UK House Price Forecast Update Following Latest Nationwide House Price Data

Image © Adobe Images

UK house prices are forecast to fall further with one economist saying a near-10% decline can be expected from here.

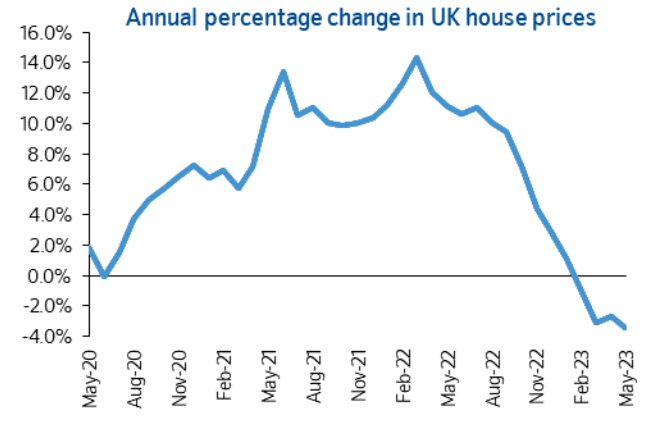

This call follows the latest data from one of the UK's largest mortgage providers, Nationwide, which reported a 0.1% month-on-month fall in house prices in May as the April rebound of 0.4% m/m fizzled out.

The year-on-year decline in house prices stood at 3.4% in May, the sharpest decline recorded since the financial crisis of 2009.

Further house price declines are expected according to economists, however, an outright crash is likely to be avoided with some saying a 'soft landing' remains the most likely outcome.

"House prices flattened off in May after a rise in April. But with mortgage rates now on their way back up we suspect that the stabilisation in prices over the last couple of months will soon give way to renewed falls," says Andrew Wishart, Senior Property Economist at Capital Economics.

Image courtesy of Nationwide.

Nationwide's Chief Economist, Robert Gardner, says headwinds in the housing market are set to strengthen as mortgage rates begin to rise once more.

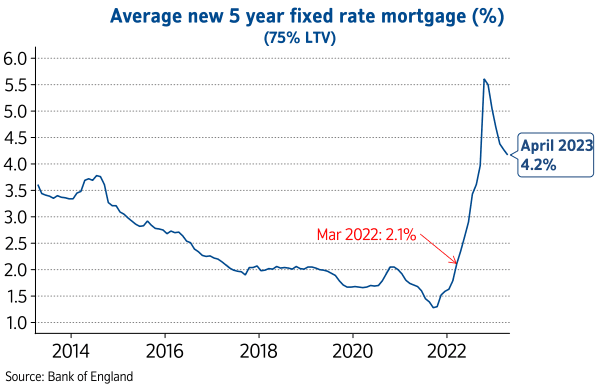

Following last week's surprisingly strong UK inflation data, investors are now expecting the Bank of England's Bank Rate to peak around 5.5%, which is well above the 4.5% peak that was priced in around late March.

This has resulted in UK bond yield rises, which in turn feeds into higher lending costs across the economy.

"If maintained, this is likely to exert renewed upward pressure on mortgage rates, which had been trending down after spiking in the wake of the mini-Budget in September last year," says Gardiner.

Image courtesy of Nationwide.

Capital Economics says the upward revision in interest rate expectations due to stronger-than-expected inflation in April means that the average mortgage rate will jump from around 4.3% to over 5% imminently and to around 5.7% by early 2024.

Despite the expected rise in mortgage rates, Nationwide does not see a crash transpiring.

"In our view a relatively soft landing remains the most likely outcome since labour market conditions remain solid and household balance sheets appear in relatively good shape," says Gardiner.

Capital Economics forecasts UK house prices will eventually drop by a further 8% on top of the 4% decline to date.