Euro Area Inflation and Outlook: Analyst and Economist Views

Image © Adobe Stock

European inflation ticked higher in April for the first time since September but the more closely watched measure of core inflation edged lower in a Eurostat report that has uncertain implications for European Central Bank (ECB) monetary policy ahead of Thursday's interest rate decision.

Inflation rose from 6.9% to 7% last month in line with the consensus among economists after food, alcohol and tobacco prices rose sharply in the month to bolster the impact of increases in the cost of non-energy industrial goods, interrupting a six-month decline in the overall measure of inflation.

Inflation had fallen steadily since September 2022 but the tick higher results from changes in volatile commodity goods and regulated price items so the implications for Thursday's European Central Bank (ECB) interest rate decision are far from clear, and even more so in light of the core inflation number.

Core inflation, which excludes energy, food and regulated price items from the goods basket measured, edged down from 5.7% to 5.6% last month.

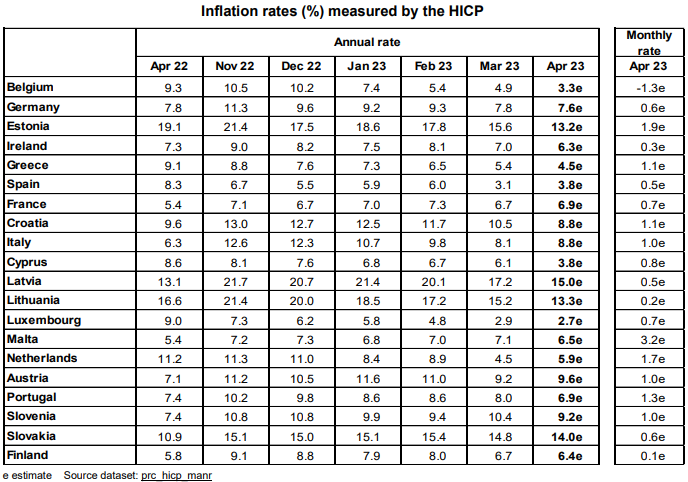

Source: Eurostat. Click the image for closer inspection.

That was also in line with economist forecasts and might be enough to keep the European Central Bank from continuing to raise its interest rate on Thursday in the large half percentage point increments used since it first began to lift borrowing costs in July last year.

The consensus among economists is that Thursday is likely to see the ECB shift into a lower gear by raising the rates charged or paid on commercial bank deposits or borrowings by a smaller quarter-percentage point increment, taking the once-negative deposit rate to 3.25%.

That would mean the ECB has raised borrowing costs for banks, commercial firms and households by a total of 375 basis points or 3.75% as part of its effort to ensure that inflation returns to its symmetric two percent target.

The decision and outlook for interest rates remain uncertain but below are the remarks of analysts and economists in Europe and elsewhere setting out how they see European Central Bank policy unfolding as the year rolls on.

Anders Svendsen and Tuuli Koivu, economists, Nordea Markets

"Service price inflation increased marginally while core goods price inflation eased, which gives a slightly more concerning tilt to core inflation as service prices are where the wage component is largest."

"Also, although unprocessed food price inflation eased, food price inflation in general remained very high."

"Inflation remains much too high and while base effects from last year’s energy price increases will lead to lower headline inflation in the coming months, core inflation remains a huge concern at the ECB. The economic outlook."

"While the economic outlook is weak, core inflation remains too high and will keep the ECB in hiking mode for now. We see +25bp with hawkish comments on Thursday."

Carsten Brzeski, global head of macro, ING

"This makes April inflation in the eurozone sticky and underlines the need for further rate hikes, albeit at a slower pace and smaller magnitude than before."

"Looking ahead, inflation developments in the eurozone will be determined by two rather opposing forces: on the one hand, negative base effects on energy and food prices as well as dropping selling price expectations in industry argue for a further drop in headline inflation."

"On the other hand, still high selling price expectations in services as well as wage increases are likely to fuel underlying inflationary pressures. As a consequence, we expect headline inflation to continue falling, while core inflation will remain sticky."

"The only open question is whether the ECB will go for 25bp or 50bp. Out in the open, only Austrian central bank governor Robert Holzmann has been advocating 50bp. The other hawks, like Isabel Schnabel, recently left the option of 50bp open but didn’t officially subscribe to it."

"Sticky inflation data clearly stresses the need to continue hiking but with last week’s weaker-than-expected GDP growth report and today’s weak loan growth and loan demand data, the case for slowing down the pace and size of rate hikes has become stronger. We stick to our call of a 25bp rate hike on Thursday."

Nerijus Maciulis, analyst, Swedbank

"Most importantly core inflation has finally peaked and fell to 5.6% in April, compared to 5.7% in March. Headline inflation was in line with expectations and remained unchanged at 7%."

"We forecast this trend to continue and core inflation to fall to 3%, while headline inflation is very likely to be close to 2% by the end of this year. This supports our view, that the ECB governing council will abstain from further jumbo hikes this Thursday and will increase base rates by 25 basis points."

"Our current forecast that the ECB will hike two more times after this meeting – in June and July. This would bring deposit rate to this cycle’s peak of 3.75%. We continue to expect multiple interest rate cuts to start early next year."

Christian Schnittker, economist, Goldman Sachs

"We see this as evidence that the cooling in core goods price pressures is continuing, but that strong wage growth continues to keep services inflation elevated."

James Rossiter, head of global macro strategy, TD Securities

"While soft food inflation, due to a normalization in the shortage-induced surge in vegetable prices put substantial downside pressure on the print, this was counteracted by another strong increase in services inflation."

"This month's m/m increase in services inflation was the strongest for any April in the history of the EZ."

"Overall, while we still see a risk of a 50bps hike on Thursday's ECB meeting, in-line core inflation and the worse-than-expected BLS [Bank Lending Survey] earlier this morning should reinforce our expectations of a 25bps hike."

"The Q1 Bank Lending Survey saw credit standards remain tight in the first quarter, following the substantial tightening in 22H2. For firms, credit standards remained unchanged while for households the improvement was only marginal."

"The pace of tightening was more than banks had expected three months ago, with risks related to the economic outlook and firm-specific situation remaining the main drivers of the tightening. On the demand side, demand for credit slowed."