Bank of England Expectations Stoke Tensions Between Two Different Stability Mandates

"There are some signs of the labour market cooling and we do pick that up, I pick that up, when we go round the country actually," Bank of England Governor Andrew Bailey.

Image © Adobe Images

Rising financial market expectations for interest rates and other circumstances almost unique to the UK are stoking a form of tension between financial stability and inflation-targeting mandates of the Bank of England (BoE) while potentially creating the appearance of comparability between Britain and the biblical city of Babylon.

Inflation rates, wage growth and other developments in and around the economy have left the Bank of England contending with an almost unique set of circumstances that have potential implications for financial stability and much more in Britain and far beyond.

"I'll repeat what I said at the Mansion House, and not for the first time," Governor Andrew Bailey told a Financial Stability Report press conference on Wednesday.

"The current level of pay increases are not consistent with the inflation target," he added.

Office for National Statistics figures announced an increase in the unemployment rate from 3.8% to 4% for May on Tuesday, worth roughly 66.1k workers, though this resulted more from an increase in the number of individuals returning to the labour market to look for work following a period of non-participation than anything else.

The rise in the unemployment rate resulted from what was effectively an improvement of labour supply but despite this, both main measures of wage growth rose further for a second month running in May, which is the opposite effect of what might have been expected if conventional thinking about supply and demand economics holds.

"There are some signs of the labour market cooling and we do pick that up, I pick that up, when we go round the country actually," Governor also Bailey said on Wednesday.

"We're going to have to put all of this information together again and see what we make of it," he added in reference to next month's forecast and interest rate decision.

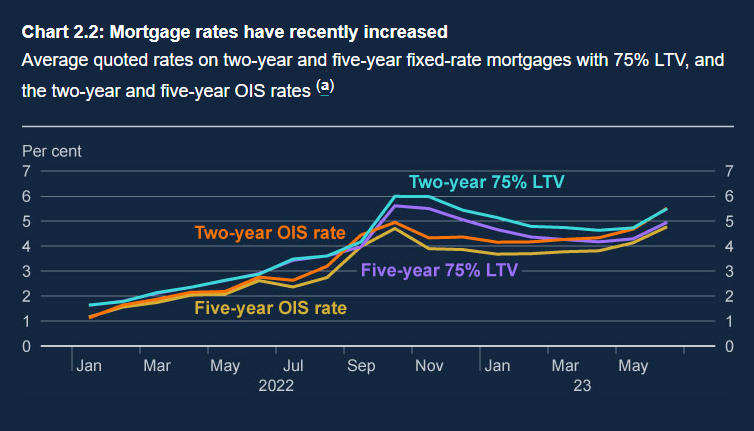

Tuesday's wage growth numbers have been widely cited for leading financial markets to price in a high probability of the BoE Bank Rate being raised from 5% to 6.5% by the early months of next year, which is part of where and how the recent labour and wage developments might be becoming relevant for financial stability.

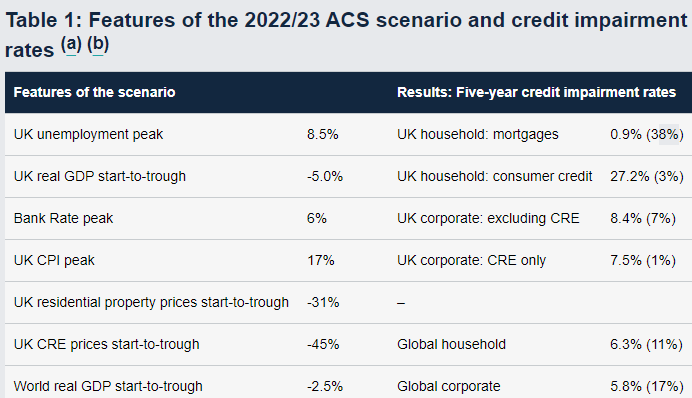

Not least because the market pricing of next year's Bank Rate is above the 6% maximum or peak assumed by the BoE in the commercial bank stress test carried out as part of its latest financial stability review, the results of which were announced on Tuesday and briefed to a press conference this Wednesday.

