Rebound in UK Retail Sales Disappoints, But the Worst Might Have Passed

Image © Adobe Images

Retail sales data showed volumes are estimated to have risen by 0.4% in August 2023, partially recovering from a fall of 1.1% in a weather-impacted July, but this was still below the analyst forecasts for growth of 0.5%, however, one analyst says the worst might have passed for retailers as wages now outstrip inflation.

Sales volumes rose by 0.3% in the three months to August 2023 when compared with the previous three months.

But in the year to August sales were down 1.4%, which was worse than the -1.2% expected but an improvement on the -3.1% reported in July.

Despite this partial recovery in August, food stores sales volumes remained 4.1% below their pre-coronavirus February 2020 levels, with the ONS reporting retailers continue to indicate that the increased cost of living and food prices are affecting sales volumes.

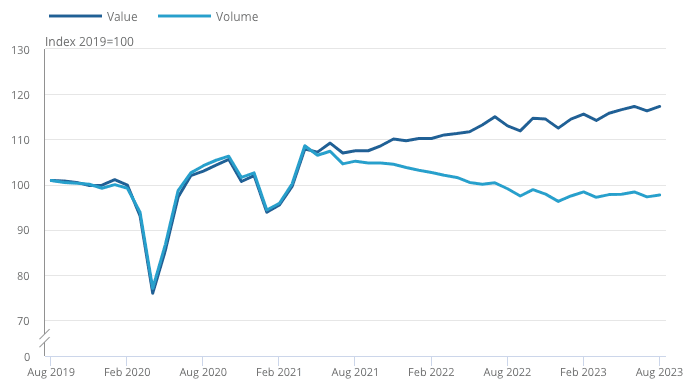

The below chart from the ONS throws the reality of multi-decade high inflation into sharp relief:

Above: Divergence between retail sales volumes and value in a period of elevated inflation.

The data is consistent with the Bank of England's views that the economy is heading into a slowdown and that no further interest rate hikes would be required to lower inflation.

"There is some reluctance after all (at least for the majority of Bank of England members) to hike the key rate further as the slowing effects of previous rate hikes are already clearly affecting the economy," says You-Na Park-Heger, FX Analyst at Commerzbank.

The tepid recovery in UK retail sales was a result of increased food store sales volumes, which rose by 1.2% in August 2023 following a fall of 2.6% in July 2023.

Supermarkets reported that some of the fall in July 2023 was because of poor weather reducing summer clothing sales.

Elsewhere, the impact of rising fuel prices was reflected in a fall in automotive fuel sales volumes, which fell by 1.2% in August 2023, following a rise of 0.9% in July 2023.

Retailers told the ONS that increasing petrol and diesel prices in August 2023 reduced fuel sales volumes.

This will only add to the sense that the economy is entering a difficult patch, with the fall in inflation witnessed over recent weeks likely to slow amidst rising fuel costs.

But the outlook could improve for the country's retailers, with PwC analyst Lisa Hooker saying falling inflation and rising earnings suggest there are signs that more confident consumers are starting to spend again.

"Some retailers have already observed that consumers are shopping earlier for Christmas goods, often to help budgeting," she says. "The hope is that the impact of recent mortgage interest rate rises and increasing petrol prices do not derail the green shoots that have appeared in time for the critical run-up to Christmas."

Gabriella Dickens, Senior UK Economist at Pantheon Macroeconomics says retail sales likely will recover further over the rest of the year, supported by further growth in real wages, as the pace of price rises continues to slow.

Pantheon's calculations show mortgage refinancing looks set to subtract about 0.2 percentage points from quarter-on-quarter growth in households' disposable income in Q3 and Q4, which is an unhelpful but not decisive headwind.

"On balance, then, real household disposable incomes should be around 2.0% higher in Q4 than a year ago," says Dickens.