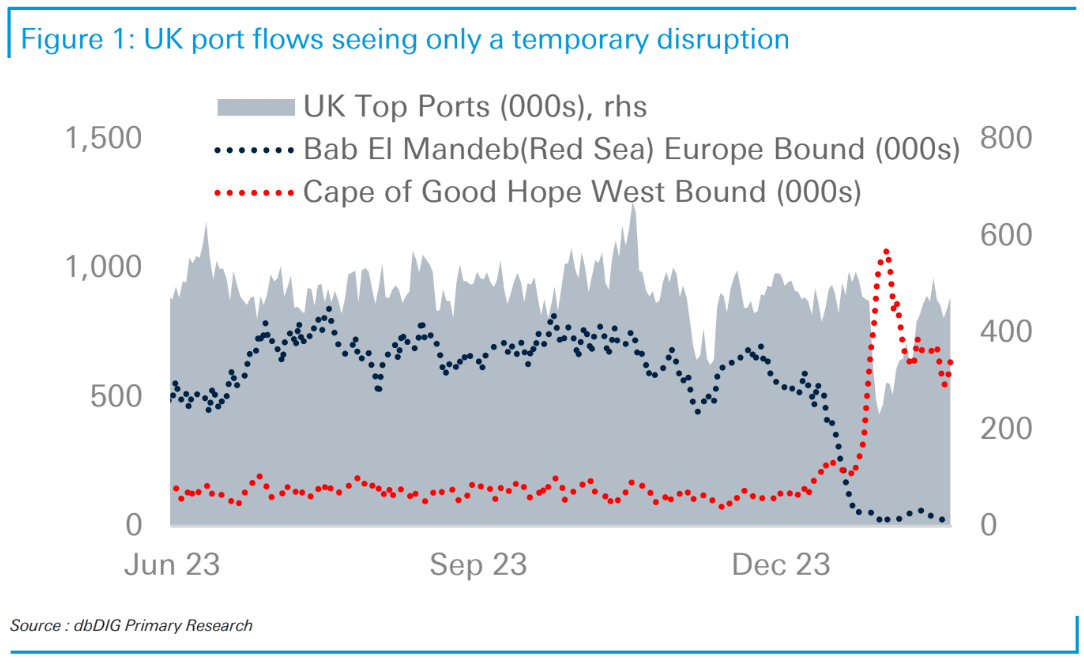

UK docks are busy again as ships that rerouted via the Cape of Good Hope in December arrive.

Analysis from Deutsche Bank finds UK port flows are back to 'normal' after plummeting in December, suggesting a "contained" impact of the Red Sea disruptions.

To be sure, the impact on UK inflation remains to be seen, according to Sanjay Raja, Senior Economist at Deutsche Bank.

"The January flash PMIs sent some alarm bells ringing, with an increasing focus on Red Sea tensions," says Raja. "With transport routes extended by 7-10 days, we saw a sizeable 10pt fall in suppliers' delivery times, with survey respondents noting an uptick in both input and output prices."

January's S&P PMI survey of the world's major economies series found the rise in delivery times was far more acute in the UK than elsewhere, with 95% of international freight transiting via sea.

But Raja has studied dbDIG shipping data that tracks the movement of ships globally and concludes that the overall impact of disruptions to shipping in the Red Sea will be contained.

The data reveals container ship activity through the Red Sea transits of Bab El Mandeb and the Suez Canal are down significantly.

At the same time, a near 6x increase in the number of ships transiting The Cape is noted.

"The knock-on effect on container ship arrivals to the UK can be seen clearly as it plummets over Christmas but recovers swiftly in January as the re-routed ships complete their journeys," says Raja. (See chart above).

"The impact on inflation will be important to watch going forward. Shipping costs have risen – though are nowhere close to where they were during the height of the pandemic," says Raja.

Based on these findings, the Deutsche Bank analyst thinks that "the impact will be broadly contained given that port flows are back to 'normal' - highlighting a more limited supply shock in the midst of still weak goods demand and large inventory holdings".