Innovative Measure of U.S. Layoffs Suggests Fed Right to Stay Course

"Press reports indicate that layoffs are rising, but they tend to overemphasize the technology sector. The official JOLTS data indicate that the economywide layoff rate remains low, but they are released with a lag" - Goldman Sachs.

Image © Goldman Sachs Global Investment Research.

New and innovative research from Goldman Sachs provides a more timely measure of layoffs in the U.S. job market and suggests Federal Reserve (Fed) officials are right to be dismissing recently-downbeat economic data while warning of their intention to stay a hawkish interest rate course.

Official figures revelaed a third successive decline in U.S. industrial production and another slump in retail sales for the month of December this week, leading many economists to fear a recession being near and prompting financial markets to revise down expectations for interest rates later this year.

Members of the Federal Open Market Committee have since argued the market is mistaken to interpret any of the recent data as something that would alter the Fed's monetary policy course, and most notable have been remarks for Vice Chair Lael Brainard who is often described as a policy "dove."

"Inflation is high, and it will take time and resolve to get it back down to 2 percent. We are determined to stay the course," she said when opening a Thursday speech at the University of Chicago Booth School of Business.

"It remains possible that a continued moderation in aggregate demand could facilitate continued easing in the labor market and reduction in inflation without a significant loss of employment. Nonetheless, substantial uncertainty remains," she added in partial conclusion of the speech.

Source: Goldman Sachs Global Investment Research. Click image for closer or more detailed inspection.

Source: Goldman Sachs Global Investment Research. Click image for closer or more detailed inspection.

Underpinning the Fed's interest rate outlook and many policymakers' preferences for higher rates over the course of the year ahead has been the strong and resilient U.S. labour market in which pay growth has been rising at levels that risks prolonging the period of high inflation.

While financial markets have taken cues from economic falling indicators like retail sales and industrial production, Fed policymakers have repeatedly cited various measures and features of the labour market that are likely supporting wage growth and in the process sustaining the pricing power of companies.

Analysts and economists often say labour demand is a 'lagging indicator' in riposte to these arguments but Vice Chair Brainard cited on Thursday leading indicators for thinking the labour market is still as strong as it was before the pandemic, and some way off from beginning to weaken.

Of the indicators cited, the exception was the average weekly hours of agency workers at temporary-help firms, which have recently fallen to the bottom of the range for the five years up to the pandemic.

"The continued decline in average weekly hours is notable because this margin is among the easiest to adjust by firms facing declining demand, especially those who may be reluctant to undertake layoffs," Brainard said.

Source: Goldman Sachs Global Investment Research. Click image for closer or more detailed inspection.

Source: Goldman Sachs Global Investment Research. Click image for closer or more detailed inspection.

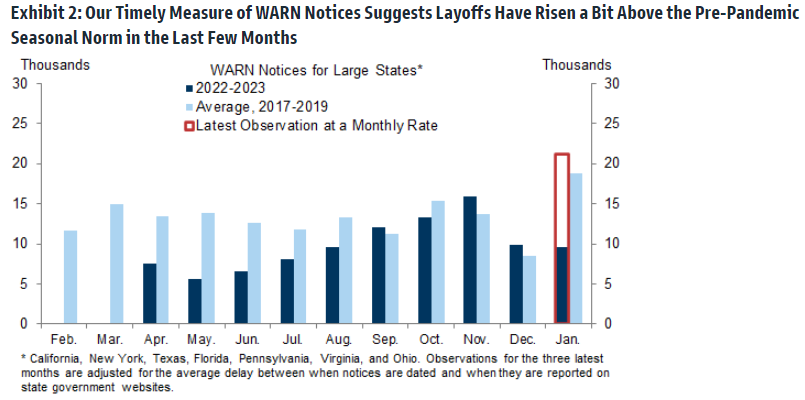

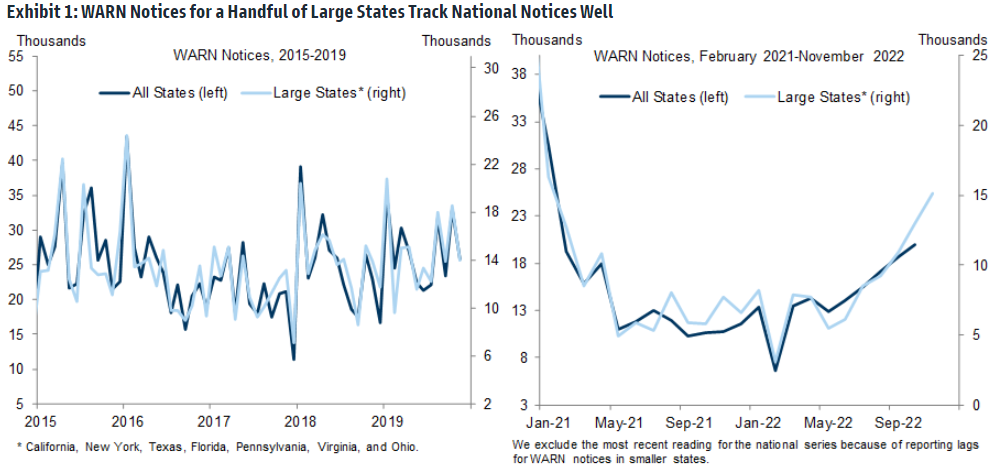

The overall argument put forward by the Vice Chair and others, however, is currently supported by new and innovative research from Goldman Sachs, which uses corporate filings under the WARN Act in order to gauge the pace of layoffs in a more timely manner.

"Press reports indicate that layoffs are rising, but they tend to overemphasize the technology sector. The official JOLTS data indicate that the economywide layoff rate remains low, but they are released with a lag," says Jan Hatzius, chief economist at Goldman Sachs.

"Many state governments upload these notices to their websites shortly after they are received, allowing us to leverage the data for a few large states to construct a timely measure of planned layoffs," Hatzius and colleagues write in a January 13 research briefing.

The WARN Act requires companies to notify state governments and affected individuals 60 days in advance when redundancies exceed 500, and applies wherever more than 50 employees are layed off in instances where a work site is shut down or the lay offs account for more than a third of the workforce.

The data appears to confirm the Fed's belief in the U.S. labour market currently remaining every bit as strong as it was pre-pandemic while also seconding the message of the average weekly hours of agency workers, which may or may not be the beginnings of a turn in overall employment.

Source: Goldman Sachs Global Investment Research. Click image for closer or more detailed inspection.

Source: Goldman Sachs Global Investment Research. Click image for closer or more detailed inspection.