Bank of England Bank Rate Forecast Raised to 5% at Goldman Sachs

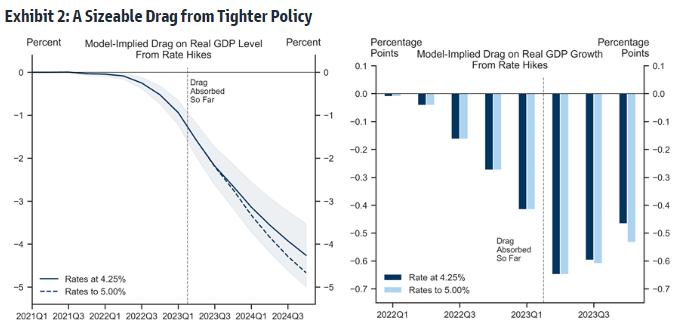

"We estimate that the 415bp of Bank Rate hikes delivered so far will cumulatively lower real GDP by close to 3% by the end of 2023 and 4% by the end of next year, with the majority of the drag still to come."

Image © Adobe Stock

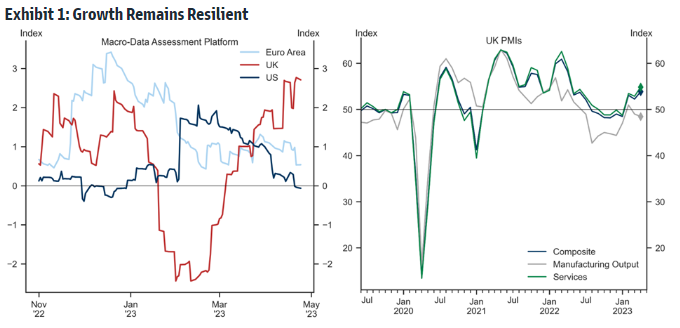

The resilience of the UK economy has taken many forecasters by surprise but risks keeping inflation higher than otherwise and over a protracted period of time, according to economists at Goldman Sachs, who say the Bank of England (BoE) is now likely to raise Bank Rate to 5% as a result.

Bank of England economists had previously tipped a crunching recession that was expected to run for up to five quarters when the original forecasts were published last year but since then the economy has surprised on the high side of projections with possible implications for Bank Rate ahead.

"It is possible that the MPC might want to slow the hiking to a quarterly pace, but we are sceptical that this will be feasible given ongoing inflation pressures," writes Sven Jari Stehn, chief Europe economist at Goldman Sachs.

"We do not look for renewed forward guidance at the May meeting—retaining data dependence—but we believe that it will be difficult for the BoE to stop tightening in light of the firm data and we look for two further 25bp steps in June and August," he adds in a late April research briefing.

Source: Goldman Sachs Global Investment Research. Click the image for closer inspection.

Source: Goldman Sachs Global Investment Research. Click the image for closer inspection.

Stehn and the Goldman Sachs team said last week that Bank Rate is likely to be raised by 0.25% at each of the next three meetings before being held at 5% between August and the opening quarter of next year as the BoE seeks to ensure that inflation returns to the 2% target.

But they also warned of a likely significant impact on the economy late in the current year and throughout the next as mortgage interest rates are reset to higher levels with adverse impacts on the housing market and consumption elsewhere in the economy.

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

"Looking ahead, the BoE’s policy tightening will weigh significantly on activity. We estimate that the 415bp of Bank Rate hikes delivered so far will cumulatively lower real GDP by close to 3% by the end of 2023 and 4% by the end of next year, with the majority of the drag still to come," Stehn says.

"That said, our modelling suggests that the growth drag from the BoE’s tightening is likely to peak in Q2 and that sharply lower gas prices are likely to provide significant relief to cost of living pressures in H2," he adds.

Source: Goldman Sachs Global Investment Research. Click the image for closer inspection.

Source: Goldman Sachs Global Investment Research. Click the image for closer inspection.

Economic growth came close to a standstill in the final quarter last year and stalled again in February after a sharp 0.4% increase in January but the danger is that falling energy prices act as a subsidy for demand in the domestic economy later this year, somewhat offsetting the effect of increases in Bank Rate.

Bank Rate has been raised in order to reduce and restrain demand with the intention of preventing domestic prices from sustaining inflation at levels above the Bank of England's 2% target, although with inflation falling to only 10.1% in March, there is a way left to go.

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |

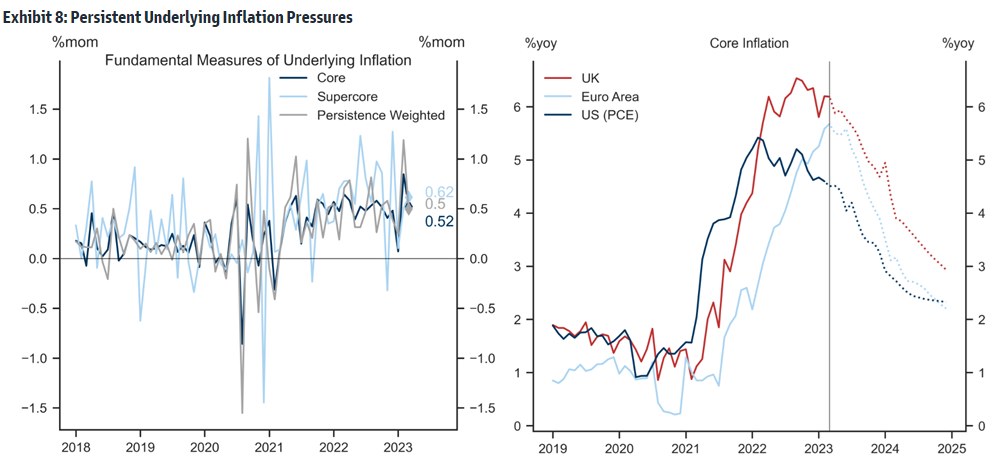

"We estimate that seasonally adjusted sequential core inflation moderated to 0.5%mom (from 0.8% in February), but this remains above the pace observed in Q4 and notably stronger than underlying price pressures in the US and Euro area," Stehn says.

"But we estimate that servicesinflation will remain sticky due to strong wage growth. We therefore lifted our end-2023 core inflation forecast to 4.7% (from 4.3%) and still see core inflation at 2.9% at the end of 2024, notably above our expectations for core inflation in the US and the Euro area," he adds.

Source: Goldman Sachs Global Investment Research. Click the image for closer inspection.

Source: Goldman Sachs Global Investment Research. Click the image for closer inspection.