A Hot UK Inflation Reading Prediction from Barclays but Lloyds sees "Sharp Falls"

Image © Adobe Images

Economists at UK high street bank Barclays are forecasting inflation figures that will beat market expectations when released on Wednesday, however, Lloyds Bank's economists are looking for a "sharp decline."

The inflation data release forms the highlight of the UK's economic calendar for the week and could set the tone for the Pound heading into the May Bank of England interest rate decision.

Indeed, the Bank of England has indicated it is now firmly in data-response mode, which places greater weight on wage and inflation data releases than has been the case in the past.

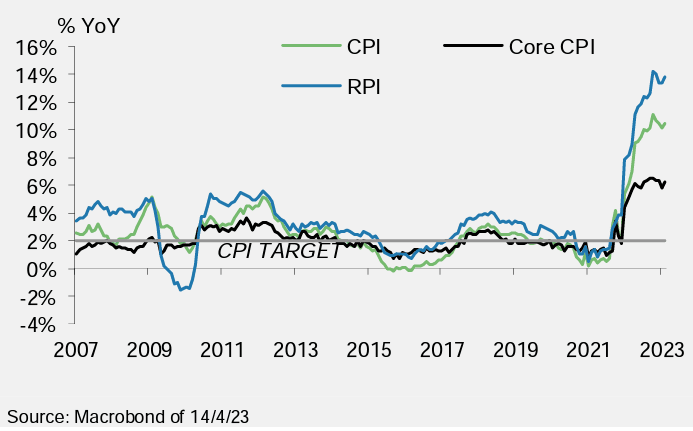

The market is expecting a reading of 9.8% year-on-year in March, down from 10.4% previously, with core CPI inflation coming in at 6.0%, down from 6.2% in February.

But Barclays forecasts March headline CPI of 10.0% year-on-year with core CPI also beating expectations at 6.1%.

If Barclays is correct the market would upgrade its expectations for another interest rate hike at the Bank of England next month.

From a financial markets perspective, the Pound could rally.

Meanwhile, economists at Lloyds Bank expect inflation to fall back into single figures.

"March UK price data are expected to show a sharp decline in annual inflation," says Rhys Herbert, Senior Economist at Lloyds Bank.

(Learn about cash advance apps, like Dave, with our advertising partners at Fit My Money)

Driving an expected slowdown in the rate of price increases will be energy prices where the sharp rises of 2023 will start falling out of the data.

But, inflation could remain resilient as higher food prices are felt.

"Overall we expect a substantial fall in CPI inflation to 9.9% from 10.4% in February," says Herbert.

The monthly decline will be the first of many as April's inflation reading (due in May) is expected to show another big decline as 2022's huge rise in the Ofgem price cap of April 2022 falls out of the data.

From a Bank of England perspective, the core inflation reading will be of greater interest than the headline as this reflects elements of the inflation dynamic they can directly control via interest rates.

Above image is courtesy of Lloyds Bank.

The market looks for a reading of 0.6% year-on-year from 6.2% previously.

But it could be service sector inflation that proves the market mover as Bank of England policymakers have specifically mentioned this component as instrumental in their thinking.

"Service sector inflation is again expected to be stickier and how quickly this falls back remains a key area of concern for the BoE’s Monetary Policy Committee," says Herbert.

All services inflation rose 6.6% in February, up from 6.0% in January.

A year prior it read at a modest 1.0%.

Barclays looks for services inflation to slightly accelerate at the 6.7% year-on-year.

"Our forecasts are consistent with a small upside surprise in services relative to the latest BoE expectation," says economist Abbas Khan at Barclays.