UK Economic Growth Outlook: Analyst and Economist Views

Image © Adobe Stock

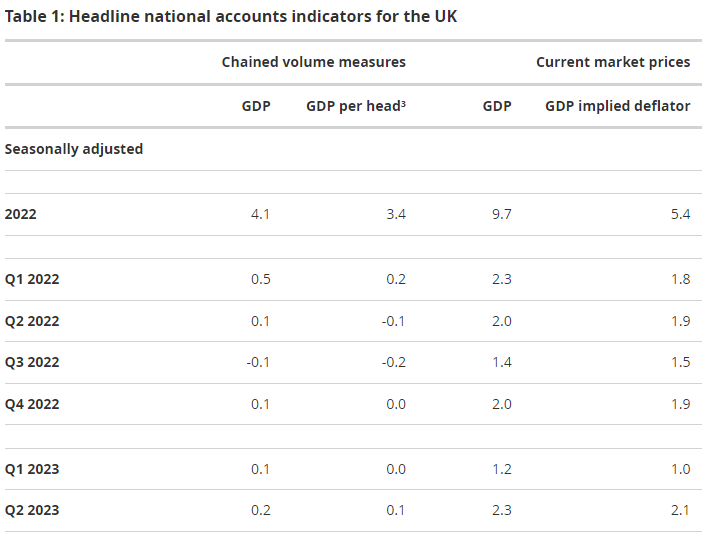

Official measures of supply and demand suggest an economy growing faster than many expected including the Bank of England (BoE), leading to forecast upgrades in some parts this week and increased uncertainty about the outlook for interest rates.

June’s half percent increase in gross domestic product (GDP) was far larger than all professional forecasters anticipated Friday while the latest quarter-on-quarter increase of 0.2% also surpassed a 0% or zero growth consensus as well as most projections.

Economic growth was a steady 0.2% in both quarters during the opening half of the year, suggesting greater resilience than that envisaged by the Bank of England in its August Monetary Policy Report last week where it was said the economy likely grew by a lesser 0.2% for the first half overall.

One important driver of June’s half percent increase was the return to a full working month following the additional bank holiday in May for the royal coronation, while the effect of the late Queen’s Platinum Jubilee last June not being repeated this year also helped lift the annual measure of economic growth.

Source: Office for National Statistics.

In short, there was a sizable tailwind in June from one-off statistical factors or accounting quirks relating to public holidays, though many economists also found more organic reasons for optimism about the current condition of the economy and the outlook for it in the months ahead.

Uncertainty about what this means for the interest rate outlook is high due partly to the non-committal stance adopted by the BoE last week conference.

“I’d finish this point by just emphasising the fact that also, there is no presumed path for interest rates from here, and as I said in the opening remarks and will emphasise again, there is more than one path back to the inflation target,” Governor Andrew Bailey told reporters in a press conference last Thursday.

Bank Rate was raised from 5% to 5.25% last week and while the BoE says its future decisions are likely to be “evidence-driven,” financial markets, analysts and economists have their own ideas, some of which are partially encapsulated below.

Samuel Tombs, chief UK economist, Pantheon Macroeconomics

“The 0.5% month-to-month rise in GDP in June was driven by big increases in manufacturing and construction output, which are particularly sensitive to changes in the number of working days; May had one less working day than usual, due to the King’s coronation.”

“While higher interest rates are putting pressure on businesses to run down inventory and sterling’s recent appreciation will weigh on exports modestly, it is unlikely that the drag on GDP growth from these components will remain as intense as in Q2.”

“Accordingly, we still think the economy will avoid a recession, with GDP rising by 0.3% quarter-on-quarter in both Q3 and Q4.”

Abbas Khan, economist, Barclays

“While a mechanical rebound had been expected in June following the extra bank holiday for the King's coronation which weighed on the May print (-0.1% m/m), the extent was uncertain given that the size of the hit was unclear. In the event, the more forceful rebound in June suggests that the economy has been more resilient than thought at an underlying level.”

“With particularly wet July weather, this resilience may temporarily reverse in the very near term, but the 17% fall in household energy bills in Q3 will provide a further meaningful boost to real household disposable incomes that is unlikely to be fully offset by the drag from the mortgage cashflow channel in the near term. This may fuel further growth in discretionary services over coming prints.”

Andrew Goodwin, chief UK economist, Oxford Economics

“A strong starting point to the current quarter implies even very modest growth over the summer would leave Q3 growth at around 0.4% (in line with the latest BoE forecast). That the quarter will have a normal number of working days will also help, as will the resolution of some public sector pay disputes and July's near-20% fall in energy bills.”

“June's rise in GDP left growth in Q2 at 0.2% q/q, a bit stronger than consensus and BoE forecasts, if still consistent with the economy broadly flatlining over the last 18 months.”

Sandra Horsfield, economist, Investec Economics

“Money markets have not shown a major reaction to the numbers, with peak Bank rate estimates still around 5.75% and the implied path of interest rates through 2024 little changed. We are therefore minded to see the rise in UK yields across the curve (by c.8bps) as more related to the move in the US after the European close that followed a soft 30-year US Treasury auction.”

“Sterling, meanwhile, has moved a little higher, Cable currently 0.3% higher on the day at 1.271. Our own view is that at the margin, today’s GDP numbers may add to the Bank’s concerns that it could be premature to stop tightening policy just yet. However, as one-off factors played a significant role, most attention will be paid to CPI inflation and labour market numbers, the next set of which are due next week.”

Emma Wilks, UK economist, Lloyds Commercial Banking

“Looking ahead, slowing momentum across business activity surveys suggests that the second half of the year may prove more challenging. However, with a drawdown in inventories in the first half and the amount of industrial action slowing, even if overall demand softens slightly, growth rates could prove stronger.”

“The Bank of England revised up its overall growth forecast for 2023 to 0.5% however, weak supply growth and the waning positive impact of fiscal support for households into 2024 and beyond means the UK economy is likely to experience a slower growth rate relative to that seen before the pandemic.”

“For now, a stronger than expected outturn in Q2 relative to BoE’s +0.1%q/q expectation is unlikely to bring much comfort that interest rates in the UK have peaked.”

Chester Ntonifor, chief FX strategist, BCA Research

“The UK overnight index swap (OIS) curve now discounts a peak in interest rates of 5.75% by next April, to be immediately followed by rate cuts that will take the policy rate down to 4.99% by end-2024 and 4.15% by end-2025 (Chart 2, top panel).”

“In our view, the market pricing for the path of UK interest rates is incorrect in both directions. The BoE will likely only deliver one more 25bp rate hike at the next policy meeting in September, leaving a peak rate of 5.5% for this cycle.”

“The BoE will also end up cutting rates more aggressively than markets are discounting in 2024 and 2025, in response to a likely UK recession and significantly lower inflation that will require interest rates to be cut to more stimulative levels.”