Bank of England Set for Close Call Interest Rate Decision Next Week

"Until the end of last week, March's MPC meeting had appeared almost certain to deliver a 25bps rate hike, with markets fully pricing that outcome" - Oxford Economics.

Image © Adobe Image

Recent data have confirmed that UK inflation and its underlying drivers are moderating but economists and markets remain split over what to expect from the Bank of England (BoE) next week with some suggesting it could elect to leave interest rates unchanged for the first time in more than a year.

The latest BoE Inflation Attitudes Survey indicated on Friday that expected levels of future inflation continued to fall among members of the public last month while economists are looking on average for official data to confirm next week that actual inflation fell again in February.

Inflation is seen dipping from 10.1% to 9.8% in a fourth successive decline next Wednesday while the more important core inflation rate is expected to fall from 5.8% to 5.7%, although whether this stops the BoE lifting Bank Rate above its current 4% level next Thursday still remains to be seen.

"The latest labour market data give the MPC good grounds for keeping Bank Rate at 4.0% at next week’s meeting, even if the recent tightening of financial conditions in the wake of the collapse of two U.S. banks unwinds by then," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

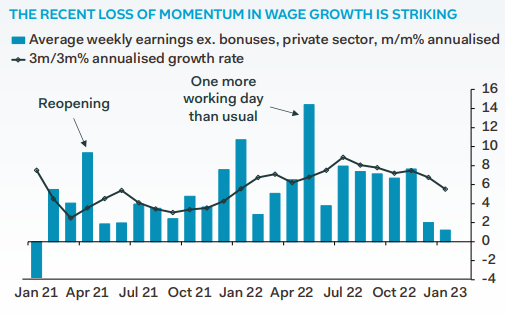

"As our first chart shows, the annualised rate of month-to-month growth in this measure of wages slowed to just 2.0% in December and then to 1.2% in January, from an average of 7.3% in the previous 12 months," Tombs writes in a review of employment figures released on Tuesday.

Source: Pantheon Macroeconomics. To optimise the timing of international payments you could consider setting a free FX rate alert here.

The BoE has been monitoring pay growth closely after the double-digit inflation rate saw annualised increases in wages and salaries rise into the high single-digit percentages, leading Monetary Policy Committee members to fear a self-perpetuating cycle of inflation taking hold.

Wages are one of the largest costs borne by businesses so rising pay can lift the prices of products and services in ways that lead inflation to be sustained at higher levels than otherwise, hence why the BoE has said it would respond to this by raising interest rates further.

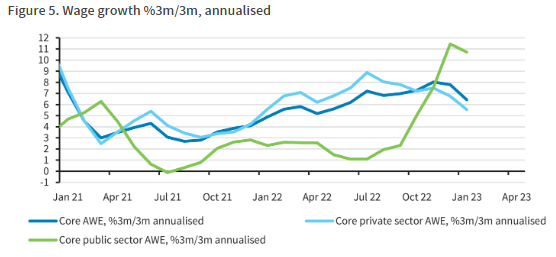

"Wage growth is decelerating. January was the second consecutive month of very weak m/m private sector wage growth," writes Abbas Khan, an economist at Barclays, in a Wednesday research briefing.

"Even at slightly less high-frequency levels, the slowing in momentum is evident, with %3m/3m growth now clearly decelerating," he adds.

Pertinently for next Thursday's decision, Office for National Statistics figures suggested on Tuesday that annual pay growth fell from 6.7% to 6.5% in January once discretionary bonuses are overlooked, and that pay growth fell from 6% to 5.7% once bonus pay is included in the measurement.

Source: Barclays. To optimise the timing of international payments you could consider setting a free FX rate alert here.

When combined with declines in the number of advertised job vacancies, the recent softening of wage growth could be interpreted by the BoE as an indication that domestically-generated inflation risks are lessening, potentially precluding any need for Bank Rate to rise further.

"Until the end of last week, March's MPC meeting had appeared almost certain to deliver a 25bps rate hike, with markets fully pricing that outcome," says Andrew Goodwin, chief UK economist at Oxford Economics.

"The collapse of Silvergate Capital and Silicon Valley Bank led markets to re-price, lowering their expectations for the peak in Bank Rate by 50bps and reducing the implied probability of a 25bps hike next week from 100% to around 50%," Goodwin writes in a Friday research briefing.

The BoE raised Bank Rate from 3.5% to 4% last month but no longer warned it would respond "forcefully" to any indications of persistence in domestic inflationar and instead turned non-committal on the outlook.

Various BoE policymakers have since said they still view risks around inflation as "skewed significantly to the upside," or something similar but most have stopped short of suggesting they would raise interest rates again next week.