Pound Sterling Edges Higher after Cracks Appear in UK Labour Market

“Overall, despite the apparent weakening in hiring and ongoing improvement in worker supply, the Bank will remain focused on wages” - ING.

Image © Adobe Images

Pound Sterling edged higher against many counterparts after Office for National Statistics (ONS) data indicated continued record growth in wage packets during June but also confirmed what appear to be cracks emerging in the overall labour market.

Office for National Statistics measures of average annual wage growth reached new records for the month of June when including and excluding changes in annual bonuses though measures of unemployment, job vacancies and labour market inactivity appeared to suggest employment and demand for workers is now falling.

Overall employment fell 0.1% in the three months to the end of June with full-time payrolled employees and the self-employed impacted at the same time as the number of inactive persons - those neither in work nor looking for work - fell in a set of outcomes that could explain the continuing uptrend in the unemployment rate.

Unemployment rose to 4.2% during the three months to the end of June, from 4% previously and from around 3.7% back in January, as the previously ‘inactive’ and newly unemployed sought new work in a labour market where job vacancies were said to have fallen some -66k to an estimated 1.02 million.

“The momentum in wage growth still is too strong for the Committee [Bank of England] to take a break just yet. But the risk that the Committee does nothing in September now is greater than the odds that they hike by 50bp,” says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

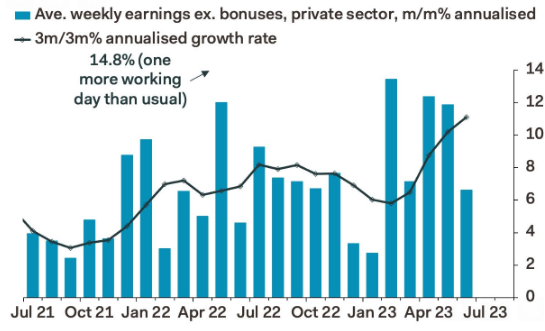

Source: Pantheon Macroeconomics.

Emerging trends illustrated in Tuesday's data suggest Bank of England (BoE) interest rate policy is beginning to take its toll on private sector companies and the labour market, which are both together the backbone of the broader UK economy and public finances.

Tuesday's estimate from the tax authority' indicated the number of payrolled employees in the labour market rose by 97k for the month of July, suggesting some recent losses of employment could be reversed in the next report,

But the ONS said the July payrolls number " should be treated as a provisional estimate and is likely to be revised when more data are received next month," while analysts, economists and financial markets are most interested in Tuesday’s reported rates of average pay growth anyhow.

“The fourth chart [above] shows that private-sector wage growth slowed in June, but still has too much momentum to be consistent with at-target inflation,” Pantheon’s Tombs writes in response to Tuesday’s figures.

Wage growth reached a new record of 8.2% in June when annual bonuses are included alongside regular pay, and another record of 7.8% when regular pay alone is measured.

Above: Pound to Dollar rate shown at 15-minute intervals alongside Pound to Euro rate.

UK wage growth appeared to peak at an annual 6.7% late last year but then began to rise again in March when it reached 6.8% before accelerating to 7.3% following the April introduction of a near double-digit increase in the national minimum wage.

“Despite the apparent weakening in hiring and ongoing improvement in worker supply, the Bank will remain focused on wages. When it comes to tomorrow’s CPI figures, we think there’s some scope for a positive surprise on services inflation, but ultimately a September rate hike still looks nailed-on,” writes James Smith, an economist at ING.

Analysts, economists and central bankers all generally cite wage growth as a prominent driver of inflation through its perceived influence on corporate pricing decisions, making it a key factor in forecasts relating to interest rates.

However, one economist says it’s a mistake to treat the official measures of pay growth in this way because they are averages that are influenced by lots of different factors.

“An alarming trend has developed in the media and social media. There is a tendency to confuse wage growth with average earnings growth. Often this would not matter, but right now this is a dangerous error. They are not the same,” says Paul Donnovan, chief economist at UBS Global Wealth Management.

Above: Pound to Dollar rate shown at daily intervals alongside Pound to Euro rate.

“Average earnings are not wage growth. Because average earnings are an average, they are affected by what sort of jobs exist. If no one in the economy receives a pay rise (wage growth of zero), but low-income employees lose their jobs, average earnings will rise,” he adds in a July research briefing.

Donnavan’s observation is potentially a salient one in light of the rising unemployment rate and other details within Tuesday’s report, which showed increasing numbers of unemployed workers competing for a decreasing number of open positions in an economic climate that is expected to grow more difficult as time goes on.

Economic growth came in much stronger than expected for the second quarter last week but a large part of the increase was the result of one-off statistical factors or accounting quirks relating to public holidays this year and last, while significant further monetary policy headwinds still await the economy up ahead.

This is after the Bank of England Bank Rate was raised from 0.1% to 5.25% between December 2021 and August 2023 in response to rising inflation, making for one of the three most significant monetary tightening cycles ever implemented by the BoE.

What’s more, when the change in Bank Rate is compared with its pre-pandemic level, it leaves the UK with monetary policy settings that are tighter than in most - perhaps all - advanced economies and also some ‘emerging market’ economies.