EUR/USD Week Ahead Forecast: Overcoming Resistance Around 1.0935

Image © European Commission Audiovisual Services

The Euro to Dollar exchange rate has consolidated its early August gains in recent trade but it could have scope to decisively overcome nearby resistance around 1.0935 and approach the 1.10 handle in the days ahead.

EUR/USD was little changed last week after handing back large gains made on Monday over subsequent days but losses were limited to a mere fraction of the early August advance, and the trend remains to the upside.

This is thanks to the explosive rally on August 05 when US payrolls surprised sharply on the downside of expectations for July, leading markets to bet that interest rates will be cut multiple times by year-end.

“We have removed our EUR/USD1.05 3-month target mostly on the view that imminent Fed rate cuts are likely to prevent a dip to this level this year,” said Jane Foley, head of FX strategy at Rabobank, on Friday.

Above: EUR/USD shown at daily intervals with selected moving averages denoting possible areas of technical support, and Fibonacci retracements of December downtrend denoting possible technical resistances. Click image for closer or more detailed inspection.

“For now, we would continue to favour selling EUR/USD on any moves to 1.10,” Foley added.

Wagers on as much as 100 basis points of interest rate cuts have seen the euro begin eroding technical resistance around 1.0935, and could see EUR/USD set its sights on the 1.10 handle this week.

This is partly because the opinion polls suggest Democratic Party presidential candidate Kamala Hariss has turned the tables on former President Donald Trump, but also because US inflation figures for July out on Wednesday could be likely to cement market expectations for imminent Federal Reserve interest rate cuts.

“On a 3-to-6-month view, we see potential risks for a break higher coming from a softer USD rather than a stronger EUR. These could be a weaker than expected US economy or a Harris win in the election, though our house forecasts are based around a Trump victory,” Rabobank’s Foley said in a Friday research briefing.

The recent shift in opinion polls is undermining one important source of support for the US dollar and its outlook into year-end because Trump’s protectionist trade policy agenda and trigger happy use of tariffs is outright bullish for business investment, production, employment and GDP in the US.

However, consensus also sees US inflation rising 0.2% month-on-month when data for July is released on Wednesday, which is expected to pull the annual rate down to 2.9%, from 3%. This keeps the US disinflation process intact and should weigh on the Dollar because it has a loose negative correlation with inflation.

The recent unraveling of US Dollar exchange rate and nascent breakout to the upside in EUR/USD suggests the pair could be on the cusp of closing the gap between itself and fair value up around 1.1577, which has risen from 1.1511 at the beginning of the year.

This estimate is derived from the author’s fair value model, which uses inflation, interest rates and the cross-currency differentials between both to estimate where currencies should trade as inflation rises and falls.

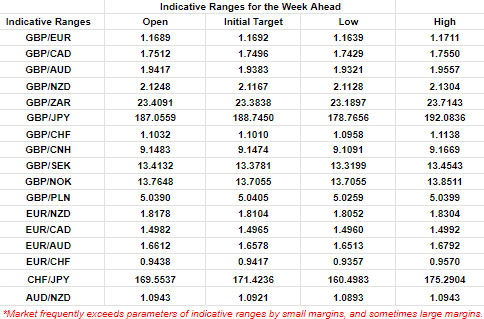

Above: Quantitative model estimates of possible ranges for the week. Source: Pound Sterling Live.