"That number of highly indebted households move from 1.6% of households to about 2% but it would need to move up to about 3.5% to get back to where we were in the financial crisis," Deputy Governor for financial stability Sir John Cunliffe said Wednesday.

Source: Bank of England Financial Stability Report July 2023.

The report and press conference were unequivocal in stating that banks under the BoE's regulatory auspices have sufficient capital to endure even higher borrowing costs than that, but they were both also clear in stating that risks to financial stability would rise with interest rates over and above that level.

This is partly because rising unemployment can lead loan defaults to compromise assets and capital reserves in the banking sector whenever and wherever unemployment results from rising joblessness rather than rising participation in the labour market.

But it's also because the labour and financial markets are at the heart of another dynamic previously touched on by Governor Andrew Bailey last September but referred to as a tension between financial stability and the inflation-targeting mandates of the BoE by governments since the last years of the prior Millenium.

The context of the initial reference was different but the applicability of the concept would become clearer if labour participation rates continue to rise and wage growth also remains elevated in the months ahead, though that would be particularly so if such outcomes lead the financial markets to then price-in even further increases in Bank Rate.

This is, in turn, where and why there might rightly or wrongly be an emerging risk or chance of the UK economy appearing to become comparable with the biblical city of Babylon (more on that here and there, as well as lots of other places) in the near future, and for numerous reasons.

These reasons include the bang returned for the BoE's buck after raising Bank Rate from 0.1% to 5% between December 2021 and June this year, which has so far resulted in a stronger labour market, a record high level of wage growth and the return of domestic inflation following a lengthy absence.

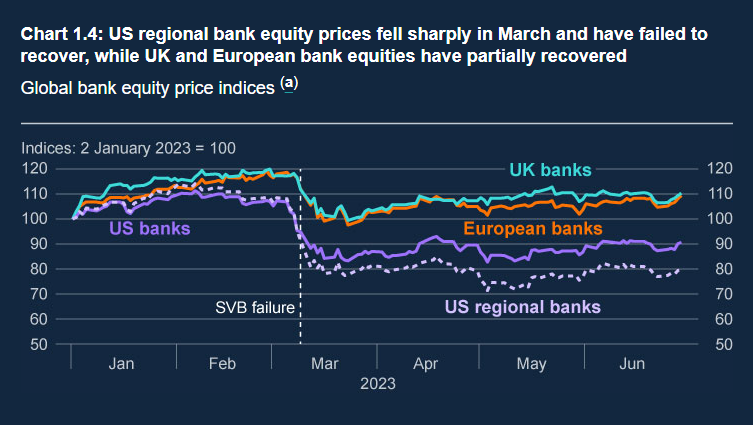

Source: Bank of England Financial Stability Report July 2023.

That too is the opposite result to the one many might have expected to see but comes only after the BoE became the most 'hawkish' major economy central bank: There is no other central bank in the G10 economy sphere to have raised its interest more aggressively in response to inflation than the Bank of England.

"One of the things I think we've seen though over the last year is actually through basically the support that banks are offering, the ability to extend terms, the ability to change mortgage terms, which is part of the Chancellor's package, that actually there are more options there to soften that," Deputy Governor Cunliffe said on Wednesday.

Meanwhile, the only other central bank to have raised interest rates sooner and to a closely comparable extent is the Reserve Bank of New Zealand (RBNZ), and it could be relevant here that New Zealand is the only other advanced economy to have inflation dynamics that are directly comparable to those of the UK.

Though other factors could explain these dynamics - such as quirks of the labour markets in each economy and differences in how financial firms have responded to increases in interest rates - the twin set of experiences do at least appear to be in the process of vindicating the inflation-targeting philosophy of Turkish President Recep Tayyip Erdogan.

He has long argued that rising interest rates lead to rising inflation and vice versa in what has tended to be colloquially or euphemistically described as an "unorthodox" approach to interest rate policy and the practice of inflation-targeting.

Source: Bank of England Financial Stability Report July 2023.